How to Invest: The Few Key Things You Need to Know

Insider Secrets from Working in the Financial Advice Industry for Years

After reading this article, you will know the few, most important things you need to know to invest well. You’ll also learn how to act on it within an hour, even if you knew little about investing before reading the article.

Why focus on investing? The main forces behind COVID and investing are the same: compounding. In the case of investing, you compound returns, and in the case of COVID, you compound generations of infections. The famous R is a bit like investment returns. Also, this topic is super important: most people are unprepared for retirement simply because they don’t know its rules. Reading one article plus one hour of work can be the difference between retiring comfortably and not retiring at all.

Disclaimer: I am not an investment advisor. For that, you need licenses that I don’t have. As such, it’s not my job to give financial advice, and you should not take this article or any other comment I make as investment advice. You should instead see this article and the rest of my writings as informational and for entertainment purposes only, as a pointer for you to look into this. The law requires people like me to put disclaimers like this, which is great because that way you’re careful about who you take advice from, and with whom you’re cautious. So please, if you find this article convincing, do your own research and confirm everything I say before investing.

In the premium article this week I’ll cover more advanced topics like:

The FIRE Movement (Financial Independence; Retire Early)

The importance of negotiation in all of this

F**k Y** Money: what it is, and what’s your number

Inflation and how advisors “forget” about it to create urgency

Cryptocurrencies, Fiat Currencies, Modern Monetary Theory (MMT), and how they affect all of this

When should you concentrate your bets?

Markovitz’ Efficient Frontier

What does diversification really mean?

Dollar-cost averaging

The mental biases that make active investing really hard

Specifics of tax optimization

The accelerating impact of returns

What parts of the work of a financial advisor can be automated

What the people working inside the roboadvice industry think about their products and how people invest

Subscribe to read them!

Ok let’s go.

I worked for four years at a startup that built investment products1. That’s where I learned what matters most to manage your wealth. There, I talked with hundreds of people about how they manage their money. Some were nightmare stories. Like this one:

It is one of the saddest things I’ve read in a long time. But there are so many other mistakes people can make managing their money: leaving lots of cash in the bank, trusting the wrong investment advisor, trading too much, leaving tax money on the table...

The goal of this article is to explain these common mistakes as quickly and clearly as possible, and to suggest what you should do instead.

1. Invest vs. Leave the Money in the Bank

The other day I was talking with a very intelligent engineer friend that I respect a lot. She is very comfortable with numbers. And yet she told me she had hundreds of thousands of dollars sitting in a few bank accounts 😳

She knew she had to do something with the money, but she didn’t want to think about it. She didn’t realize how much of a grave mistake that is: leaving the money in the bank can be the difference between retiring early and not retiring at all.

A person saving about $600 a month for 60 years will end up with $575k—and that’s assuming 1% interest in the bank, which is unheard of lately. A person investing that money instead will have close to $6 million. The single decision of investing the money early on instead of letting it die in the bank account would multiply this person’s wealth by 10.

You know all that time you spend working every day? What if I told you that one single day of work in your life—the day to put your money in order—could earn ten times more money for you than the rest of your professional career combined?

This is traditionally known as the power of compounding. If your money is in the bank, it barely compounds. If it’s invested, it does, and it makes a tremendous difference over time.

Another fun stat: within ~15 years of investing, you start earning more money through your investments than what you’re saving from work!

But most people don’t need $6 million. A number that matters to people more is: When can I retire?

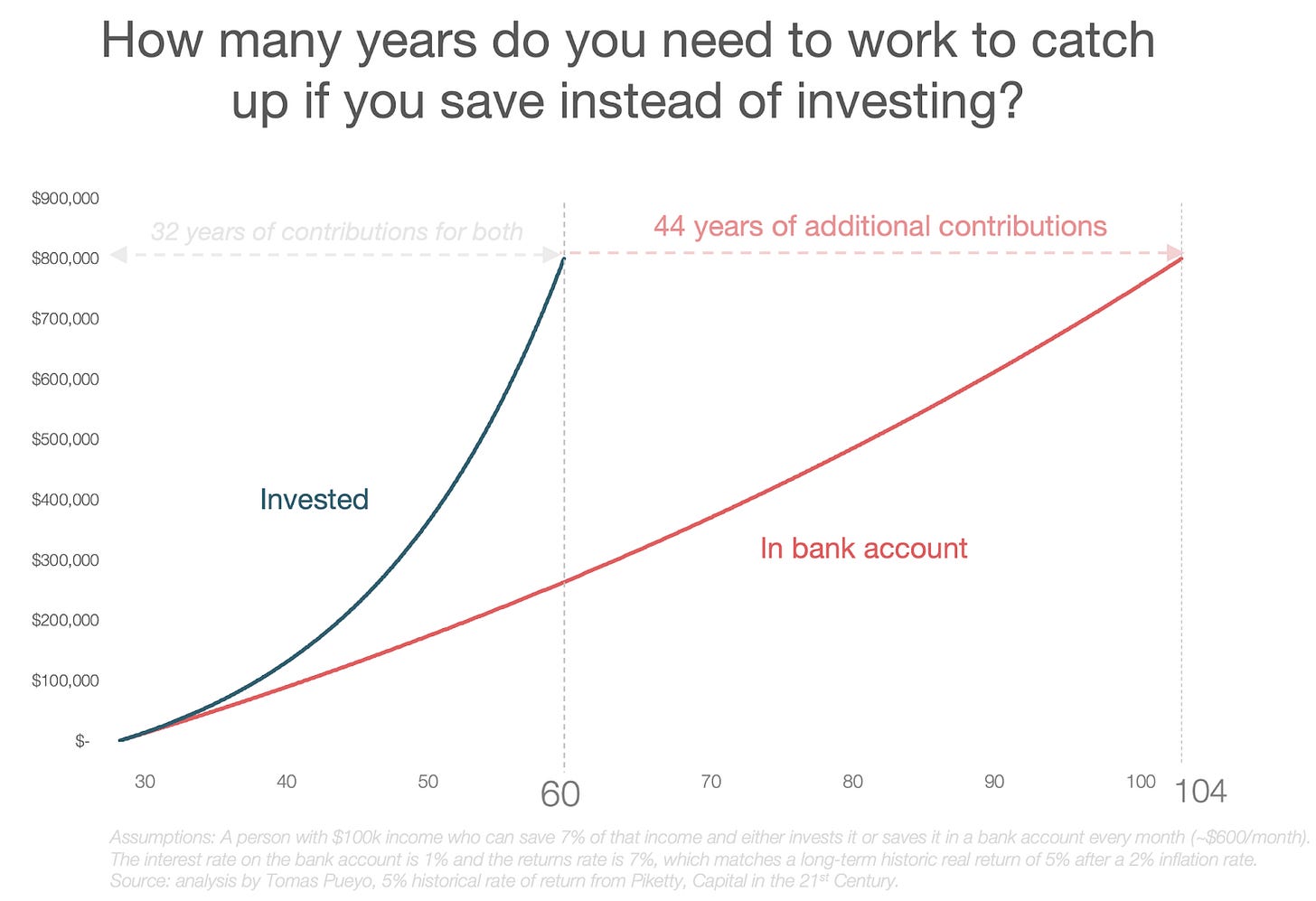

If the investor decides to retire at 60 years old, when she’s accumulated around $800,000, how many more years would the person who is saving in the bank need to work to reach that same amount?

The answer: 44 years.

Put another way: The investor has worked for 32 years, between the ages of 28 and 60. To accumulate the same wealth, the saver who puts money in the bank needs to work for 76 years instead of 31, for an additional 44. More than twice the amount of work. Yet another way to put it: investing is the difference between a good retirement and no retirement at all.

Many people kinda realize this, but until they see these numbers, they don’t spring into action.

Risk Profiles

The other concern savers have that prevent them from investing is that they don’t want to lose money. They’re less attracted by the potential gains than they’re fearful of the potential losses. There are two answers to that.

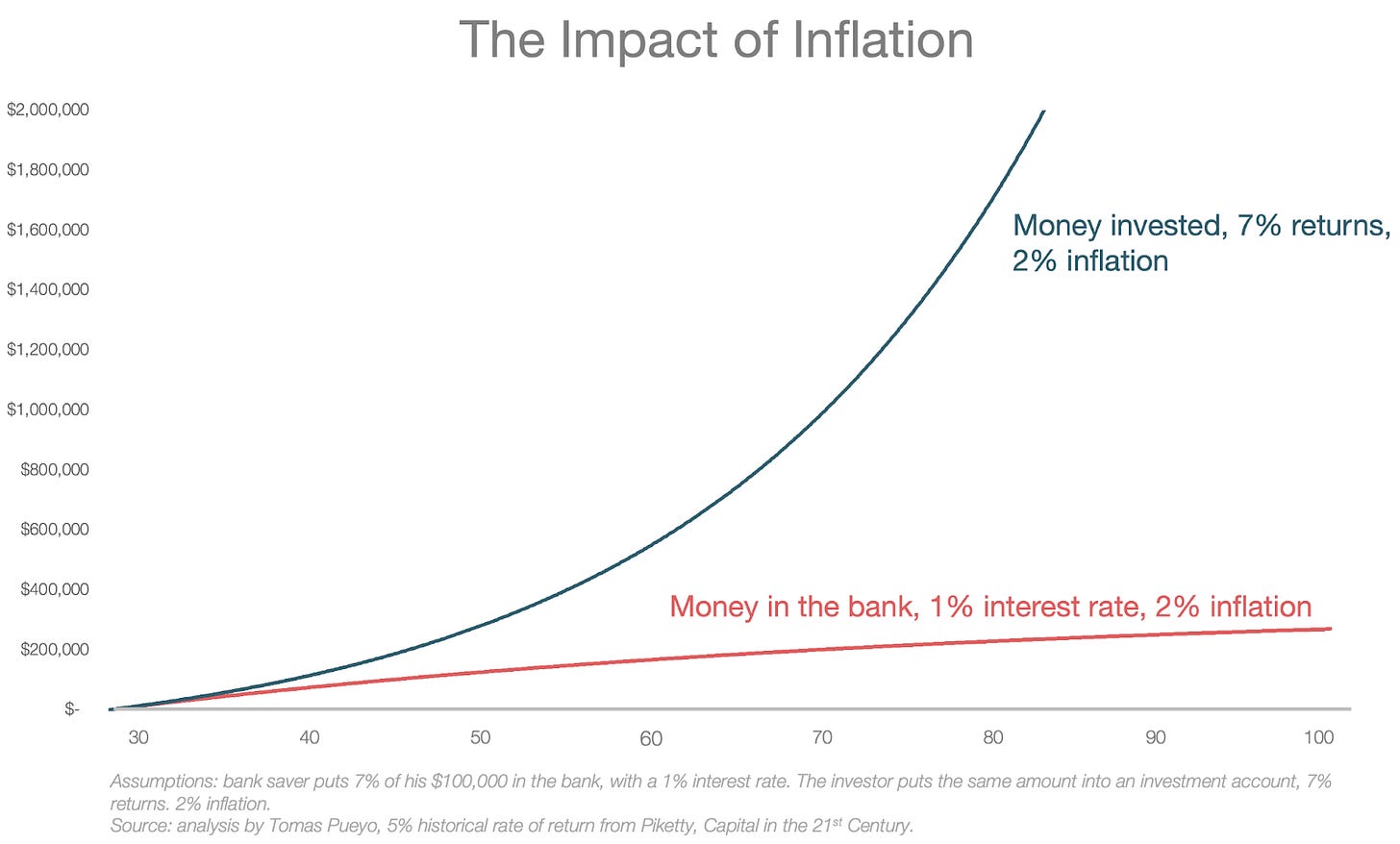

The first one is that you’re already losing money by leaving it in your bank account. At the tune of whatever the inflation is at the time—nowadays, at the highest level in the last decade. What if we added an inflation of 2% to the previous math?

Notice how now the red line slows down instead of accelerating? That’s the impact of inflation2. It eats your money away. You can’t let it die in your bank account.

The fear that people have is that they don’t want to put it in the market and then lose it. That is a possibility. But the good thing is you can decide how much risk you want to take.

You don’t want to take any risk? Then buy US debt. The only situation in which you lose that money is if the US can’t pay back its debts. If that moment arrives, how safe do you think the money is in your bank anyways? Also, how do you think the bank can afford to give you that 1%? In a big part, what they do is turn around and buy US debt with the money you lend them, and they only return you only a share of what the bond gives them.

If you want you can take a bit more risk than that, by buying debt from other governments, or from corporations. They’re a bit riskier, but they pay better. Or more risk, buying stocks. In fact, you can take as much risk as you want and get commensurate rewards. I’ll explain later how to decide the right level of risk for you.

Ready to invest now? Good. But what should you invest on? There are so many options…

2. Diversify your portfolio

You hear lots of stories of people who made a lot of money investing early in Amazon, Google, Tesla, Coca-Cola… But for every one of these stories, you have an untold one of people who lost everything on Enron. Or who bought Tesla at its peak. Or shorted the wrong stock.

These are the horror stories that keep people away from the market. But they don’t need to. There’s an easy way to avoid them.

Most investing—picking where to put the money—is essentially gambling. Black or red? You don’t know what’s going to go up or down. So what to buy?

Everything.

If you buy a bit of everything, you aren’t picking the winners. You’re going with the entire market. That way, you don’t put all your eggs in the same basket.

This is called “diversifying”. It is one of the only proven ways to keep your returns while lowering risk. This concept is so proven that Harry Markovitz won a Nobel Prize for it. I go into the detail in the premium article for this week.

For example, instead of picking Tesla, Facebook and P&G to invest in, buy a bit of hundreds of companies. That way, if Elon Musk tweets about his drug habits, or if the government passes a law against internet monopolies, your gains don’t vanish.

A great way to diversify your portfolio without thinking too much about it is to buy index funds (similar to ETFs)3. These are funds that say: “I don’t know what stocks will win, so I’ll invest in all of them, proportionally to how much the rest of the market believes in them.” For example, if you buy an index fund that tracks the S&P 500, that index fund owns a bit of the biggest 500 companies. The bigger they are, the more it invests in them. That way, you grow as fast as the average of the top 500 companies, which is likely to be a good result over the long term

Index funds were created by a company called Vanguard. It’s been one of the best things that has happened to investors worldwide, and that’s why they trust it with $7 trillion of their money to manage4. To give you an order of magnitude, there are about $70 trillion invested in the stock market worldwide.

It took decades for Vanguard to grow to this size because people have a hard time with finance. But as more and more people have realized the value of diversification, they’ve flocked to companies like Vanguard.

In general, the more you diversify, the better. Ideally, you’d invest in all the companies and government debts in the world at once. There are companies called online wealth management companies —or “roboadvisors”—which help you do that. We’ll talk about them later. Short of that, you want to invest in index funds that are very broad. S&P 500 is good, but you should have more diversity than that: big companies, medium companies, small companies, across countries, maybe some debt… We’ll get back to this too.

Vanguard is not the only one that offers index funds. Other companies, like BlackRock or Schwab in the US, do it too. There is also another thing to invest in called “mutual funds”, sometimes called “actively managed funds”. What’s the difference between mutual funds and index funds? How do you know which one is what? And what’s the benefit of each?

In mutual funds, the company picks a bunch of companies that they believe in. So for example they might choose “the best technology stocks” and create a mutual fund about that.

There are two problems with mutual funds. The first is their fees. The second is that they don’t follow indices, but the picks of some analysts who think they can beat the market. These are two very grave mistakes when investing. Let’s look into each.

3. Minimize fees and commission

Have you seen The Wolf of Wall Street? This scene is relevant:

“We don’t create s**t, we don’t build anything. So if you have a client who bought stock at $8, and now sits at $16, he wants to cash in.… You don’t let him do that, ’cause that would make it real. What do you do? You get another brilliant idea, a special idea … another stock to reinvest his earnings, and then some. And they will, every single time, because they’re f*****g addicted. And you just keep doing this, again, and again.… Meanwhile, he thinks he’s getting rich … but you and me, the brokers, we’re taking home cold hard cash via commissions m**********r!”—Mark Hanna, in The Wolf of Wall Street

Wall Street is rich primarily via fees and commissions. And paying them all that money can be avoided. This is the difference between investing for 50 years, from 28 to 80, with fees of 2.5% vs. only 0.3%:

After 50 years, the one that paid only 0.3% in fees has more than double the money than the one that paid 2.5% annually.

It makes sense: if you remember, annual returns are about 5%. Fees and commissions of 2.5% eat half of that every year! So there’s much less compounding.

Ok, so now you know you need to reduce these fees and commissions. How do you do that? Let’s understand each.

Fees are what you pay to investment advisors so that they advise you where to put your money and manage your wealth on your behalf. Commissions are the cost of the funds you buy, such as index funds or mutual funds. Let’s look into each.

Fees for Investment Advisors

If you are scared of investing by yourself, you’ll want an investment advisor. But getting the right one is crucial. The average advisory fee for a $50k account is 1.18% in the US. It’s usually more elsewhere. And that’s just an average!

It might be worth it if their advice was amazing, but it’s not—it’s terrible. From a paper on Canadian advisors:

“A common view of retail finance is that conflicts of interest contribute to the high cost of advice. [...] However, we show that advisors typically invest personally just as they advise their clients. Advisors trade frequently, chase returns, prefer expensive and actively managed funds, and underdiversify. Advisors' net returns of −3% per year are similar to their clients' net returns. Advisors do not strategically hold expensive portfolios only to convince clients to do the same; they continue to do so after they leave the industry.”

Or put another way, financial advisors’ advice is bad, but not because they lie. They’re just bad: they make the same mistakes for themselves.

So what are your options? You have three: invest yourself, find an amazing financial advisor, or use automated investment advisors—roboadvisors.

We’ll go through investing yourself in a moment. Finding amazing financial advisors is really hard: the great ones make so much money that you can’t afford them. Most of the ones you and I can afford are not that great. But they still need to make a living. That money comes from your pocket.

Imagine you have $150,000 in assets with an advisor that charges 1%. That means you pay them $1,500 per year. For them to make $200,000 per year, they need 130 people like you. With about 200 working days a year, that means they can only spend about 1.5 days per year on your account. How well do you think they’re going to serve you?

Most of the advice that a good financial advisor gives is the same as in this article anyway. And most of their management is better automated than done manually. We’ll go in depth into this in the premium article this week.

Online investment advice companies, or “roboadvisors”, automate the entire investment process, from picking stocks to optimizing their management for tax purposes. That way, they can serve millions of people at the same time, and their fees are much lower—about 0.25% on average, instead of 1.18% for human financial advisors.

These roboadvisors include names like Wealthfront, Betterment, or SigFig in the US, Nutmeg in the UK, Indexa in Spain, and many others. Since I worked at SigFig for years I have a huge conflict of interest here, so please read the details in the footnote5 (just click on the little number. Once you’re reading the footnote, you can click again on the number to come back here). But I was a roboadvisor customer before working at one, and still have a big chunk of my money in some of them.

If you want to minimize your fees, and you don’t want to manage your money yourself, roboadvisors are your best bet.

Regardless of what you do, you don’t want to just minimize advisory fees. You also want to minimize your commissions.

Commissions for Funds

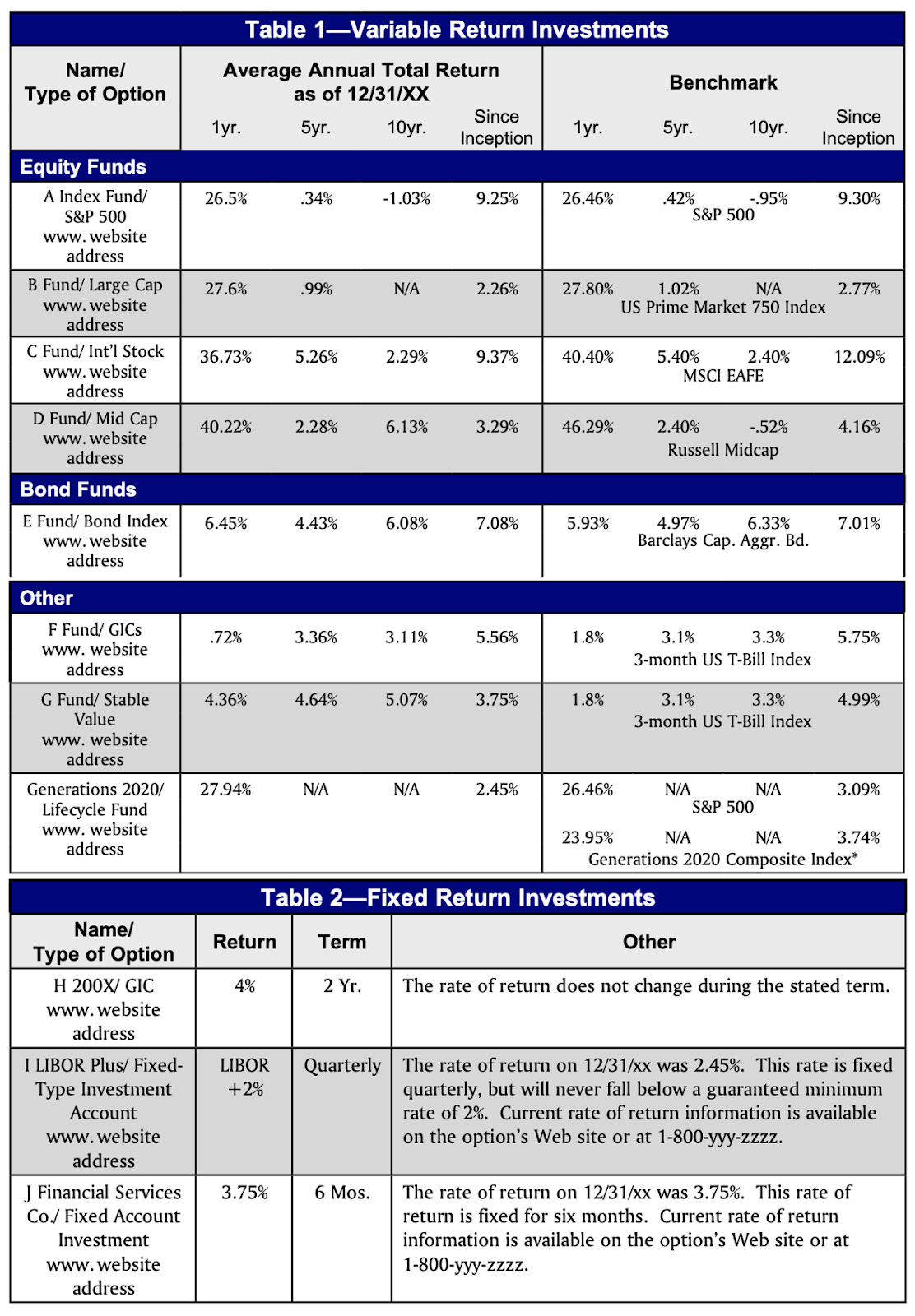

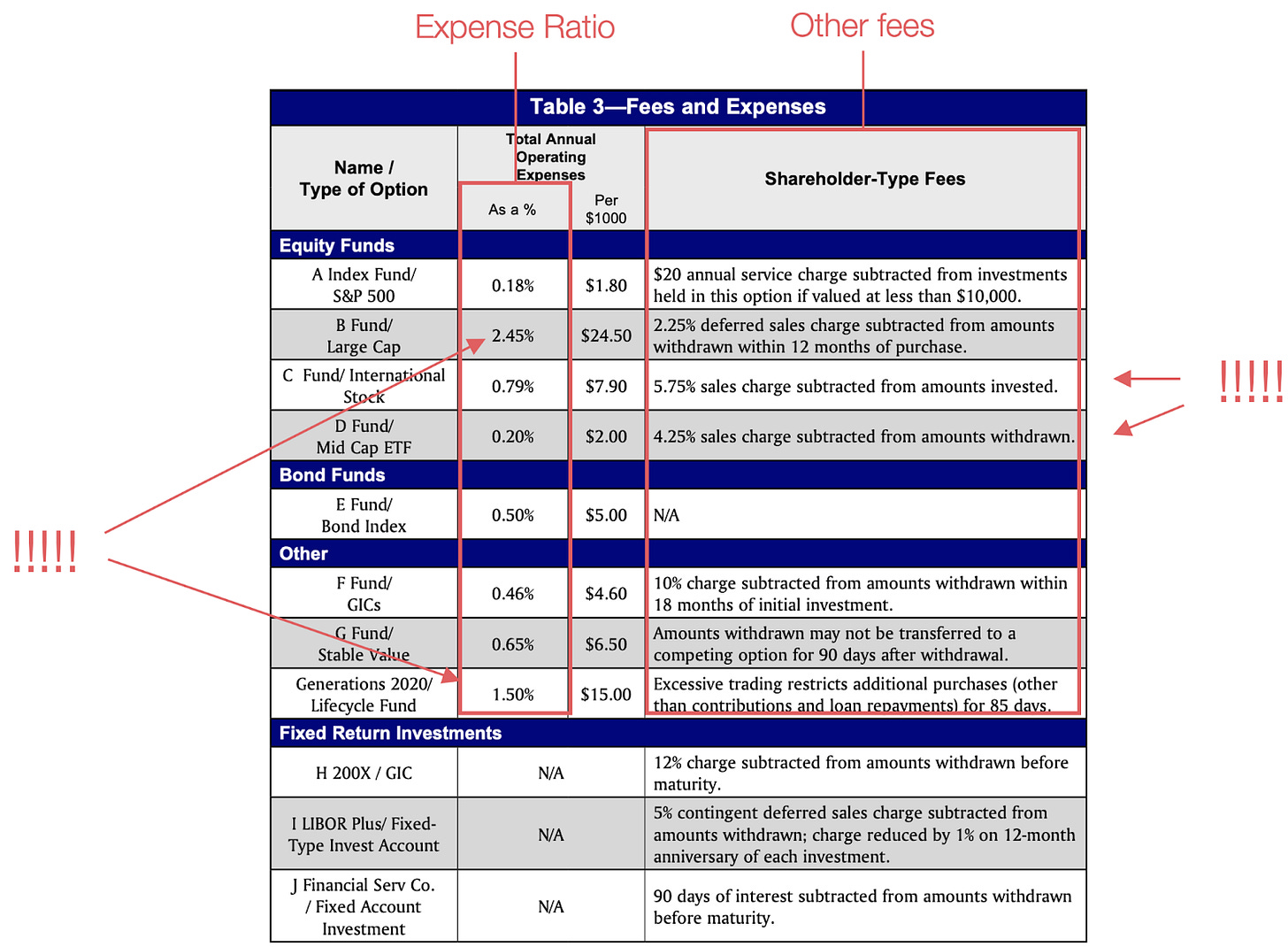

If fees are what you pay to your investment advisor, commissions are what you pay to buy some funds. This is one of the two most important pieces of information when deciding which fund to buy, but many funds make it hard to find this information. Consider this:

Complex, isn’t it? With so much information to digest, you forgot what’s not there: the cost of these funds! Many investment prospectus make it hard to see that information because they want you to be confused and go for whatever is easiest or what’s advised by the financial advisor—which will make them more money.

In this case, you can find the information farther down.

There are two types of commissions. The most common one is the expense ratio, which is an annual commission that you pay every year as a share of your assets. Here, for example, you can see that the lowest expense ratio is 0.18% and the highest is… 2.45%! To give you a sense of comparison, a normal index fund charges anything from 0.02% to 0.2%. Most of these prices are exorbitant6. Historically, you can expect on average a 5% return on your money7. 2.45% fees would take half of that every year!

The expense ratio should be the only cost you pay to buy funds. But some are very sneaky and try to… scam you? For example, look at the line “5.75% sales charge subtracted from amounts invested.” What does it mean? As soon as you give them your money, they’re going to take 5.75% of that! And then on top of that, 0.79% more per year!

That’s why when you’re buying funds the first thing to look at is these commissions. Make sure there are no weird fees, and make sure the expense ratio is close to 0%. 0.02% is great, and above 0.5% you should really reconsider8.

Picking the right funds is also something that roboadvisors do really well. For example, the funds Wealthfront has picked have expense ratios between 0.03% and 0.39%. Even if you want to invest yourself, you can just look at what funds roboadvisors recommend and buy them yourselves.

The value proposition of roboadvisors is pretty simple: “Hey, nobody can consistently beat the market. So we don’t try. We just automate everything so you get the gains from the market, and then we optimize all the fees and taxes.”

Do you still think you’re better and you can beat the market? The next section is for you.

4. Don’t Try to Beat the Market

Going back to our friend Mark Hanna from The Wolf of Wall Street:

“Name of the game: Move the money from your clients’ pocket into your pocket.... Number 1 rule of Wall Street: Nobody [...] knows if the stock is going to go up, down, sideways or in f* circles, least of all stockbrokers.”

Or, as superinvestor Warren Buffett would put a bit less flamboyantly:

“Lethargy, bordering on sloth, should remain the cornerstone of an investment style. Why? Because constantly buying and selling in an attempt to beat the market is a fool’s errand. It simply won’t work.”

In fact, even hedge funds rarely beat the market. In 2005, Buffet argued that amateur investors who simply sat still would financially outperform the active investments made by professionals. He figured massive fees from all of these financial helpers often leave clients worse off than if they just invested in a low-cost index fund and forgot about that money for a decade.

To prove his point, he bet $1 million that just buying and holding the stock of the top 500 US companies would be a better investment than whatever any professional investor would could come up with. One hedge fund guy took the bet, and he lost. Ten years later, once the bet was done, Buffet’s stable strategy to follow the market completely outperformed the strategy of the hedge fund guy.

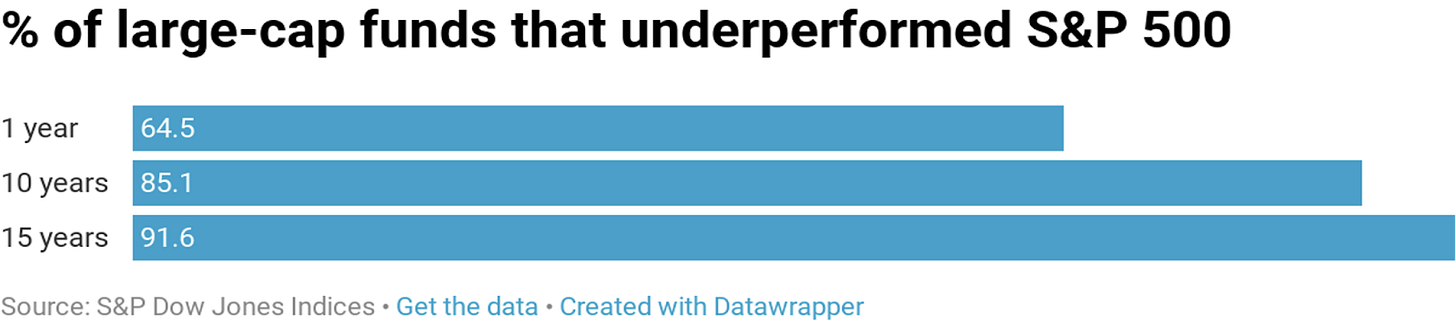

The only reliable way to beat the market is to know something the world doesn’t know. There are 7 billion people in the world. The ones that invest the most have legions working for them, analyzing where to put their money. Do you really think you’re going to outsmart them? Over the last 15 years, about 90% of active fund managers have underperformed against the market. So you’d need to do better than professionals to just meet the performance of the market.

Stop it. You’ll never beat the market unless you’re reckless or plain lucky. Would you bet your life on recklessness or luck?

This is especially important to keep in mind today, because the stock market has gone up like crazy. When there’s such a bull market, most people tend to win. Those who take the most risk make the most money. Because they’re beating the market, they think they’re geniuses. They aren’t. They’re just taking more risks in a moment where that pays off. But the moment there’s a downturn, these are the people who lose it all in a 2001 crash, or a 2008 crash, or a 202x crash.

Many people have joined the market in the last decade, led by hot markets and easy investing thanks to apps like Robinhood. But 50% of Robinhood’s 18 million customers are first-time traders, so they have no stock market experience. What will happen to them when there’s a crash?

There are a few situations in which trading yourself makes sense. I’ll cover that in the premium article this week, along with more psychological biases investors have. But in most cases, it’s dangerous to invest yourself. You can’t consistently beat the market. Better diversify it through index funds, set it and forget it.

Until it’s time to start withdrawing.

5. Assume You’ll Retire Late

So far, we’ve talked about how to invest better and what to invest in, but we haven’t talked about a more important question: why?

Almost every client I talked to in the financial advice industry wanted to know how they could invest to improve their retirement plan. Other things are secondary. Once you can retire, you’ve bought your freedom and you can do what you want. This is what investors are looking for first. Financial freedom.

Investment is about retiring.

Unfortunately, you run out of money fast once you stop working. At the beginning, you can rely on the returns of your savings. But the more you tap into your accumulated wealth, the faster it goes down.

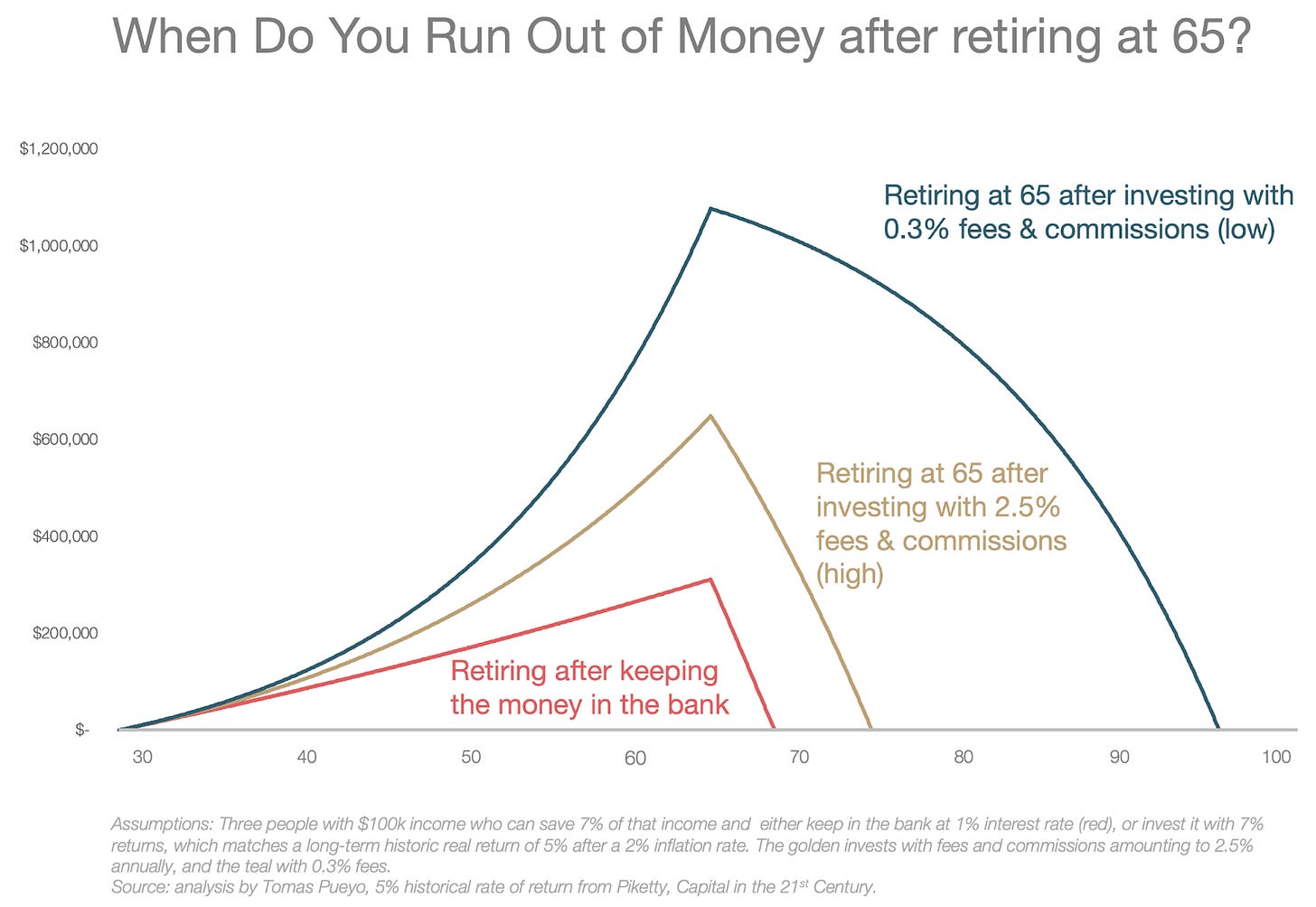

In these three scenarios, the people who saved their money in a bank account (red), who invested their money with a 2.5% fee (golden), and who invested for a 0.3% fee (teal) all retire at 65. If they withdraw every year 80% of what they used to make, the first two are out of money within 10 years. Even the good investors run out at 97 years old. Better not survive past that age!

Some think: But I don’t need to withdraw every year 80% of my pre-retirement investments. I can count on social security payments! Can’t I?

With the evolution of social security costs around the world, do you really think the state is going to pay your retirement the way it’s been spending its money on Baby Boomers? No. And it shouldn’t! We’re living older and healthier. It’s easier than ever to create things, to freelance, to collaborate with projects around the world. It makes no sense to keep the same retirement age as when we died before 65 years old.

Millennials kind of know they won’t retire when they’re 65, but I don’t think they’ve fully internalized it. For that reason, it’s worth accepting one potentially uncomfortable fact: You are not likely to retire at 65.

Let’s assume you retire at 70 instead of 65. What happens?

You still run out of money if you leave it in a bank account.

Poor investing runs out by the time you’re 84.

Something interesting happens with good investing though: it keeps growing after retirement! You reached escape velocity. You have so much money that just the capital gains from it can pay your cost of living.

Those last few years of compounding just before retiring are huge when accumulating money. There’s a ton of value created from spending even a few more years in the workforce. Not only that, but these are also years that you’re not depleting your wealth. So keep that in mind and work from this assumption as you build your investment strategy.

6. Optimize your taxes

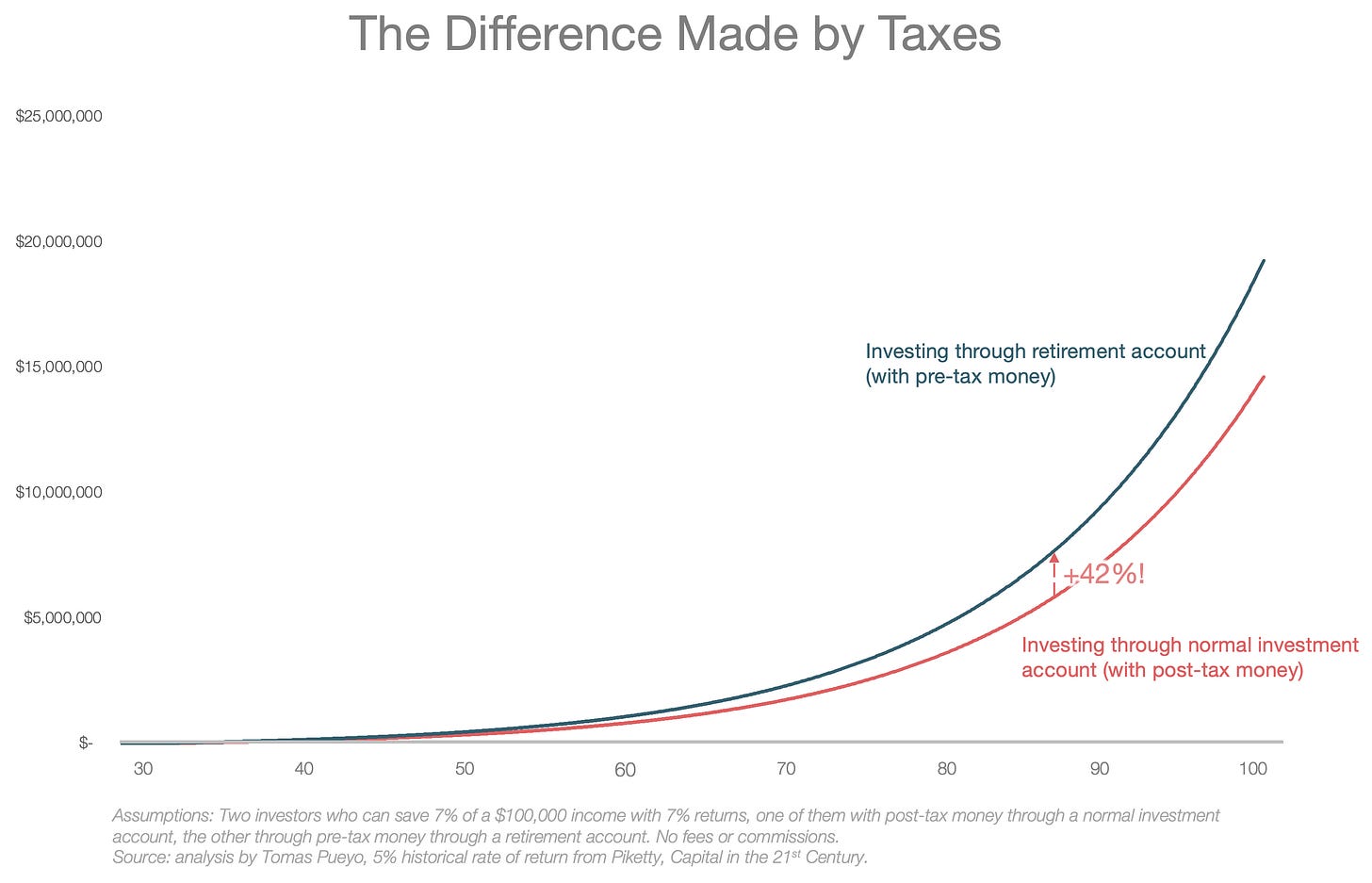

People don’t realize the massive impact that good tax management can have on their retirement. Let’s illustrate it.

So far we’ve taken as an example a person who saves 7% of his income every month. What if that person was able to save on taxes so that instead of 7% he can invest 10% of his income? What impact would that have?

After 60 years of investing, he’d have 42% more money.

Let’s take a more specific example. One person saves through a normal investment account, another one through a retirement account such as a 401k in the US. What happens then?

Just with this small difference, after 60 years of investing, the retirement account has 30% more money than the normal account by deferring taxes. When it’s time to withdraw those funds after retirement, because your income is lower, you pay fewer taxes on them9, and funds last longer.

The simple difference of investing through a 401k (and thus deferring taxes) instead of an investment account makes money last 15 more years!

Taxes fund the roads you use, the water that comes from the faucet, and all sorts of public utilities that we take for granted. Of course, we have to pay them. But governments create this type of tax advantages precisely for you to enjoy them. They want to encourage some behaviors—in this case, properly preparing for retirement. Not taking advantage of them is leaving money on the table at best, and condemning yourself to work for decades more at worst.

There are many ways to reduce taxes. You can find the main ones online easily. I’ll go through some of them in the premium article this week.

How to Make This Happen Easily

Let’s summarize what we’ve learned and apply it with as little work as possible:

Learnings:

Leaving your money to die in the bank is the worst thing you can do. Invest it.

Don’t try to beat the market with clever investments. Just diversify with index funds or ETFs. At least with most of your money. If you want to invest yourself, only do that with money you’re ok losing. It’s play money. Don’t gamble your retirement away.

Be very careful with fees and commissions. Ideally, the combination of both should be about 0.5% or less. Don’t ever pay weird costs like upfront commissions.

Optimize your taxes as much as you can.

Assume you’ll retire later than 65. 70 is a good age to aim for. 75 is even better. The best is if you find a career that isn’t work at all, and you look forward to keep working instead of dreading every day until then.

There. This is what 95% of good advisors would tell you. Unless you are deeply in debt, you probably don’t need to know more than this. Now how do you make all of this happen?

Hire an automated investment advisor (aka “roboadvisor”). As I mentioned, I’m biased because I worked at one and I’m still a shareholder there. But that’s because I put my money where my mouth is: I was a roboadvisor customer before I worked at one, and I still have a big chunk of my money across several roboadvisors.

Why roboadvisors? You tell them how much risk you want to take—in a similar way to what you would discuss with an financial advisor—and they invest for you, diversify for you, don’t try to beat the market, minimize your commissions, optimize your taxes, and have planning tools that help you plan for retirement and other investment goals. It usually takes about 10-20 minutes to get it done, and if you want to talk with a human, many of them allow you to.

In the US, the main roboadvisors that I know are Betterment, Wealthfront, SigFig, Personal Capital, and Schwab Intelligent Portfolios. If you’re a woman, Ellevest focuses especially on you. The investment is mostly the same, but the communication is not. That might be useful.

In the UK, Nutmeg is a good solution. It was recently acquired. In Spain, Indexa is the most famous one and the team behind it is very solid. If I ever have an investment account there, that’s what I’d probably take. This site is great at summarizing the roboadvice options in Europe, and this page looks at Canadian ones.

When you’re picking the best roboadvisor for your country, there are many things they’re going to sell you on, but most of them are broadly similar. The thing that makes the most difference is the fees and commissions, so try to lower that10.

But as we’ve said, you don’t need a roboadvisor. You can do this yourself, or hire a financial advisor. The most important thing is to simply start investing.

Remember: I am not a licensed investment advisor so please don’t take any of this article as professional advice. Study this for yourself. But if there’s one message you should take away from this article, it’s that the single most important thing for you to do is to figure this out quickly and get it done rather than postponing it for some time in the future when maybe you’ll have time. You won’t. So do it. Now.

There are many many many more things to say about investments. I’ll have a few additional premium articles on this topic, including one this week.

Here are the topics I’ll cover this week:

The FIRE Movement (Financial Independence; Retire Early)

The importance of negotiation in all of this

F**k Y** Money: what it is, and what’s your number

Inflation and how advisors “forget” about it to create urgency

Cryptocurrencies, Fiat Currencies, Modern Monetary Theory (MMT), and how they affect all of this

When should you concentrate your bets?

Markovitz’ Efficient Frontier

What does diversification really mean?

Dollar-cost averaging

The mental biases that make active investing really hard

Specifics of tax optimization

The accelerating impact of returns

What parts of the work of a financial advisor can be automated

What the people working inside the roboadvice industry think about their products and how people invest

If you know people who might benefit from this advice to improve their investments—and you think this article can help them—please share it with them!

In the spirit of transparency, I’ve uploaded the excel where I made all this math. It’s not pretty because I didn’t plan on sharing it out, but I thought: why not? That way, if you want to improve it, or if you want to look at what I did, you can. If I made mistakes, you can spot them. LMK if you do and I’ll correct them!

It’s called SigFig. It makes investing really easy. I was the VP of Growth there, which meant building the product, financial industry partners, and more importantly talking with customers and non-customers about their money and money habits.

That’s because the more money you have, the smaller your income is compared to the assets you have, and the more the 2% inflation rate weights on your investments, in a way you can’t counterbalance with more income.

You might have heard about ETFs instead of index funds. So index funds or ETFs? I use “index funds” because the word is self-explanatory. But they’re basically the same. ETFs are like diversified stocks, which gives them some small advantages. So technically it’s better to buy ETFs. But I chose to keep it simple in this article.

A sizable share of my assets are in Vanguard funds, inside of roboadvisors.

I worked between 2014 and 2018 at SigFig, where I was a VP of Growth. I learned most of what I know about finance in my MBA at Stanford and during my time at SigFig. I still have stock from SigFig. That said, the very reason why I went to work at SigFig is because I really think roboadvisors are the best way to manage your money. I had money in a roboadvisor before joining SigFig, and I still have most of my money in them—not just SigFig. Most of them are quite good. Betterment, Wealthfront, Schwab… Any of them is a good pick.

This expense ratio is what is much more expensive in mutual funds than index funds.

As explained in painstaking detail by Piketty in the magnificent Capital in the 21st Century, which goes through centuries of data to show that.

This evolves all the time. Vanguard has been reducing these prices for decades now. That’s what they do. The founder, John Bogle, was a legend. His purpose was to make funds as cheap as possible, always. As a result, he’s been putting pressure down in the market. Some have followed, like Schwab and BlackRock (in some cases), but many are still hanging around like vultures trying to extract the last penny from unknowing customers before they go extinct.

There are many assumptions that underlie this bet. One is that taxes remain broadly similar. If they spike up, you’d rather pay them now. If they go down, better defer them. The marginal tax rates can also change through an evolution of societal wealth or inequality, for example. Here I’m keeping it all the same, but it’s important to note this, because if you have for example a strong belief that taxes will go up—or you will make substantially more money in your retirement than today—you might not want to defer your taxes.

There are other things that matter a bit, such as tax loss harvesting and things like that. But that stuff is super advanced. You don’t need to understant it to make a decision. The key is to invest. If afterwards you’re interested in optimizing, it’s easy to look into them and pick one that’s better. But that has a small impact in comparison with the benefit of simply getting going.

Good article on the fundamentals, however "plan to retire at age 70-75" - how is this possible when every day there is a new report about how people over 50 are having a harder and harder time finding work? I guess the real insight here is that you need to find a way to make yourself employable (or self-employed) until age 75, which seems near impossible for the vast majority.

A second comment... you were too kind to the AUM ("assets under management") fee model that's typically a 1% fee. Besides the enormous lifetime cost (as you showed in your variations of exponential charts), there are at least two other problems with the 1% AUM fee besides the obvious one that they can't beat a passive index.

First, it essentially captures close to 100% of the after-tax returns in the fixed income portion of the portfolio -- all the gains go to the advisor but any losses accrue to the client. Nice work if you can get it!

Second, it's rife with conflicts of interest. Consider the simple case of a $1 million client who asks his advisor if he should pay off his $300K mortgage with some of his savings. If he does so, the advisor's fee is going to shrink by 30%. That's tricky to resolve when the advisor tells you you're better off keeping the mortgage.