Playing Catch-Up with the US

How the GDP per Capita of the US Can Explain the Economics of so Many Countries

How much should the US fear the Chinese economy?

Is it like in the 1980s, when it feared the Japanese economy would surpass the American one? Why didn’t it happen?

Why has Europe stagnated after the 1970s?

Will the economic growth of Taiwan slow down? Will it accelerate in India?

You can answer these and many more questions simply by looking intelligently at Gross Domestic Product per person (or “GDP per capita”)1. It’s a special tool that few people know how to use well. But if you learn a few tricks, it can help you see some of the world’s big economic patterns, understand where different economies are going, and call out the constant BS spewed by many pundits.

On top of that, we obsess about GDP, but GDP per person matters much more, because it tells you how rich people are. So it’s good to dive into it. Let’s do it!

If we look at a handful of world countries—including those that have the most historical data—we can see that GDP per capita was broadly stable for millennia until it exploded during the Industrial Revolution2.

We can also notice something else: see that red line? The US has been at the top of GDP per capita in the world for about 150 years! The trend can be traced back to about 1830.

In 1830, the GDP per capita in the US starts growing at ~2% per year3 and never stops4.

We have a track record of nearly two centuries of uninterrupted growth at about 2%!

Unbelievable.

In antiquity, that annual growth was at most 0.1%, usually less, and definitely not as reliable.

Why? I’ll go into the details of this in the premium article of this week. For today, the only thing we need to know is that the growth in US GDP per capita is the highest in the world and hasn’t changed in nearly two centuries.

This is enough to explain the “post-war miracle” that happened in Europe.

Europe: Les Trente Glorieuses Catch-Up

In France, they call the 30 years after the war les trente glorieuses, as if French people had some sort of élan vital that made them hyper productive, never to be replicated afterwards. Since then, the French have looked back at that time wondering what, exactly, they did so well, and how to get back to that miraculous level of growth. Maybe the young are indeed lazier?

You should be suspicious, since Germans, Brits, Italians… all had similar stories of their own economic miracle.

Hmmm… European countries suffered a dire economic destruction during WW2, but they’ve been growing ever since. In fact, it looks like… they've been simply following the US GDP per capita growth?

What if we used the US GDP per capita as some sort of… yardstick? What if we look at GDP per capita of different countries simply as the % of US GDP per capita they’re able to achieve?

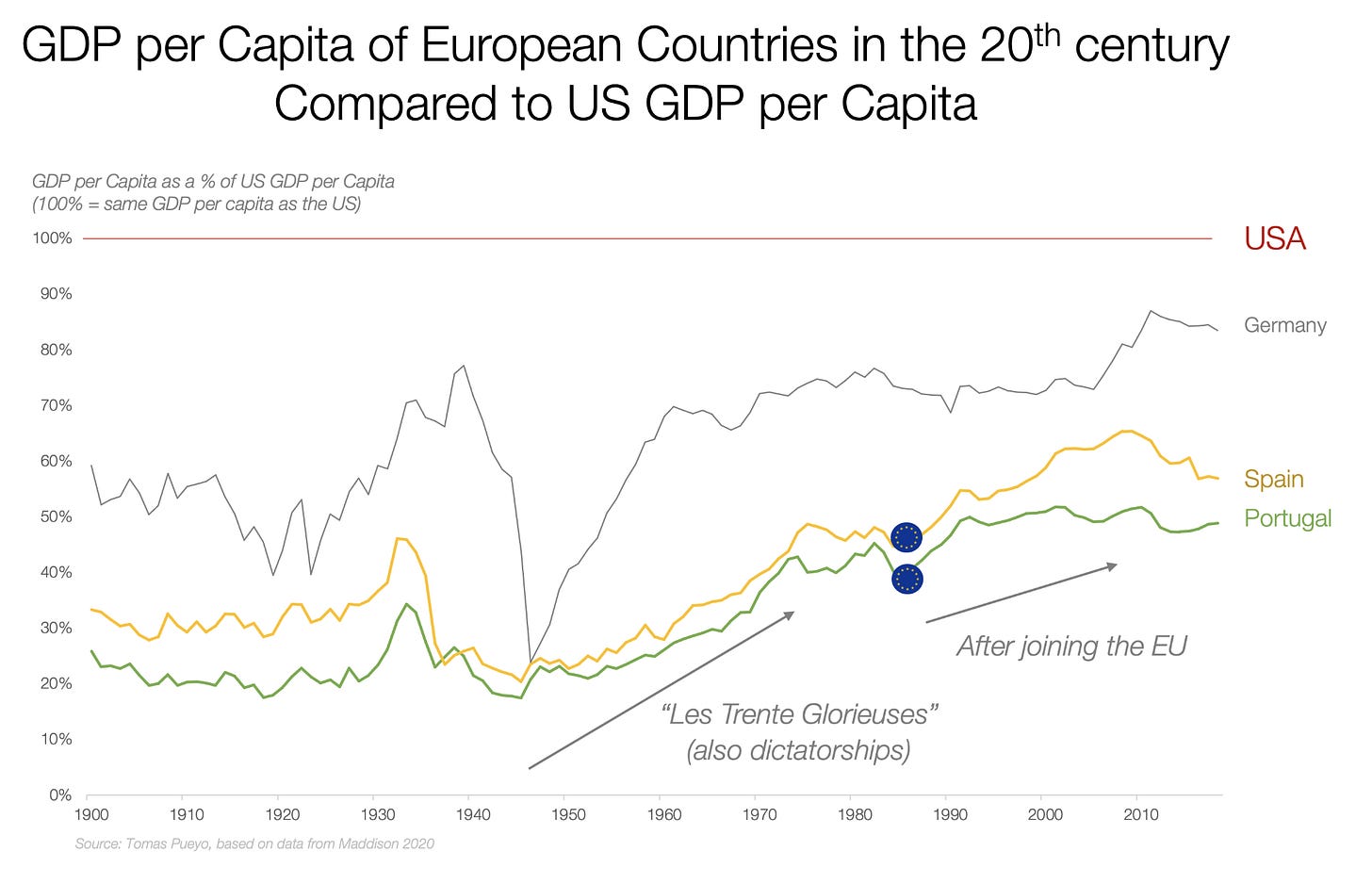

And there you have it. Les Trentes Glorieuses, the German Miracle, and every other economic growth in Europe was simply the continent catching up to the US during the 30 years after the war, while Europe was reconstructing, and then after that keeping a broadly stable level of GDP per capita compared to the US.

It is notable how stable the growth of European countries is compared to that of the US after 1970.

What if we use this yardstick with other countries?

Spain and Portugal

Portugal and Spain suffered their own collapses in the 1930s, but didn’t participate in WW2 so they didn’t suffer too much from that. However, after WW2, they also lived through a prosperous period of GDP per capita catch-up. Like the rest of Europe.

And like the rest of Europe, these countries presented the post-WW2 growth as a story of exceptional local management. This is one of the reasons why the Portuguese and Spanish dictatorships, which lasted coincidentally until the mid-70s (when the Trente Glorieuses ended), still have a lot of popular support: people mix causality, and assume they were well managed.

When in reality they were just playing catch-up.

In fact, unlike other European countries, they grew less between 1945 and 1975, but they resumed their catch-up around 1986, when they joined the EU. You can imagine how the accompanying reforms and foreign investment helped the countries continue their catch up.

What about the Eastern Bloc?

Eastern European Bloc

Being under communist management meant they caught up much more slowly after WW2. Their economies were collapsing in the 1980s5 and through the fall of the USSR, but starting in 1995 they have started catching up faster. It’s probable that they will continue catching up for decades—which would make them a good investment opportunity.

But what level are they going to catch up to? It seems like countries catch up to some level of US GDP per capita and then remain there. That level is ~50% of US GDP per capita for Portugal and ~60% for Spain, while countries like France, the UK, and Italy hover around 70%, and Germany and the Netherlands have been around 85% since the early 2000s.

It’s as if the US led the world in productivity, and foreign countries could catch up to a greater or lesser extent depending on their internal factors.

This can help us understand Japan’s rise and stagnation.

Asian Economies

Japan’s Rise and Stagnation

In the 1970s and 1980s, there was a common fear in the US: Japan’s meteoric rise meant it would soon pass the US in GDP! Then somehow there was a crisis in the 1990s, which many blame on overinvestment and hubris, and according to the story Japan has not been quite able to get back on its feet since.

But a GDP per capita analysis compared to the US shows a different story.

The American fears of Japan were unfounded. Japan, like other European countries, caught up with the US after the war. It’s just that it kept going a bit further, with 15 more years of growth that was probably unsustainable for the country given its internal factors. Since then, it’s just converged with the other developed economies to a level of ~70% of US GDP per capita.

This can help us guess what will happen with Taiwan and South Korea.

Taiwan and South Korea

Taiwan and South Korea have a similar story: both were poorer than Japan before WW2, both suffered more than Japan during WW2 and started from a lower point after the war, and both took more time to start growing, maybe due to their respective dictatorships.

More importantly, the current levels of GDP per capita they have achieved tell us that it’s unlikely they will keep growing as fast as they have been. With slower growth also comes political instability. It’s possible that Taiwan and South Korea will become less stable in the coming decades...

What about other East and South Asian economies?

East and South Asian Economies

A new story is demystified. All these countries took a few decades to do any catching up, but as countries started adopting a globalized model—that is, closer to what the US promotes—they started catching up with the US.

Sometimes there are ups and downs. Like the 1997 Asian Financial Crisis. But the long-term trend is unmistakable.

In this light, the story of Chinese growth becomes much more banal. China’s economy is nothing special. The only thing that’s special about China is that there are a lot of Chinese people6.

This is also a potential investment idea7: if you want to invest in Chinese growth, but don’t like the government, you don’t need to invest in China proper. You can invest in any east, south, and southeast Asian country and the growth will likely be similar on average.

OK, if countries that open up to the US catch up with it, but they reach a threshold below US levels at some point, what determines that threshold? Wouldn’t it be good if we could have a sense of where that threshold is?

What Drives Country Thresholds of GDP per Capita?

Why is US GDP per Capita always at the top? What drives its growth so much? Is it culture? Land? Institutions? Politics?

One way to get a sense of that is comparing the US to other countries that are very similar: similar language, similar philosophy. I’m talking about developed Anglo-Saxon countries. If their GDP per capita is well below the US’, then we know there’s something truly special about the US.

Anglo-Saxon Countries

It’s remarkable how stable these graphs are: after WW2, they become much more like horizontal lines, which means that the growth of these Anglo-Saxon countries8’ is just following that of the US.

There are ups and downs—like New Zealand until the 1990s, or Australia’s boom starting in the 1990s—but in the grand scheme of things it’s pretty stable.

And lower than the US! Whatever the US is doing, everybody seems to just try to keep up with it.

Another thing we can take away is that Anglo-Saxon countries do seem closer to the US than other countries. Canada and Australia, two countries that follow the US pretty closely in culture, institutions, and regulation, are respectively at 85% and 90% of US GDP per capita.

Except for Ireland there. What’s going on? If you read The End of Nation States, you already know: taxes.

Tax Leeches

Famous tax havens like Switzerland, Luxemburg, and now Ireland are some of the few countries with a higher GDP per capita than the US. And it’s not because they’re especially productive.

What they do, however, is attract some of the wealth generated by bigger countries into their smaller economies through lower taxes. Since they’re always small countries9, attracting a few rich people and companies makes a big impact in their economies—and makes them rich.

Then you have middle-income trap countries:

Not all countries converge towards US GDP per capita levels. Others remain pretty stable. For example, Brazil, El Salvador, Colombia, South Africa, Morocco, Iran, Lebanon… These are countries suffering from the middle-income trap.

By the list, you can quickly see that one of the main reasons why these countries are this way is their management. Countries like Cuba, with a communist system, can’t converge with the US. Others, like Argentina or Brazil, are full of corruption and mismanagement.

Takeaways

It’s quite remarkable that the US is at the top of GDP per capita in the world, and has been for over 150 years. And it keeps growing!

That’s enough of an explanation for the growth of Japan and Europe after WW2. There wasn’t a magical force. They just caught up with the US.

How can we know which countries will catch up with the US’ GDP per capita? Those who try hard to emulate it. Developing countries that get in that system do indeed catch up. Those who don’t, remain at their previous level.

There are ups and downs depending on crises, good policies, and luck, but otherwise these trends are quite stable and reliable.

We also know what their threshold of growth is: usually, a high percentage of US GDP per capita is their limit.

This is also a fantastic way to know how much an economy is underperforming its potential. If it’s at 45% of US GDP, like Greece has been for the last few decades (except between 1995 and 2010), it’s clear that there’s lots of room for improvement.

It doesn’t mean that these countries can fully catch-up (sometimes their land make it very hard. But then look at Dubai, Singapore, or Japan…) or should (maybe their goals don’t include maximizing average citizen wealth). I’m just highlighting what’s possible and isn’t.

All of this means that the US’ system is a beaming light of growth for the rest of the world. As countries emulate it, they grow. This system lifts the income levels of billions of people every year.

Ironically, this is the US’ blessing and its curse. Blessing, because it exports its economic system everywhere. Every year, every country becomes a bit more like the US. Curse, because the more other countries learn how to manage their economy the US way, the faster they grow in comparison to the US, and the smaller the size of the US’ GDP as a share of global GDP.

This reminds me a lot of Romans: as centuries of occupation passed, barbarians at the borders of the Roman Empire caught up with Rome. So much so that by the middle of the 1st millennium AC, they had fully caught up, invaded Rome, and erased it from the map.

The US’ economic success will be its grand contribution to the world.

And its demise.

This week in the premium article I’m going to go deep into why the US GDP per capita is so high compared to that of other countries, and why it constantly grows at a clip close to 2%. Subscribe to read it!

GDP is a good measure of the economy. GDP per capita is a broad measure of income per person. I’m using real GDP based on 2011 prices, which is what the Maddison Project Database has. I don’t use PPP because that’s more useful as a tool for analysis of inequality, redistribution, and perceived wealth, than it is to compare relative sizes of economies and their potential.

The Italian and Dutch records of wealth held for centuries are a good story for another time.

1.7% to be exact

Well, OK, it does stop. For example during World War II. But aside from that it’s pretty stable.

which maybe was a sign that the USSR was going to collapse at some point? Hindsight is 20-20.

As Jorge Hintze mentions in the comments, size does really matter. All other things being equal, a bigger economy has more network effects and can impose its goals more successfully.

I’m not a financial advisor, this is informational and entertainment only.

I included the Netherlands because historically their economy has been closer to the British than that of their continental neighbors.

The math wouldn’t work otherwise. I’ll write an article about this.

Having read the whole paper again today, I guess I remain confused by it.

I might be wrong, but your opening statements suggest the subject is geopolitical rivalry, which is great, because it is indeed one of the biggest issues the world has currently, but then tea leafs are read based on GDP per capita, a measure indicative of, but not even necessarily the best on, the wealth of citizens.

If GDP per capita was significant for geopolitical competition, US would have considered Luxembourg, Singapore or Qatar etc. global competitors. I would have thought GDP is far more relevant, since it relates to what an expenditure of X% of a nation’s GDP on their military, foreign aids, R&D or infrastructure development etc. would mean. Throughout history, the issue is the capability and capacity of countries “throwing their weight” around, for good or for bad, don’t you think?

In other words, not only is the paper reliant on the Maddison estimates, which are rather different to World Bank’s or IMF’s and hence potentially questionable in terms of accuracy and utility for informing policies and trends, the paper examines and concludes from a parameter that is at best tenuous to geopolitical competition.

The US is hostile to and wants to “contain” China because the issue is who is going to be the king of the mountain internationally. While currently their GDP are similar (certainly in PPP terms), if China continues to maintain just 2/3rd of what they achieved over the past 30 years (i.e. 6% pa rather than c9%) while US remain at 2%, it would take only 18 years for China’s GDP to be twice as big as that of the US (or greater than US and EU combined). You know the power of compound growth, and a low GDP per capita suggests structural ceiling, if any, for China’s GDP is likely to be distant - I hope this answers your question to me about China’s growth in our discussion yesterday.

For the avoidance of doubt, I am not saying GDP is the only measure relevant to geopolitical competition. Innovation (e.g. patent filings, number and quality of PHDs), availability of asymmetric tools (e.g. hypersonic missiles vs aircraft carriers), level, efficiency and effectiveness of national investments, educational and career backgrounds of politicians etc. are all relevant, to name just a few.

The fact remains it will become very noticeable, soon enough, if not already, that China has overtaken US geopolitically – a reality many in the US find difficult to accept, given their exceptional position over the past 150 odd years, which led the Anglo-Saxon if not the Western world to adopt various exceptionalistic narratives with religious fervour, e.g. that the American political system is the best (as implied throughout your paper), despite contrary to facts and logic.

So what is counterfactual or illogical? Is it not ironic for a country to accuse another of being “belligerent” and dangerous to international orders on a daily basis, while the accuser 1) is the one with c800 military bases around the world, 2) has a military expenditure that is more than the next 10 spendiest combined, 3) waged numerous wars causing the death of circa 1 million over the past 4 decades, and 4) regularly sending warships to the coast of the other in the name of defending freedom of navigation while freedom of navigation is what the other relies on as the biggest trader in the world?

And it is not as if the US has nothing else worth focusing on - the bottom 50% of Americans have not seen their economic circumstances improved for over 4 decades, and 40% of Americans don’t have $400 in the bank for emergencies today. The sad thing, is that many of those who have nothing and hence most vulnerable believe, wrongly, that they have nothing to lose by electing morons.

US exceptionalism is of course also why, realising that China has no intention to follow US’ developmental and political path anytime soon, US is turning on China on a bipartisan basis.

Why am I saying all this? With Covid, you have demonstrated that you are able to filter out noise and nonsense to get to the crux of the matter, and communicate in such a way that makes perfect sense to any who has the chance to read what you wrote. I think if you would apply your outstanding talents on this topic, you could again make the world a better, safer place!

Strange numbers: Cuba's GDP per capita is 1/6 of the US, but has the same life expectancy. Italy's GDP per capita is 62% of the USA, but life expectancy is 4.5 years higher. Cuba has a similar human development index as the USA, but needs just one planet, not seven or more as the USA (and other industrialized countries). Maybe it's time to look at the well being instead of the GDP. It's the ecology, stupid!