Robotaxis Are Here

I was talking with my friend Pierre Djian a few weeks ago and he made some interesting points about Tesla. Among other things, he convinced me that Tesla is likely undervalued. More importantly, the conversation unlocked for me some glaring holes in the market’s ability to value companies. I thought the conversation was very insightful, so I proposed that we write an article about it together. This has now expanded into a few articles. This is the first.

If you go to San Francisco, this is what you’ll see:

The city is now filled with Waymo robotaxis. This is what it feels like to take one:

It’s only been ramping up its presence in SF for a year or so, but here’s how its market share has been evolving:

And Waymo is not the only player in town. The looming giant is Tesla and its self-driving cars. These companies are building cars that drive better than most humans.

What will happen in the coming years? The world will be upended. This is the vision of what’s likely to happen.

A Vision of a World of Self-Driving Cars

In the beginning, you’ll take self-driving cars because they’re new and fun: “Look, it’s moving the wheel alone!” It will help that you’ll look at the stats and know that they have fewer accidents than human drivers.

Then, you’ll notice that self-driving cars are more convenient. You don’t need to talk with a human, manage their expectations, fear their driving skills, suffer their eating or smoking… You will start changing your habits, and instead of ordering an Uber or hailing a cab, you’ll default to Waymo or Tesla’s robotaxi.

Then, you’ll notice that they tend to be cheaper! At first, they will be just a bit cheaper. Then, prices will drop more every year. You’ll forget about human cabs.

Then, you’ll take the robotaxi for more and more things—for example to pick up the kids at school during work hours, to go have dinner (in case of drinking), to go downtown (parking is hard), and things like that: It’s so convenient, you won’t even notice.

Trips to the city where in the past you were on the fence between using your car or a cab will become no-brainers: You won’t have to find or pay for a parking spot with a robotaxi!

Then, you’ll start using robotaxis for new purposes, like dropping off and picking up your 12 year old child from extracurriculars—something you’d never imagine doing with a human driver…

One day, you’ll hear from a friend who jettisoned her car.

“How do you commute to work?”

“With robotaxis! I ran the math and it’s actually cheaper!”

Commutes will be the key milestone: They represent a huge number of miles because they happen twice a day, every week day, 40-50 weeks per year. Replacing them will accelerate the takeover of robotaxis. How will that happen?

In the US today, the cost per mile of owning a car is ~$0.65 to $0.70. But that’s just an average. People who live and work in a big city might not use their cars frequently or for long distances, making them much more expensive per mile. They will be the first to replace their daily commute with robotaxis: They will prefer working or watching YouTube during their commute than paying attention to the road. The more people drop their cars, the more robotaxis will be on the streets, and the cheaper they’ll become. Meanwhile, the fewer miles each person travels with their car, the more expensive the car will be per mile.1 As prices per mile of traditional cars increase and those of robotaxis decrease, more and more people will switch their commutes to robotaxis, adding billions of miles per year to robotaxis.

And robotaxis will be more convenient than owned cars too: No upfront payment, no need for parking at home, no need to look for parking at your destination, no need to risk death when you drink, no need to drive your loved ones everywhere…

The car will be relegated to ad hoc situations: Things like long trips, emergencies, big families… The more that’s the case, the more it will be treated like a luxury. Eventually, people will sell their cars or not bother to buy a new one when they break down.

The uptake of self-driving cars might eventually be accelerated through regulation, because these cars are already safer than humans, and will be even more so in the future.

At some point, the cost per mile will be close to that of mass transit options, but comfort will be much higher:

You don’t need to share the space with others, which is more hygienic and safer

You can go from any point to any point, rather than going to stations

You don’t have to wait for buses or trains to come pick you up on a timetable

This means robotaxis will also replace a big chunk of mass transit.

And as costs go down and convenience goes up, people will use more cars than before, in new situations that previously didn’t require a car.

This process will be faster in expensive and high-commute cities like the US’s West Coast or world capitals, and slower in places where driver costs are low and roads harder to navigate, like Vietnam or Africa.2

And this is a massive market. If every person uses a car on average a couple of times a day, that’s 16 billion potential car rides per day, or nearly 6 trillion rides per year. At $1 per ride, that’s nearly $6 trillion! And that’s just passengers. Add the transport of goods, and the potential market goes to the moon—here I’m paying attention to self-driving cars, but trucks will go through the same process.

You can limit this to fewer rides per person, fewer potential customers, and lower prices, it will still be a staggering market.

Is this vision likely to come to pass? Let’s see.

Robotaxi Costs

Today, rides with Uber, Lyft, and the robo-taxi service Waymo cost about the same to customers: around $2 per mile.3 Of those, for human ride-hailing services:

Uber claims to take ~30%, so ~$0.60 per mile

Some analysis suggests the cost of operation for an Uber is ~$0.20 per mile, and Grok says $0.27, so I’ll say $0.25, or 12.5% of the total ride cost

The rest goes to drivers, so $1.15 per mile or ~57.5%

ARK Investment Management’s analysis reaches similar orders of magnitude:

Remember this growth in market share? It is happening despite Waymo being about as expensive as Uber and Lyft!

What will happen when robotaxis are cheaper?

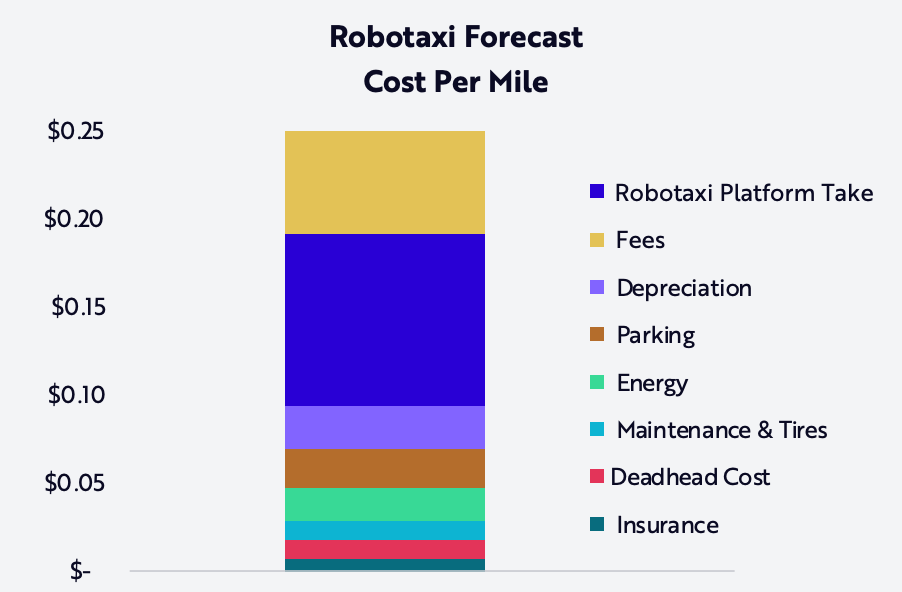

And they will get cheaper. Consider Waymo. Let’s assume you double the costs of the car to account for the self-driving technology4 for a total cost of $0.50 per mile.5 It will probably shrink over time as technology improves, cars last longer, electricity costs go down, and because electric cars are structurally cheaper than ICE (internal combustion engine) cars. But let’s assume for now that costs will start at $0.50 per mile. Waymo / Tesla Robotaxis could still claim the current take rate per mile, $0.60, for a total price to consumers of $1.1 per mile. Almost 50% cheaper than the current $2/mile! Uber could eliminate its margin, and it would still not be able to compete (from $2 per mile to $1.4).

And Tesla’s robotaxis are likely to be even cheaper:

They think Tesla’s robotaxis will cost $0.25 per mile to customers! Imagine what will happen when those prices get translated to customers!

Regulatory Approval

But you might wonder: How will Tesla be able to get approval from municipal authorities across the world? Look at what happened with Uber: it took a long time and it’s not even legal everywhere. Won’t people be scared of robots driving them around? Won’t there be a backlash? Won’t cab drivers and Uber drivers protest enough to shut them down?

Some might try. But they will be overwhelmed by this:

Safety

Indeed, self-driving cars can react 150x faster than a human driver.

Reaction time: human driver 0.3 seconds vs self-driving car 0.001 s!

Execution time: human driver 1-2 s vs self-driving car 0.1 s!

This is how self-driving robotaxis manage to have 90% fewer accidents than humans driving latest-generation ICE cars:

From AI Weeks When Decades Happen:

After 25.3M fully autonomous miles, a study from Waymo and Swiss Re concluded that Waymo had 88% fewer property damage claims and 92% fewer bodily injury claims.

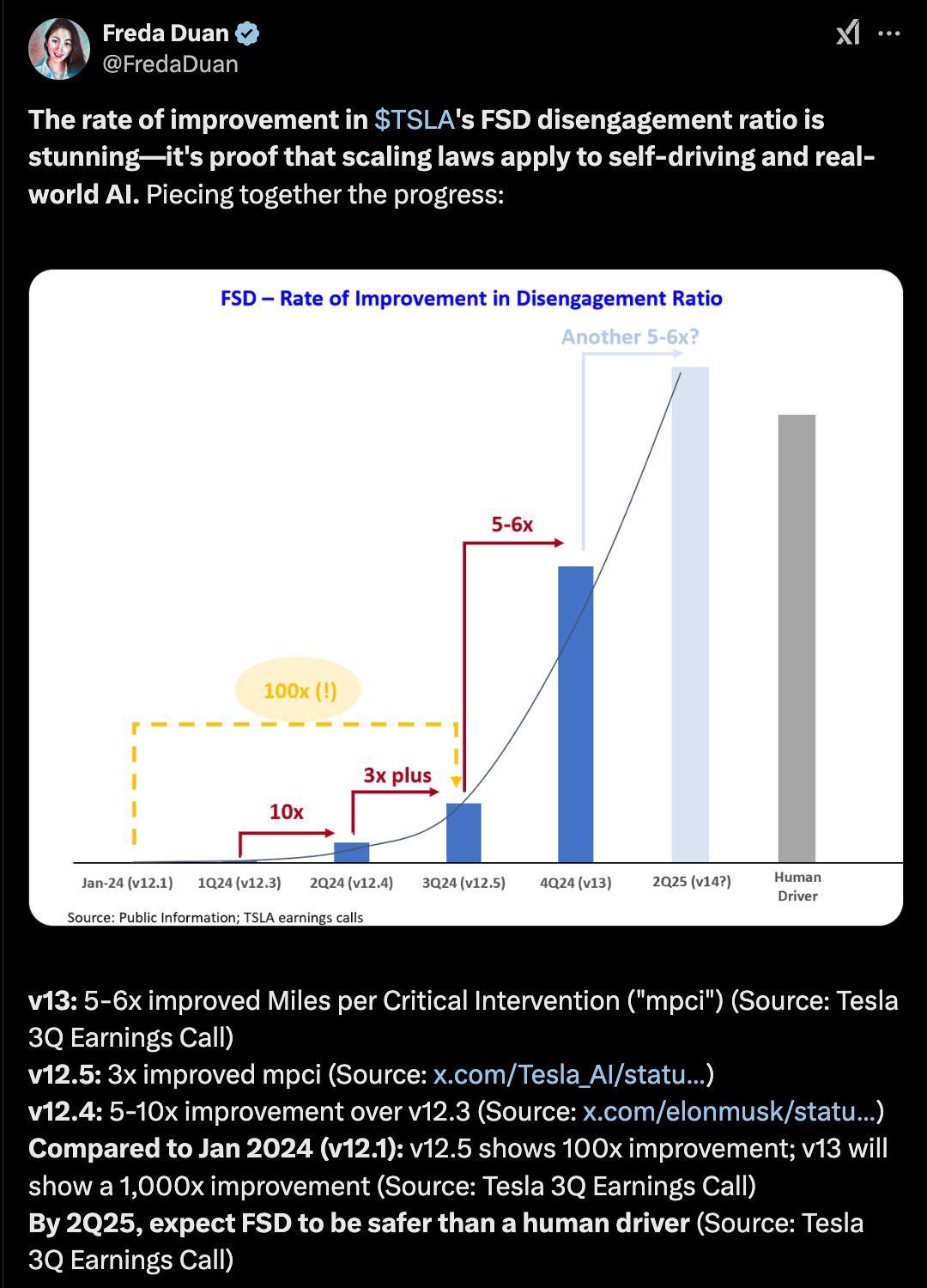

Tesla measures its cars’ safety in terms of disengagement rate: How many miles before the human needs to take over control.

The graph above doesn’t give you timelines, though, because Tesla is pretty secretive about FSD’s progress. But the graph below pieced together the rate of improvement of FSD in terms of disengagement rates:

In one year, that number has improved by ~500x! Tesla now expects its FSD to be safer than humans next quarter, and to keep improving exponentially from thereon.

Given the economics, the regulatory outlook, and the safety or robotaxis, they are clearly set to take over the world.

This will be a unique opportunity for a few companies to become wildly rich.

The Economic Opportunity of Robotaxis

Market Size

It’s very clear that Tesla FSD and Waymo are going to be much cheaper and safer than their human alternatives. Usually, when the cost of something falls, demand increases so much that the overall market size grows. This happens until saturation is achieved6 and is called the Jevons Paradox.7 If quality improves at the same time, this will be a bloodbath for cabs, all while the market explodes. Robotaxis won’t just take over the taxi market. Or the ride-hailing app market. Or the car market. Their revenue will grow beyond those.

How much bigger than the current ride-hailing market is this going to be?

ARK Investment believes people will take 400x more rides, for a $5T global potential market.

More than 10x bigger, for a total addressable market of $5 trillion!

Does that number strike you as surprisingly high? Let’s do the back-of-the-envelope. If:

Every person uses robotaxis for 30 miles per day8

Customers pay $0.25 cents per mile per ride9

About 20% of the world population uses them10

Then this constitutes a market of ~$3 trillion11 just for rides. This does not include the transportation of goods!

When will this happen?

Timelines

Waymo says it will be present in 10 cities in 2025. That’s about 40% of the US market.12 That should accelerate in 2026, and then further beyond that. Within 3-4 years, the biggest cities in the world should already be crawling with Waymos. That is, if Tesla doesn’t preempt it!

Elon Musk and Tesla executives have stated they will launch an unsupervised robotaxi network in Austin, Texas this summer, and in California by late 2025. For that, it will be able to use normal Teslas or its dedicated Cybercab, which are going to be in Austin and will be in full production by the end of 2026.

Since Musk is overly ambitious, we can update the estimate of ramp-up to mid-2026. The initial low-volume launch will involve around 1,000 cars per city to prove the concept. Once validated, scaling will follow rapidly. Analysts believe that robotaxis will replace cabs between 2025 and 2027, and car ownership after 2028. It might take more time to replace public transit systems, but the more people take these rides, the less revenue public transit will have. Since their costs are fixed, though, many public transit systems will go bankrupt, and robotaxis will end up taking over.

Of course, in countries with cheap labor (e.g., Thailand, Philippines, Vietnam), Robotaxis won’t be competitive until a new, lower-cost vehicle is introduced.

Who Will Win This Market?

To win, you need to play, and there’s actually very few legitimate players left in the market.

The Players

Companies have been working on self-driving cars for over two decades, but they’re only getting them to market now. Most car companies tried and gave up releasing self-driving cars.

Maybe it’s because you need tech-savvy companies? No:

Apple tried to make a self-driving car. It spent $1B per year for a while. It couldn’t make it, and the plan was canceled in 2024.

Uber, whose survival depends on self-driving cars, couldn’t make it happen and stopped its effort in 2020, when it sold its self-driving car unit to Aurora Technologies.13 That company now focuses on trucks.

GM bought Cruise for about $1B. After many more investment rounds and billions spent, it closed its operations in 2024 and refocused its attention on GM’s drive assist efforts.

Many other companies have tried and failed, like Starsky

There are still about 50 companies in the market, but very few serious players. By far the strongest ones are Waymo and Tesla. Why so few despite a $5T market potential? Because you need a unique combination of technologies.

Electric Cars

Robotaxis will be electric, because they’re already cheaper to operate, and will soon be cheaper to buy.

This is the cost to buy them:

You can see the convergence. This graph tried to project it into the future:

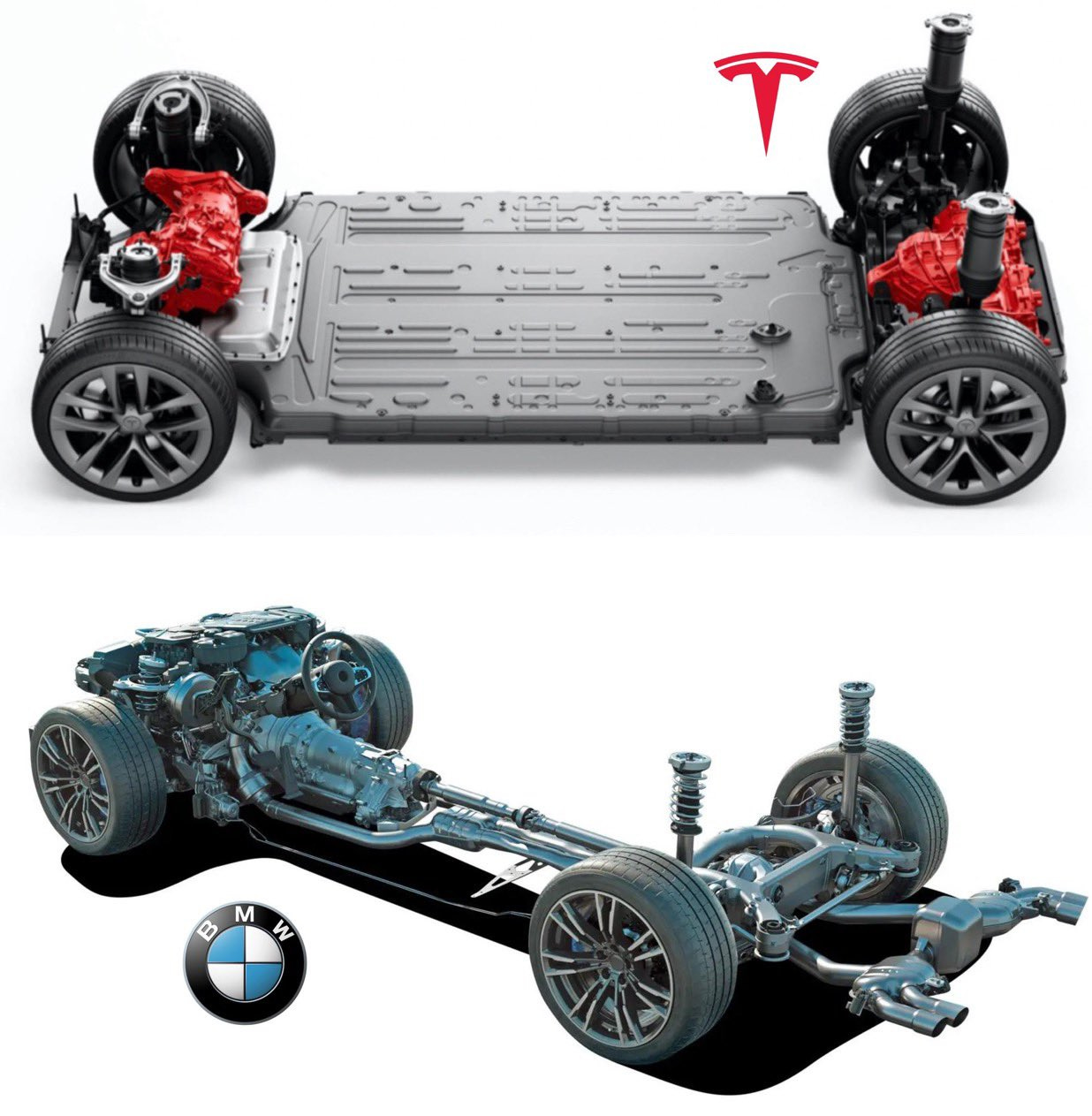

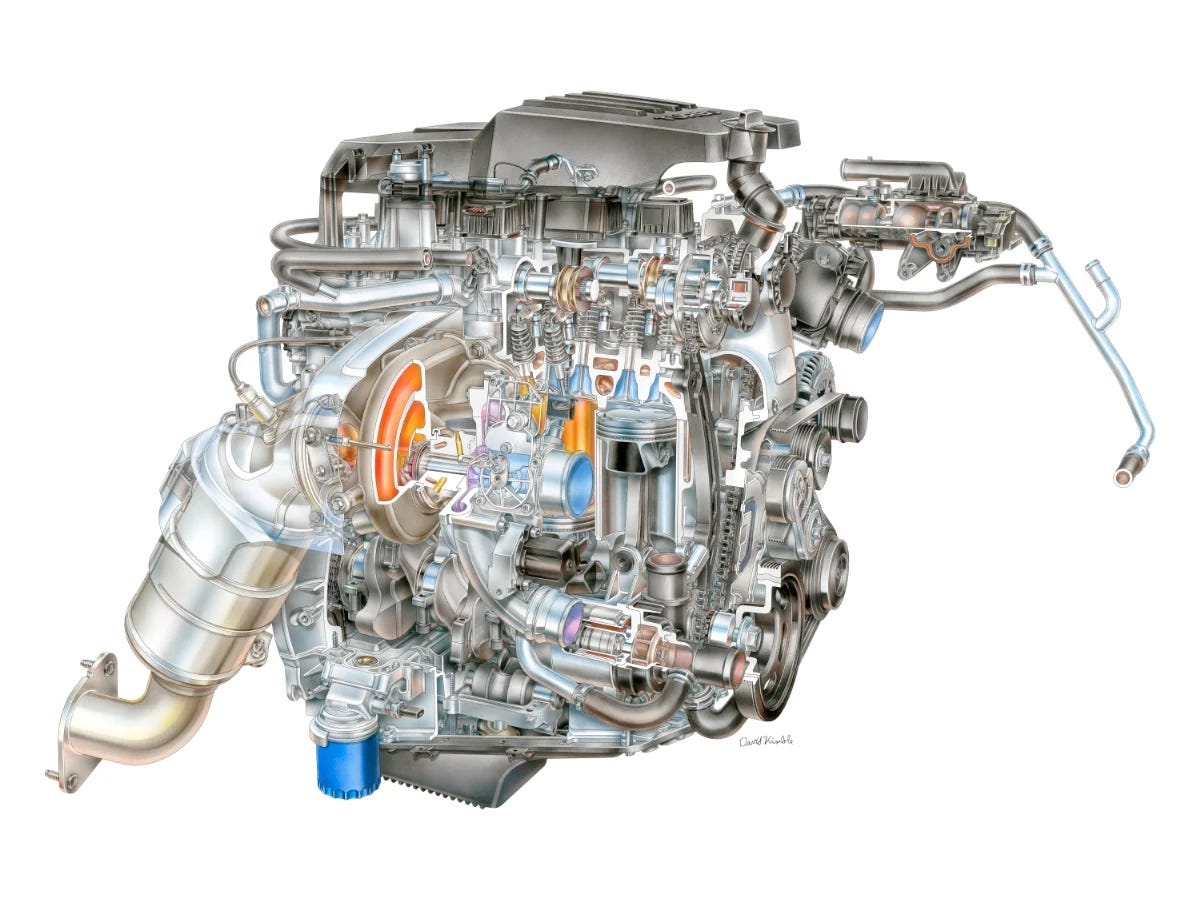

Why are electric cars going to be cheaper? Because this is an ICE engine:

And this is an EV engine:

EV engines are much much simpler. They have fewer moving parts, so they have less wear and tear and don’t break down as much.

The biggest cause of EV’s higher price in the past was their batteries, but as we know:

This means operating an electric car will be cheaper: less maintenance, but also, of course, less fuel:

My guess is that maintenance will only get cheaper as these machines are optimized and battery prices drop.

That should also drop the cost of insurance—which would already be lower as self-driving cars will have fewer and less severe accidents than humans.

As for fuel costs, the gap is only going to grow. Over the long term, oil prices are either stable or go up:

While as we know, renewables are going to reduce the cost of electricity.

So the first requirement of robotaxis is that they must be electric. What else?

99.999999%

It’s easy to get something to work in 90% of cases. It’s a bit harder to reach 99%. For driving, you need to go something like 99.999999% of the time14 without accidents.

To achieve that, you need to:

Understand the world around you precisely

Make the right decisions on how to navigate it

On the first point, the key debate has been LiDAR vs vision.

LiDAR vs Vision

Waymo chose to use vision, radars, and most notably LiDAR to create a model of the world:

Vision and radars are cheap, but LiDAR is not. Adding it cost Waymo a fortune.

This gave Waymo a very good sense of depth: How far away each thing is.

Tesla chose the harder path of using only cameras.15 Musk is betting that LiDAR won’t be needed for Tesla’s cars, and he’s pretty adamant about it:

They are all going to dump LiDAR, that's my prediction, mark my words.

His argument is simple: To make a self-driving car, you need to solve the vision problem (that is, use vision so that it’s perfectly reliable), and once you have that, you don’t need anything else.

Who is right? I don’t know. Here are the reasons why I’m thinking vision might win:

Musk has an unbelievably good track record of making the right industrial bets.

He knows LiDAR well: his other company, SpaceX, uses it in its space capsules to dock with the International Space Station. So he is acquainted with its pros and cons and yet decided not to use it in Tesla.

We’ve seen how many miles Teslas now drive without their drivers disengaging them. They are now reaching or even beating LiDAR-based self-driving cars.

It’s not vision, but vision plus AI—the same as we need eyes and a brain. What AI does is predict the future, and for that the distance to the next car is not as important as, say, how it’s moving or veering, the expression on the face of the other driver, the meteorological conditions, how other cars are reacting… This is even more obvious in an urban setting with pedestrians, cyclists, cars crossing in all directions… Visual perception is in fact a very small component of the solution. The AI is the biggest part. And Musk has a tremendous advantage with AI.

However:

I haven’t heard Musk talk about LiDAR in terms of cost-benefit, or diving into the details of why he thinks LiDAR is not necessary. He focuses only on its costs, not the benefits.

Tesla promised its customers self-driving cars, but it couldn’t afford to add LiDAR to its cars, so he has an incentive to believe vision is enough.

That said, the price of LiDAR is plummeting anyway:

If adding LiDAR to a car amounts to a few hundred bucks, it won’t matter.

What will matter are the decisions: What to do with the data gathered—whether it’s vision or LiDAR? This depends on AI.

AI

As we know, doing AI well is very hard and expensive, and it’s 10x harder when you’re not a huge tech company with billions invested in the space. My guess is that’s one of the biggest obstacles that traditional motor companies couldn’t overcome: It’s just too hard for them.

But Waymo is part of Google, one of the big players in the AI race. Google basically invented the latest AI technology that has catapulted us into the future (transformers), and it’s so advanced it makes its own AI chips.

Tesla is a very strong AI player on its own—and if needed, can benefit from Twitter (xAI)’s bleeding edge position in AI (Grok). It has an advantage vs Waymo in that it has focused its AI efforts on cars for over a decade. It built its own chips for its cars and data centers, uses technology to query the data from the fleet,16 specialized its AI training on video...17

All this makes it hard for normal companies to compete. But Google is not normal: It can do all these things. What Google doesn’t have much of, though, is driving data.

Edge Cases and Data

The problem is getting from 99.99% of safety to 99.99999999%, and for that, the key is edge cases:

It’s impossible to predict that a woman in an electric wheelchair would be chasing a duck in circles on the street, but you still need to be prepared for that. Like this example, there are millions of unique situations for which a self-driving car must be ready, even if no other car has seen it before: Countless other vehicles of all shapes and colors, pedestrians not abiding by the rules, strollers, animals. Construction zones, emergency vehicles, ambiguous road markings… Real life is incredibly diverse and messy.

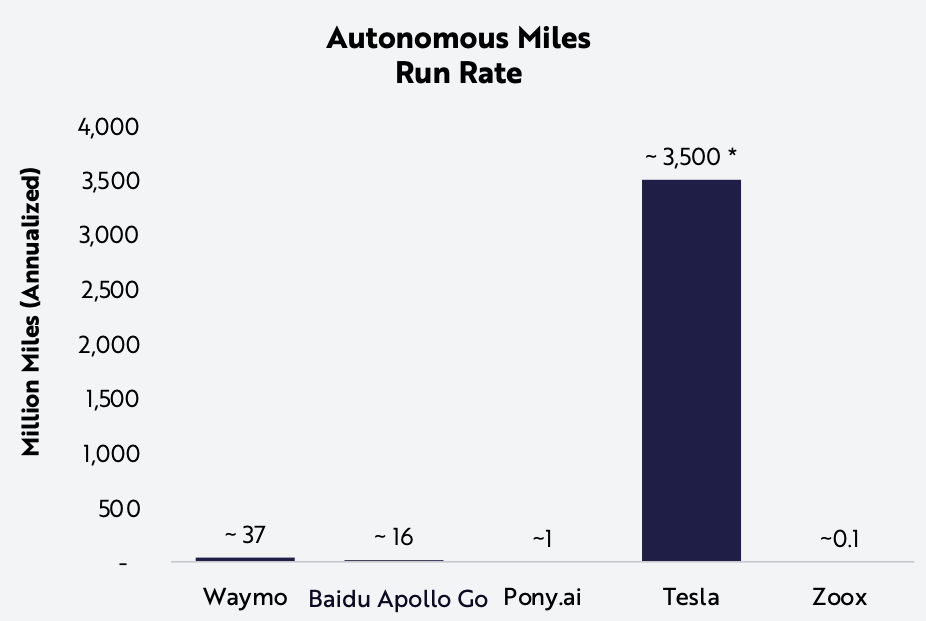

You can better prepare your AI for these edge cases with a more expensive and capable AI, and with synthetic data (like running your cars in driving simulators). But you will never be fully prepared for real life this way. The only way to do it is with enough data: If your cars have seen a gazillion weird situations, you’ll be more prepared for them. And this is precisely what Tesla has achieved:

Because of its existing fleet of cars, it has 100x more data than Waymo. This is a huuuuuge advantage for Tesla against any other player. Very hard to emulate, and one of the reasons why the vision play was sound: It couldn’t have obtained so many miles with LiDAR.

Not only that, but it has a perfect data set of Reinforcement learning from human feedback (RLHF). Good AIs get trained first with data, and then humans train them too, by correcting their answers when they’re bad. Tesla has recruited its customers to do that for them for free! Each time they disengage Tesla’s FSD (“Full Self-Driving”), they are telling the AI: “You shouldn’t have done this. Do this instead.”

Now Tesla has all this training data, the envy of every other competitor.

Manufacturing

Now, getting the self-driving tech to work is only half the battle. To win the market, you also need to get to scale fast and cheaply. And this is where Tesla truly shines.

Waymo is currently operating a fleet of ~700-1000 vehicles total. Tesla is currently shipping about 35,000 cars every week!

Few companies have been able to ramp up their production like Tesla has. And this is not from a company with deep manufacturing expertise! It had never manufactured anything at scale, and then it built some gigafactories that could churn out millions of cars per year.

And these were not standard cars. Tesla gave up a lot of the acquired knowledge from other cars because it knew it had to reengineer them from the ground up: Electric cars don’t need a big engine. They do need a big battery, but it can be placed nearly anywhere in the car, so putting them at the bottom makes more sense—it lowers their center of gravity. This requires completely reinventing the drivetrain and chassis, which is not something most existing automotive companies have done: Many just partially adapted what they had to electric models.

And that’s an optimization of the car, but Tesla also optimized the manufacturing process itself. For example, it replaced the traditional linear mounting of cars on a conveyor belt with a more modular approach, where each part is mounted separately, until they’re all put together. This could reduce the manufacturing cost by 50%.

Tesla has been applying this approach to its robotaxis, the cybercabs:

They will be two-seaters18, so smaller cars to build.

They will have no glass roof and no back window, which means less heat loss, and less energy to regulate the car’s temperature.

The cybercab is pared down to limit its maximum speeds, while personal cars still need to be able to go fast for occasional fun drives or racing.

Tesla is designing cleaning robots so won’t need human cleaners. The car itself was designed to facilitate that.

Tesla is planning to charge its cybercabs wirelessly, again removing the need to involve humans.

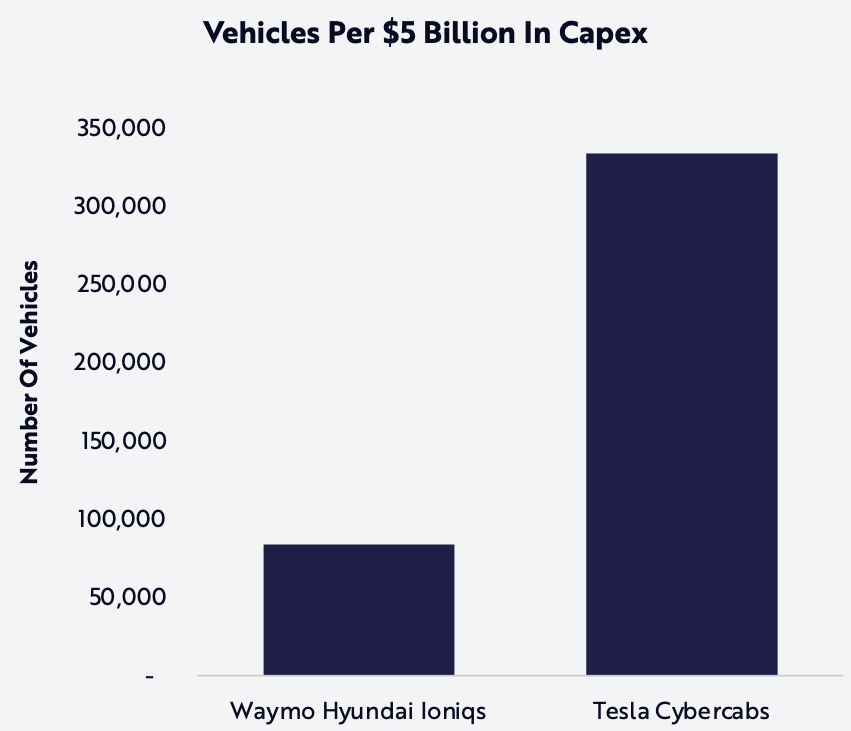

Tesla’s manufacturing ability, coupled with its ability to optimize car designs to robotaxis, will allow it to get five times more cars than Waymo per dollar invested!

That means there will be many more cybercabs than the competition’s—and they will be cheaper.

Vertical Integration

We’re touching on an important point here. The Waymo approach requires the involvement of three companies today:

Car-making companies

Self-driving companies

Ride-hailing companies

For example, Waymo just launched in Austin, where cars will be provided by Jaguar and the ride-hailing by Uber. But when you have three companies involved, each one has different incentives.

Jaguar doesn’t want robotaxis to fully win, because then they will just be a tech provider to a robotaxi company. So they’re incentivized to make good robotaxis, but they still want to sell their own cars to the public. Because they want to minimize costs, they are more likely to use the same chassis for their robotaxi and their own cars, which means it would be harder for them to make two-seaters without back glass windows, for example.

Uber doesn’t want to depend on Waymo, because that would weaken it. So it will offer Waymo rides, but it won’t try to replace its human drivers yet: A lot of its power comes from them.

Waymo won’t want Uber to corner the market, so it will try to offer its services through other apps too, like Lyft—or their own app.

Each time these incentives are misaligned, it means negotiations and suboptimal decisions for end customers. Clay Christensen explains that, when things are standardized, modularization makes sense. But we’re not modularized yet. The entire experience is being built, and a single vertically integrated company owning the entire value chain is much better placed to win than a modularized one.

My guess is that Waymo will eventually try to do it all—maybe merging with Uber? But in the meantime, Tesla will move much faster.

Installed Base

And I haven’t mentioned the obvious yet: Tesla already has one million self-driving enabled cars on the road. These are not fully autonomous yet, but when they are, owners will be able to monetize them by opting in to provide robotaxi services.

Takeaways

Our lifestyle is a few years away from a massive change thanks to robotaxis.

They are already here. Waymo, the leader, is servicing several cities in the US. It’s a matter of time before robotaxis take over most cars on the road:

Without a driver, they will be much cheaper than cabs

They will even be cheaper than owned cars

They are already safer than humans, and will become even safer over time

They are much more convenient

When they do, they will not just replace cabs, but privately owned cars, and large segments of public transport. They will even increase the number of rides we take daily. This will open up a new trillion dollar market.

Who will win it? For me, there are two main players:19 Waymo and Tesla.

Waymo is going to be present in 10 cities by the end of 2025, and will grow faster from there. Tesla is likely to release its cybercab service at some point in 2025, and start ramping up in 2026. Who is best positioned? It’s unclear:

Waymo has a big advantage in that it already has full self-driving cars.

However, every other advantage is on Tesla’s side: Its vision-only bet sounds reasonable, it has a massive fleet already, it’s vertically integrated, it has huge manufacturing expertise, it has much more data, and its AI is probably the best.

And there are scale effects here: The more you build cybercabs, the cheaper and safer they will get, because of economies of scale, optimizing manufacturing, and more data and edge cases.

Based on all of this, I would not be surprised if Tesla takes a huge share of this trillion dollar market. In that situation, its current valuation will look like a steal.

If a car costs you $30,000 and you make 30,000 miles per year for five years, that car will cost you $0.20 per mile (just buying the car). If instead you only make 10,000 miles per year, that same car will have cost you $0.60 per mile, or three times more.

Although look at this Tesla navigating Chinese streets!

This is an average, because their pricing is completely different. You pay some money for the base rate, and then a per mile cost and a per-minute cost that is lower than the $2 quoted. Different cities have different prices, too. And Waymo doesn’t do highways yet, which means sometimes much longer (and costlier) rides, but that will not be the case for long.

Each Waymo vehicle’s equipment costs are ~$100,000 today. Assuming it operates for four years and has similar costs to a modern Uber otherwise, that’s $25k additional per year. A standard Uber drives 30-60k miles per year, but the drivers have to sleep. Since robot-taxis won’t have to, we can assume they’ll drive 80k miles per year. That means the additional $0.30 per mile, close to the total cost of ~$0.25 today. Note that Teslas have self-driving technology today and they retail for as little as $30k, and Tesla’s margin on that is ~25%, so clearly this is super conservative. Self-driving costs will probably end up being a few cents per mile.

Some people actually think Waymo’s technology is going to be more expensive, and clocks in at $1 right now.

People have so much of the thing, and it costs so little to them, that they don’t buy more. This happens with things like household lighting, water, air, chewing gum…

Apparently Uber makes more money than the entire cab industry before Uber arrived in SF. It was making $500M in SF alone in 2015. Grok estimates that cabs made $300-$400M per year in 2010, the year Uber was founded. Its calculations: Now, what was the SF cab industry revenue before Uber? Precise historical data for the SF taxi industry prior to 2010 is scarce, as comprehensive public records from that era are limited. However, we can piece together some context. In 2010, when Uber began operations, the SF taxi industry was still the dominant player in for-hire transportation. A 2014 report from The Atlantic, citing San Francisco Municipal Transportation Agency (SFMTA) data, noted that average monthly trips per taxicab dropped from 1,424 in March 2012 to 504 by July 2014—a 65% decline—largely attributed to competition from Uber and similar services. If we assume the taxi industry was operating at full capacity before Uber’s disruption, we can estimate its pre-Uber revenue by working backward.

The SFMTA regulated about 1,800 taxi medallions in the early 2000s, a number that remained relatively stable into the 2010s. If each cab averaged 1,424 trips per month in 2012 (before the steep decline), that’s about 47 trips per day per cab. Assuming an average fare of $10-$15 (a rough estimate based on historical taxi rates in SF, adjusted for shorter urban trips), each cab could have generated $470-$705 daily, or roughly $14,000-$21,000 monthly. For 1,800 cabs, this suggests an annual industry revenue of approximately $300 million to $450 million in the years just before Uber’s impact became significant (say, 2009-2011). This is a rough extrapolation, as trip volumes and fares likely varied, and not all cabs operated at full capacity daily.

The average American travels 40 miles per day. We can assume that with robotaxis, this should increase, as convenience will increase and costs will shrink. But for the sake of the argument, let’s keep 30 miles as a global average.

As this is the number we looked at from Ark Investment before.

And let’s assume the average ride takes 1.5 passengers

30 miles at $0.25 per day is $7.5 per day. Let’s assume each ride carries on average 1.5 people, that’s $5 per day, or ~$1,800 per year. 20% of the population is 1.6 billion people, so this would be about ~$3 trillion, close to the $5B.

I looked at share of GDP per city as a proxy for share of cab rides. The top 10 US cities account for 40% of US GDP. Now Waymo is not saying it will open in the biggest metropolises (eg NY is not in their plans), and some cities are not even in the US (Tokyo), but this is just to give you orders of magnitude of how fast this can go. The very first year, Waymo could cover 40% of the US market! How fast do you think this can go beyond that?

Uber owns 26% of Aurora, although the CEO of Uber resigned from its board in January 2025.

I’m being cavalier with the units and the number of 9s. I don’t think they matter for this conversation.

They used to use radar but apparently that is being eliminated.

Once they see an edge case that FSD doesn't handle well, they query the entire fleet to add many more examples of that edge case and better train on that.

Google has focused more on text and images, although it has YouTube, so it can train its tech on video easily, too. But not as much on driving video.

Early on they’re targeting the cab market. Once that’s taken, they might expand and insert some bigger cars for families.

So many issues here:

1. You don't even consider the Chinese self driving operators such as Baidu who is testing with ±400 vehicles. They seem behind Waymo but not entirely out of the calculus, same may be true for Yandex.

2. You take Musk's promises seriously. His track record, Tesla's cult culture, the fact they have not test driven autonomous miles at any scale and so many other 'small issues' should make one very careful believing that the structural problems in Tesla (no LIDAR, the plan to roll out FSD without careful training, culture of risk taking and poor safety record and much more) would somehow be wished away into a globally scaled operation.

3. You take calculations from ARK invest seriously... Hard to know where to begin here but they are the most unserious 'investment fund' I have ever seen and none of their models stands external reviews well.

4. For Waymo, there is no dependency on Uber at almost any point beyond the launch periods and there is a reason they do not need Uber in San Francisco where they now have large enough user base. The opposite is not true as most car rides are done in a single local and if Waymo is cheaper, has better car experience and is available - why would a user not prefer it? In November I rode both in PHX & LA and my preference for Waymo was very strong, not to mention it was half priced when compared with like for like cars (Waymos are a premium Uber flavour).

5. There is also no dependency on car manufacturers - in Europe in 2025 YTD 600! different EV cars have been sold: https://eu-evs.com/bestSellers/ALL/Brands/Year/2025

I find it hard to find any reason why any of these manufacturers has any particular hold or agenda over AV, now that Waymo proved its a setup that can be fitted to their cars. These companies have over capacity (not only in China) and would do a lot to satisfy a client like Waymo who looks like the future.

I am quite surprised by this analysis quality, I much appreciate most of your posts but this one is not well enough thought through (and AVs are the future, but it would be Waymo's model and others like it delivering it in the next years - I doubt Tesla would even be a player).

The logic for replacing current driven rides seems reasonable. However, thereafter - especially in crowded non US cities - the possibility of replacing mass transit is going to be limited by road capacity. There is simply no room on the road to move thousands of passengers off mass transit and into self driving cars, even if they are smaller and faster than current human driven cars. Traffic will always grow to fill the roads available and that will happen long before they can out compete mass transit in cities.