Is There an AI Bubble?

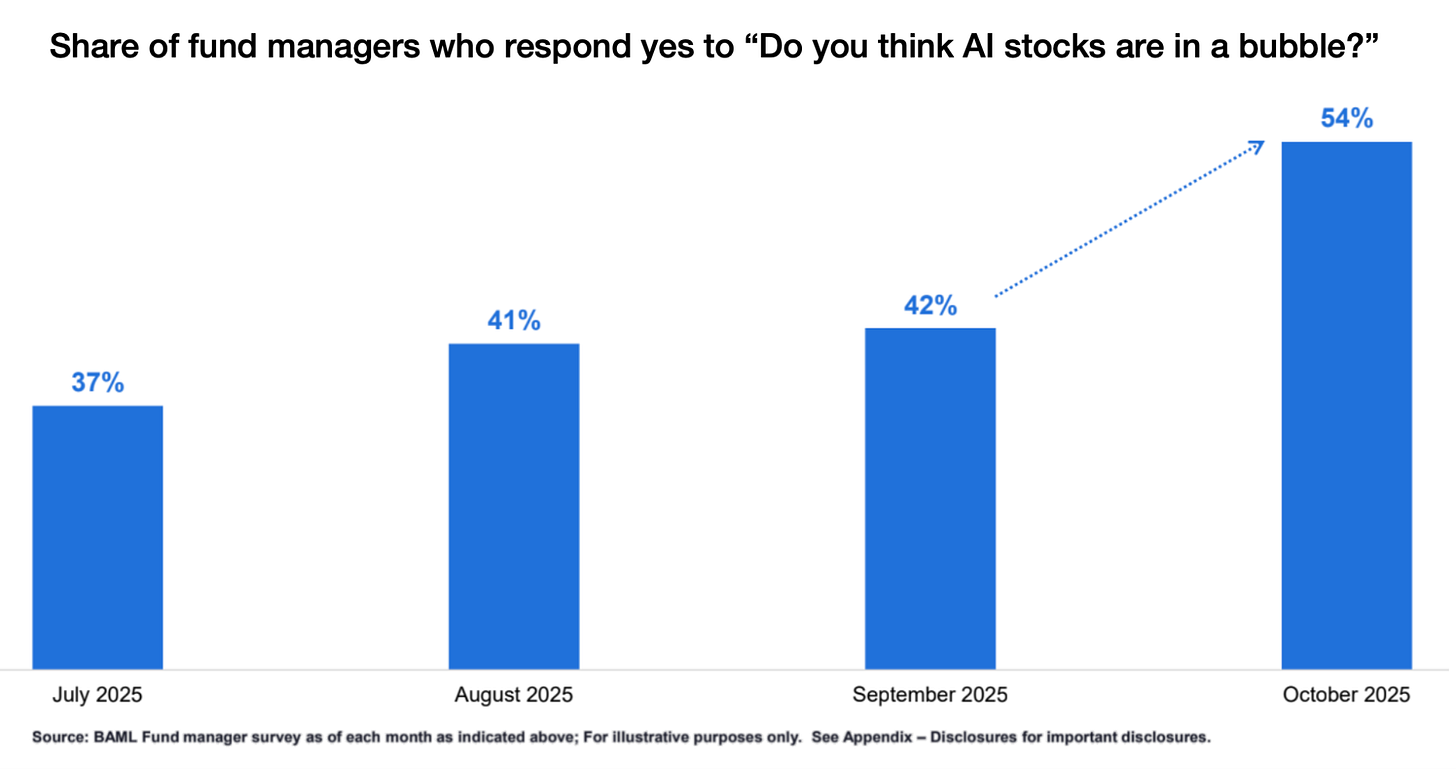

The Financial Times has written about it. The Economist. The New York Times. The Atlantic. It was a big theme at a few recent conferences I went to. The investment community thinks we’re in a bubble:

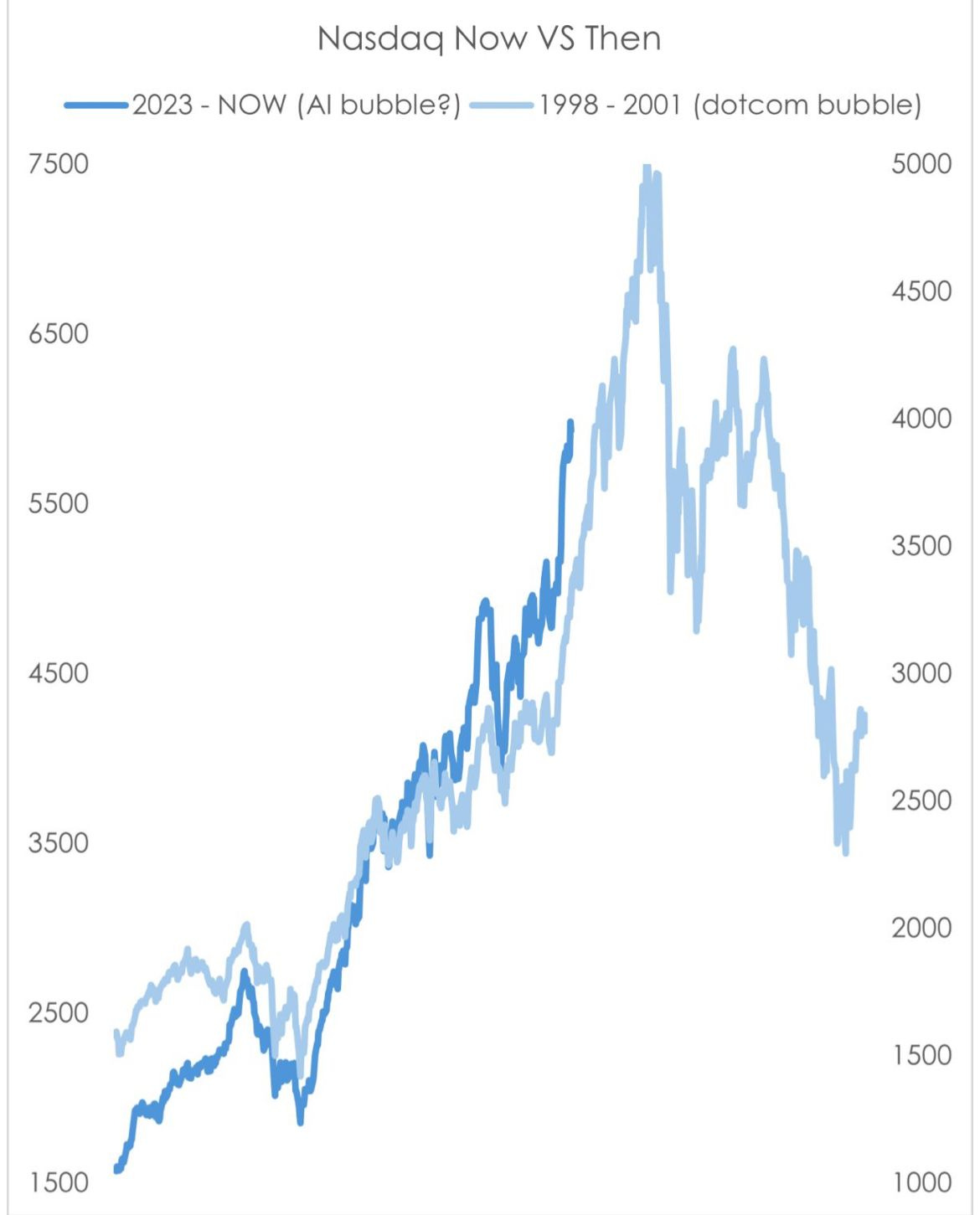

The fear is that we’re in a similar situation to the tech bubble in 2000-2001, or the railroads in the late 19th – early 20th century. In both cases, the investment (in Internet cables, websites, railroads) was amazing in the long term, but there was initial overinvestment. When early demand didn’t materialize, lots of companies went down and investors lost their money.

A market correction of the same magnitude as the dotcom crash could wipe out over $20trn in wealth for American households, equivalent to roughly 70% of American GDP in 2024. Foreign investors could face wealth losses exceeding $15trn, or about 20% of the rest of the world’s GDP. For comparison, the dotcom crash resulted in foreign losses of around $2trn, roughly $4trn in today’s money and less than 10% of the rest of the world’s GDP at the time.—Gita Gopinath on the crash that could torch $35trn of wealth

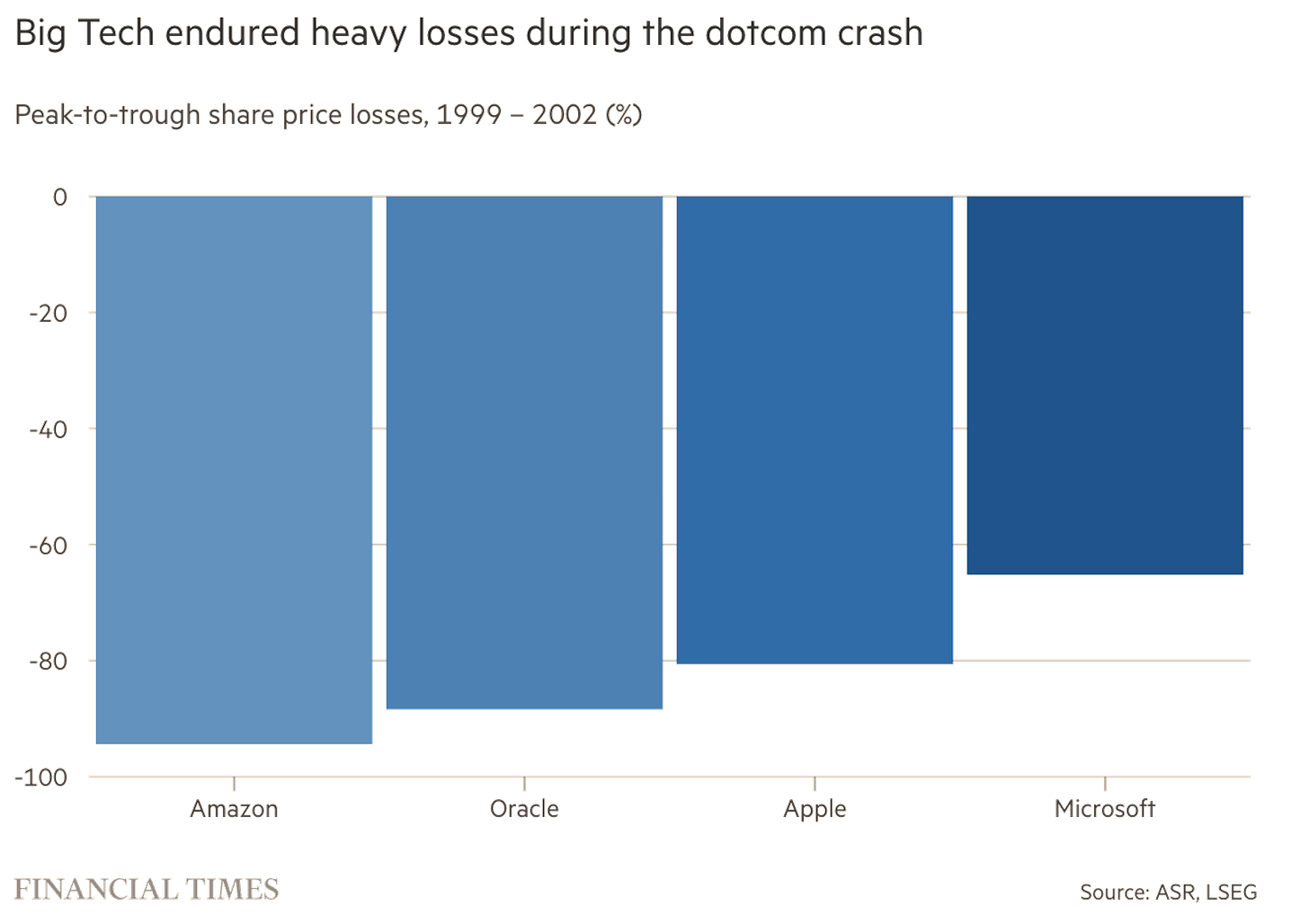

This is what happened to top tech stocks in the dotcom crash:

If you invest in stocks and like having money, you might not want your portfolio to look like this. So is this happening now?

The Signs of a Bubble

They’re everywhere if you pay any attention.

Exuberant Valuations

If you take a huge step back, we should be in a recession. Interest rates went up dramatically after COVID, there’s a trade war around the world, the European economy is in tatters because of overspending on social programs, the high cost of energy, and competition from China. Yet the economy is booming and the stock market with it.

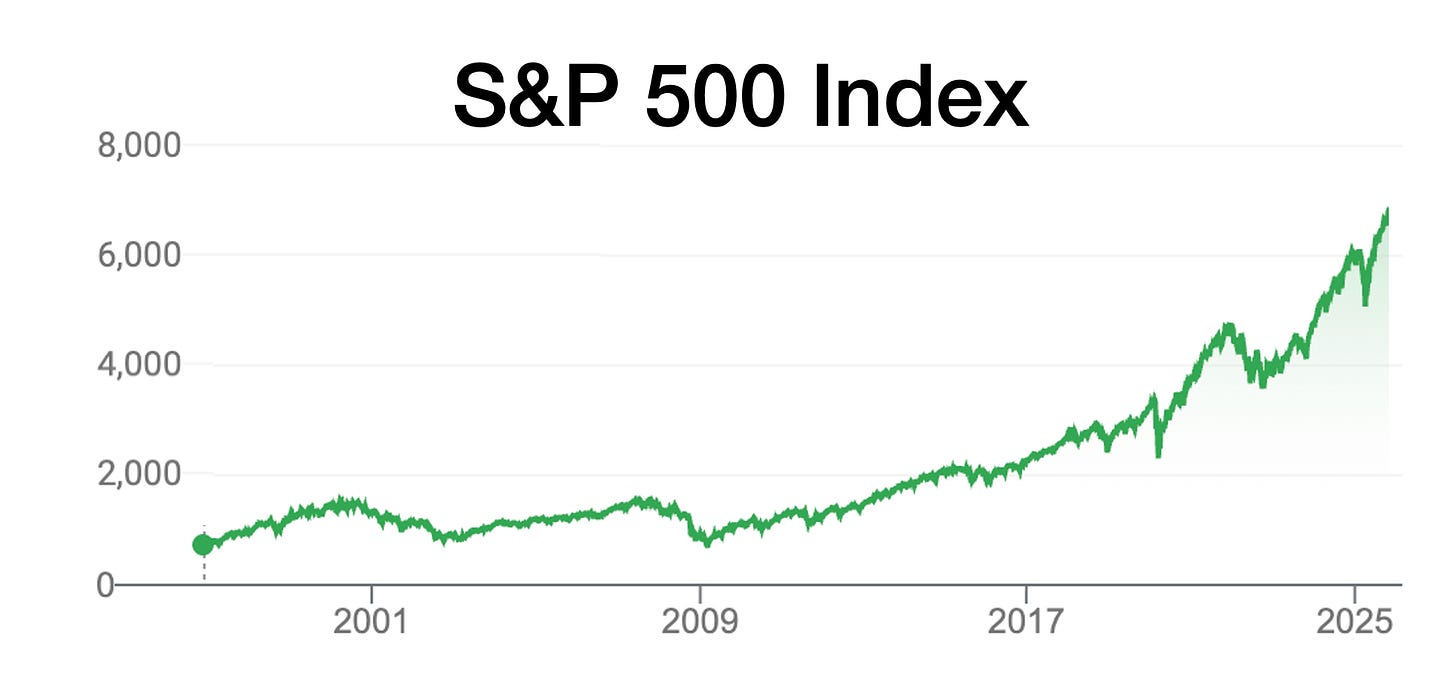

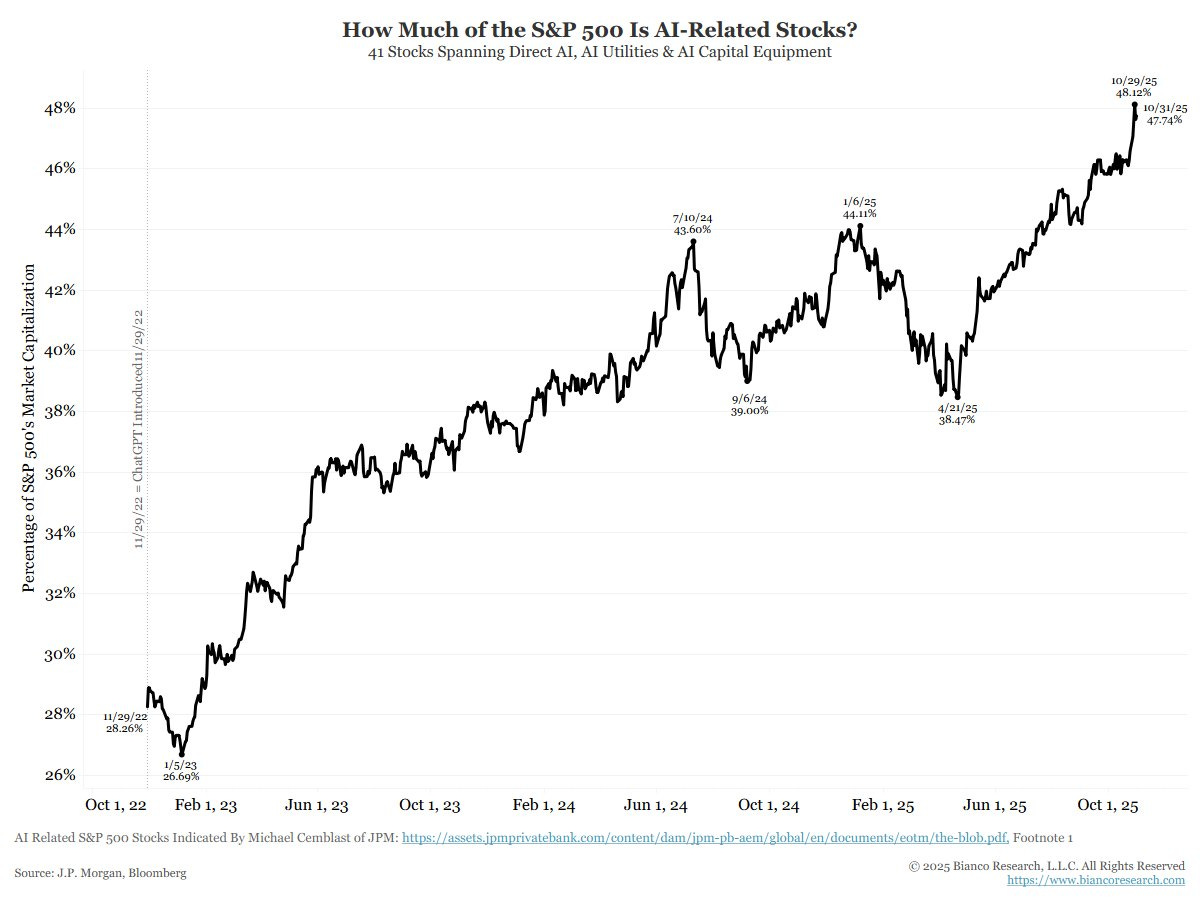

This is single-handedly driven by the impact of AI, which accounted for 85% of the gain in US stocks so far in 2025!1 AI companies now make up half of the S&P500!

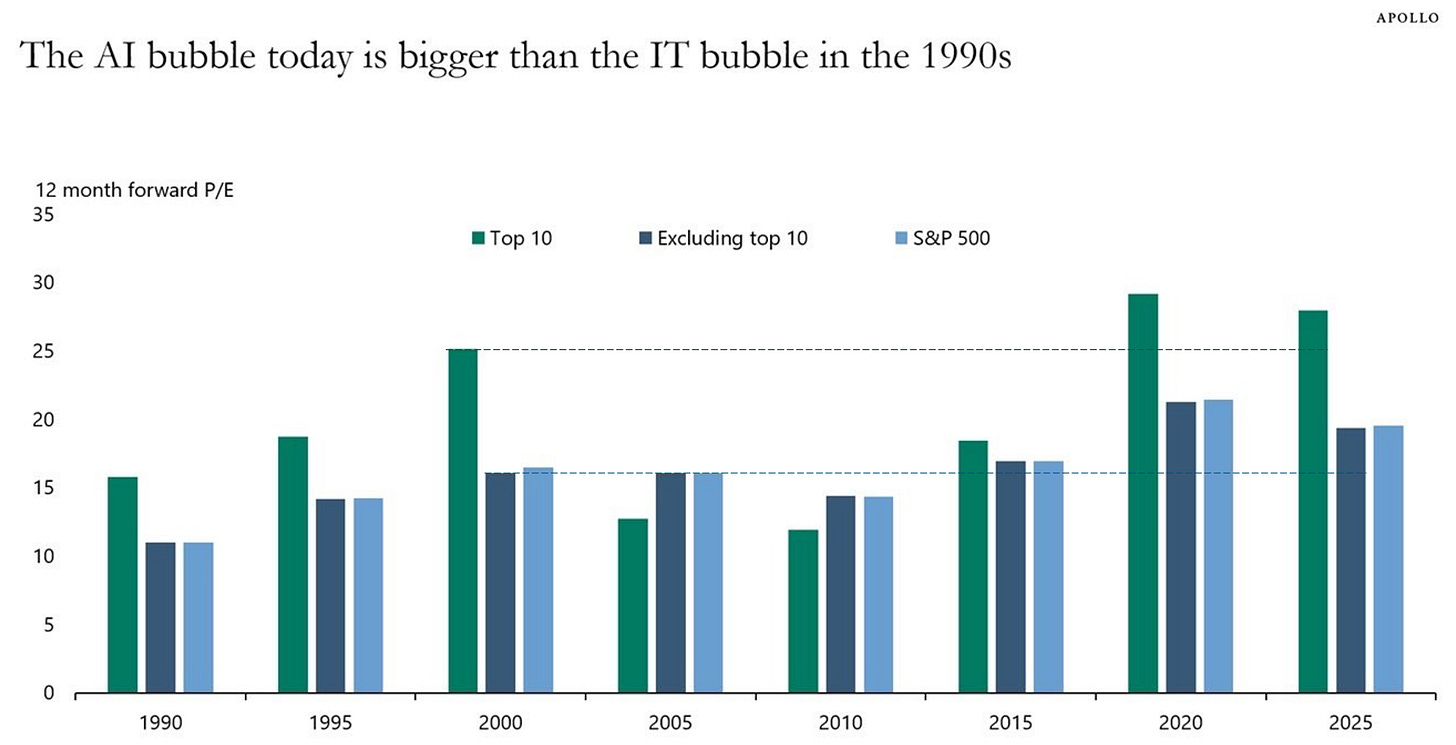

This viral chart puts it in context:

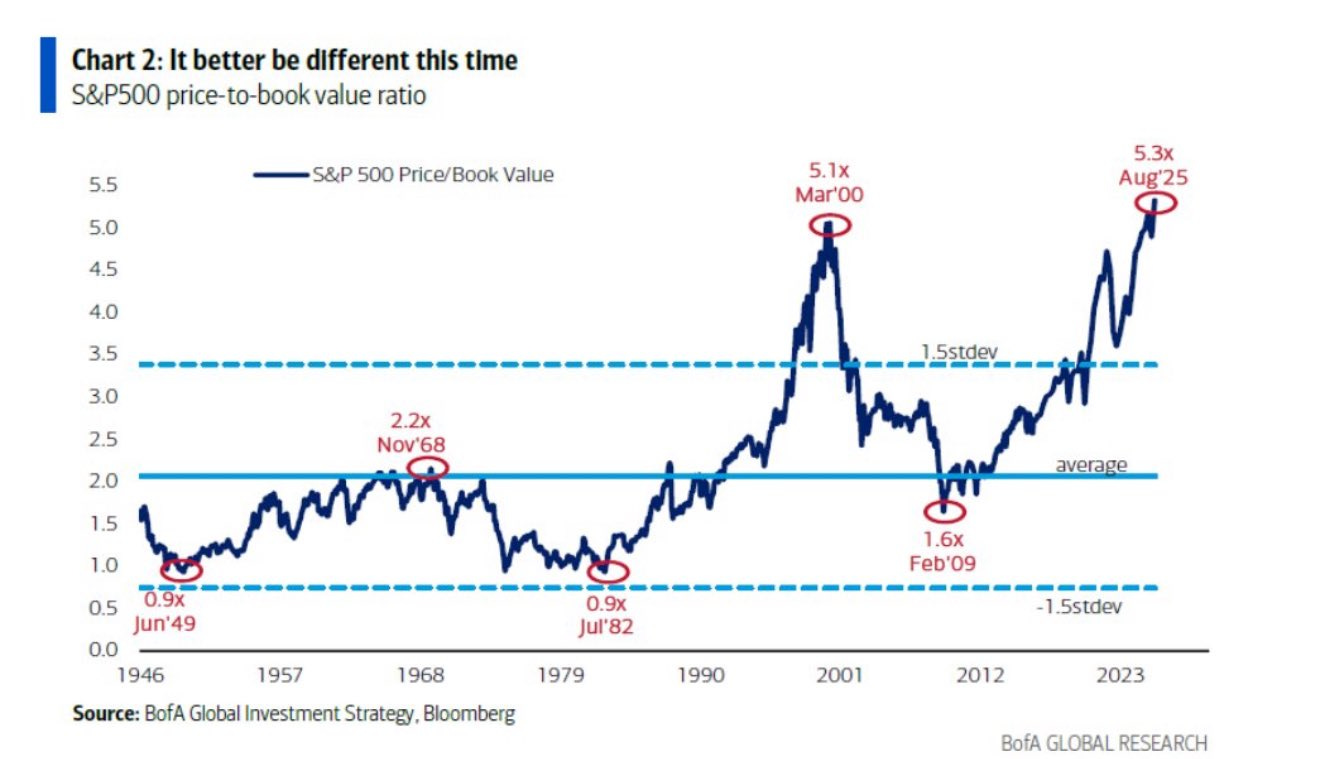

From peak (2002) to trough (2006), the S&P lost 64% of its value. Yet the stock market is more expensive today (vs its actual earnings) compared to the equivalent numbers in 2000, just before the dotcom burst.

If instead of P/E ratio you look at price-to-book value (the price compared to the value of the company in the books; its assets minus liabilities):

People love comparing the evolution of stock prices:

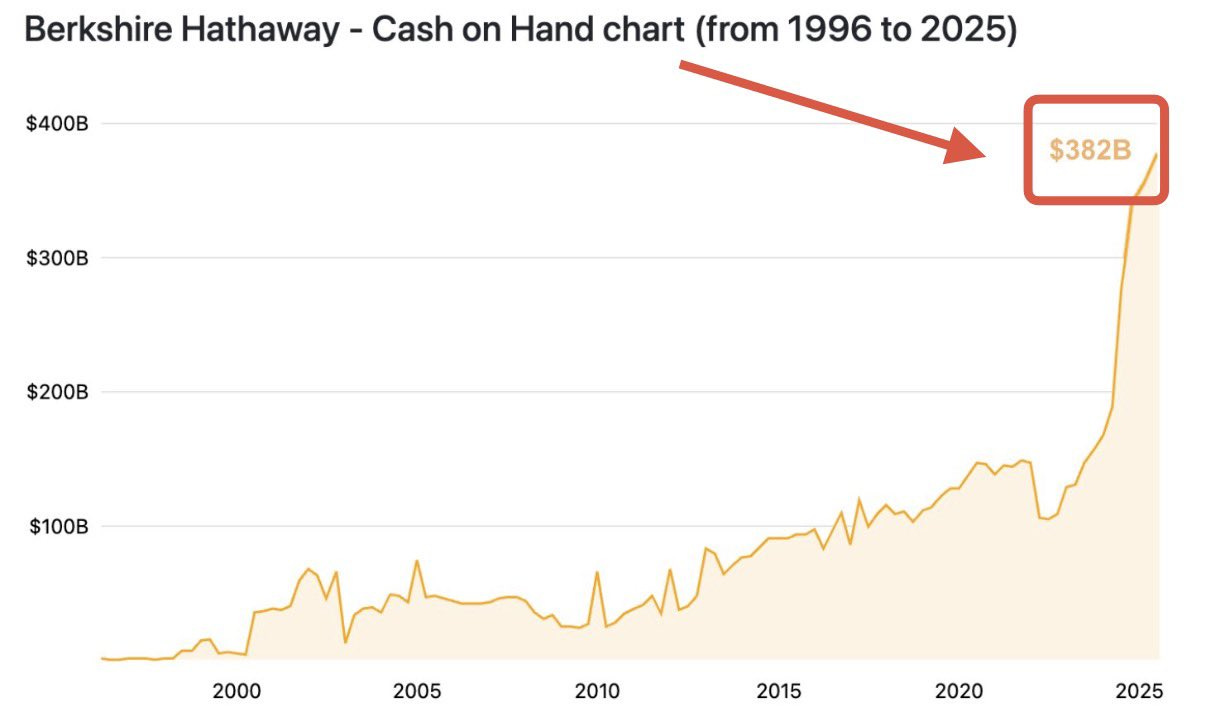

Warren Buffett is smelling the blood and is accumulating cash, anticipating a buying spree when the markets crash.

He’s been selling stocks for four straight years to build up this war chest:

Huge Investments

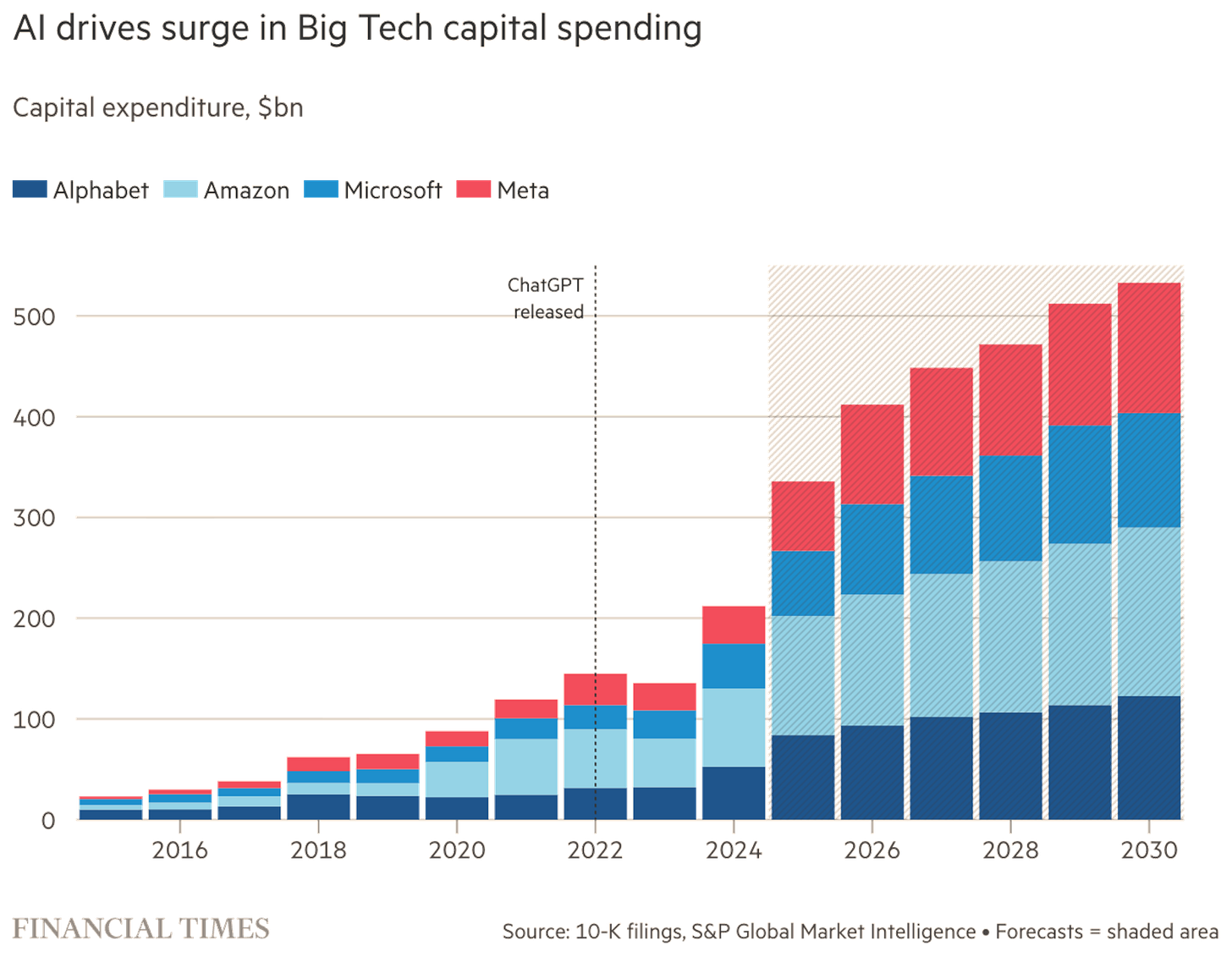

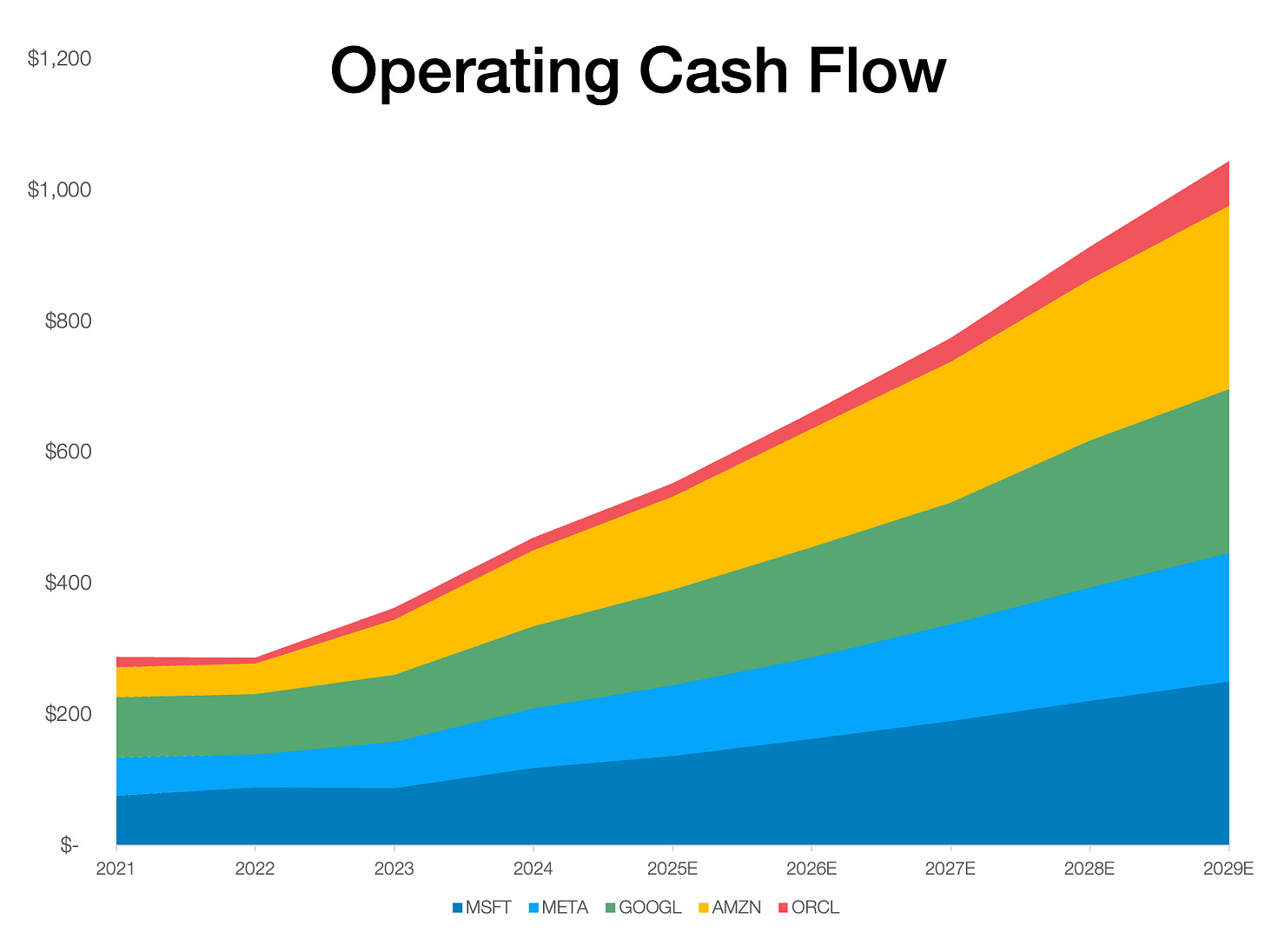

The outsized valuations Buffett is preying on are based on the promise that AI will make these companies a ton of money. For that, they need to invest a lot upfront in chips, data centers, servers, software… This is so much investment that ~45% of the US economy’s growth so far in 2025 is due to AI build-up! A lot of it comes from the top 4 biggest AI companies.

They are not the only ones investing.

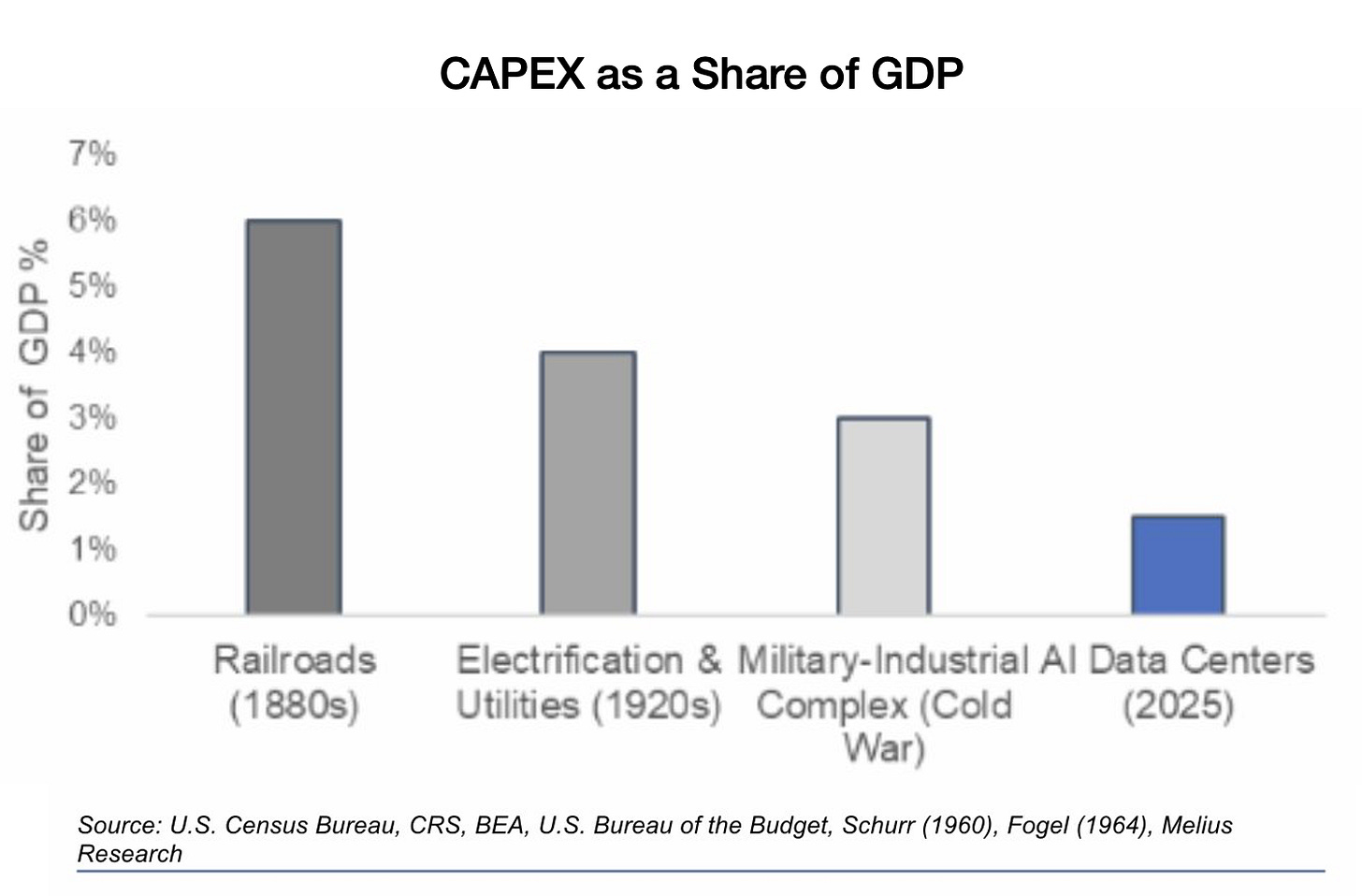

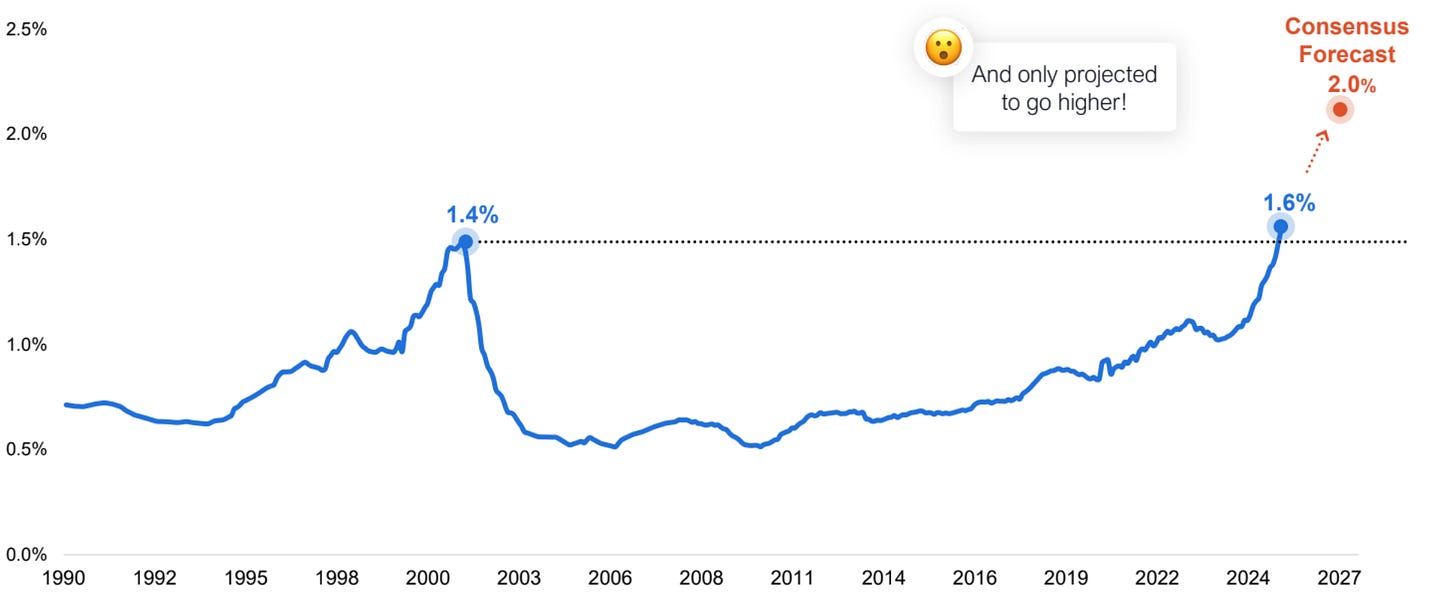

There’s a projected $1.5T debt for AI data centers by 2028. Together, all these investments account for a higher share of GDP than in the dotcom bubble!

It’s not yet at the level of railroads or electricity, but if it keeps growing as planned, it might reach ~4% of GDP, competing with the electrification craze.

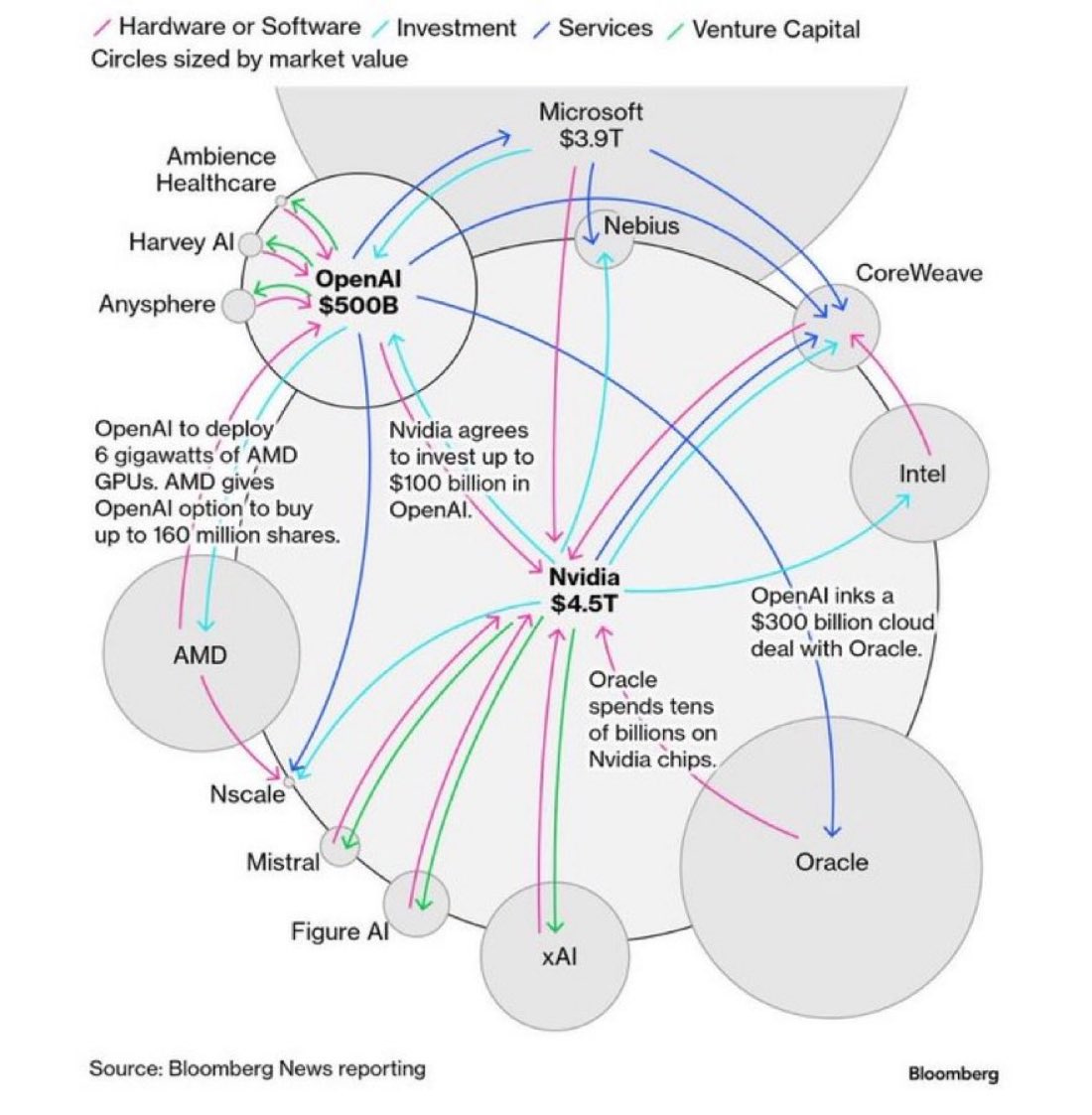

But also, everybody is investing in everybody else.

Circular Investments

The fear here is that companies might be inflating valuations by investing in and spending with each other. There’s also the fear that if one fails, many others might, too.

So are all these investments supported by sound financials?

Return on Investment

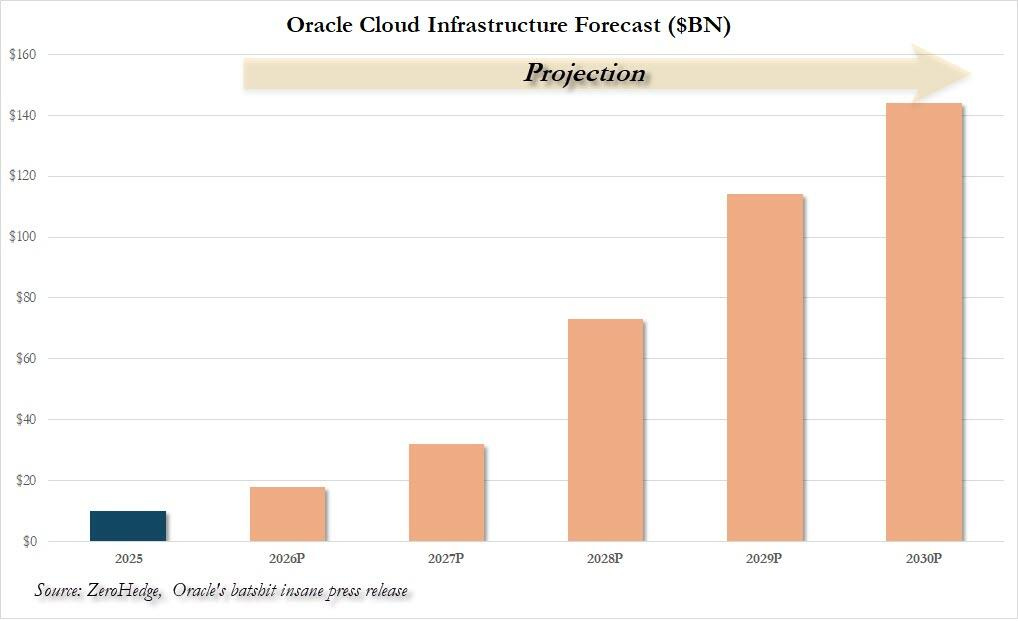

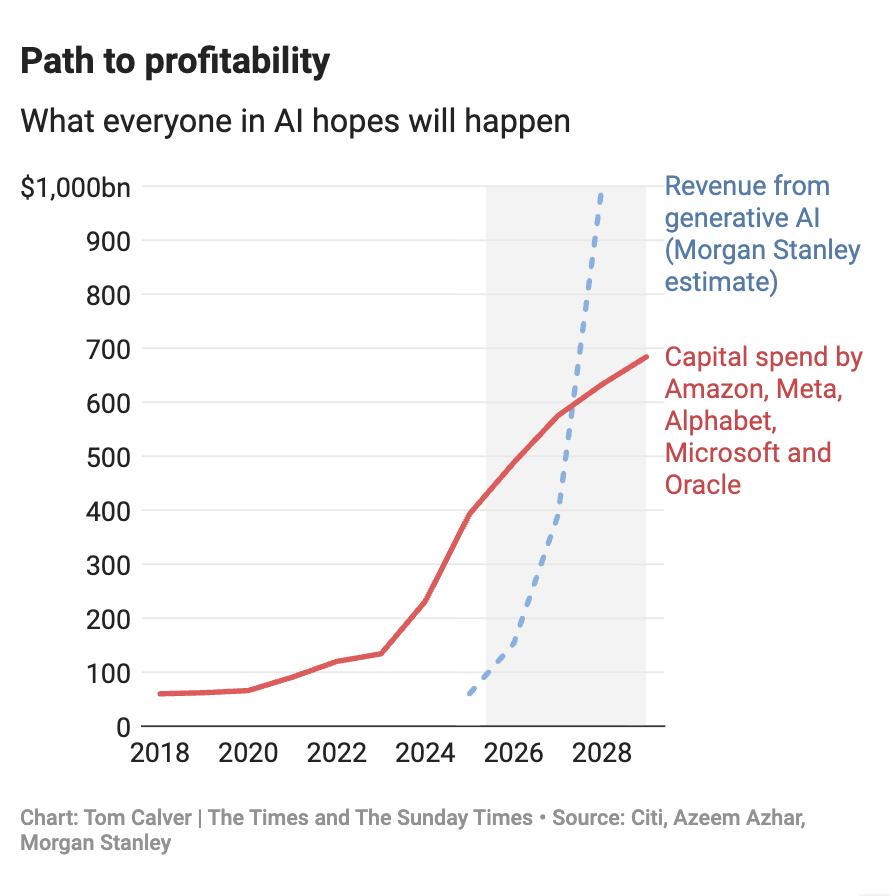

How can a company with $13B in revenue make $1.4T of spending commitments?—Brad Gerstner, All Things AI podcast

Sam Altman says OpenAI makes more than $13B, and revenue is growing fast, but still. Only 1% of spending commitments are covered by revenue?

Most of what we’re building out at this point is the inference [...] We’re profitable on inference. If we didn’t pay for training, we’d be a very profitable company.—Sam Altman

What this means is that the initial investment costs are so humongous that OpenAI, the company that makes the most money from end consumers of AI, loses money. In fact, it’s valued at $500B with no profits expected for 5+ years! The company is burning about $12B per quarter right now, on 700M weekly users.

OpenAI is burning $12B per quarter

And what happens if chips are outdated in 3-5 years? Wouldn’t that be a way to burn trillions in value?

Profitability

All of this would be OK if customers were seeing a lot of value in AI and couldn’t stop buying more and more: OpenAI and its peers could learn how to spend its money better over time, amortize their huge investments over decades, and print money. But this doesn’t seem to be the case

95% of organizations are getting zero return in their GenAI investments.—State of AI in Business, MIT.

If end customers like Unilever or Walmart don’t see a return on their investment into AI companies like OpenAI or Anthropic, will they keep investing? If they don’t, what will happen with the hundreds of billions of investment commitments the AI companies have with the likes of NVIDIA and Coreweave?

Demand Is Lagging

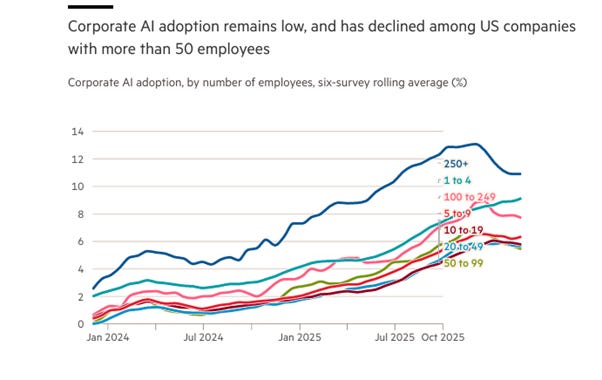

That’s why it’s a worrying sign that corporate AI adoption remains low and is shrinking!

Remember that the big four tech companies are investing hundreds of billions per year in their AI build-up. They would need trillions in revenue to make this back!

This reminds me of Internet infrastructure.

By the early 2000s, telecom companies had raised almost $2T in equity and $600B in debt, mostly to build over 80M miles of fiber optic cable in the U.S. alone. By 2005, as much as 85% of those cables were still unused (“dark fiber”). This led to plummeting bandwidth prices and eventually, serious financial losses and bankruptcies in the telecom sector.—Akshat Shrivastava, checked here

The supply was built too far ahead of the demand. Worryingly, Microsoft is canceling data center leases due to the fear of oversupply. They are specifically targeted to limit OpenAI’s training of better AIs.

Competition

Maybe you could imagine a return to reason, where players realize they might lose trillions, and decide to lower investments and increase prices? But this will not happen here because these are the biggest companies in the world fighting to be the first ones to create a god, and harness all the power and value that come from it. Luckily for them, they’re already making money hand over fist, guaranteeing that they can keep financing this at steep losses for a long time.

So hold on a second: The bulk of GDP growth and market exuberance comes from a handful of companies with circular investments that lose money servicing every customer. Meanwhile, these customers don’t understand these AI products well enough to make them useful, so their adoption has slowed down, but this whole castle is built on estimates of revenue growing exponentially?! Which must happen through more customers, because more revenue per customer might be hard, as all these companies are competing on price, and their pockets are so deep they can keep pushing prices down for decades?

Is it a bubble then? Here’s why I don’t think it is.