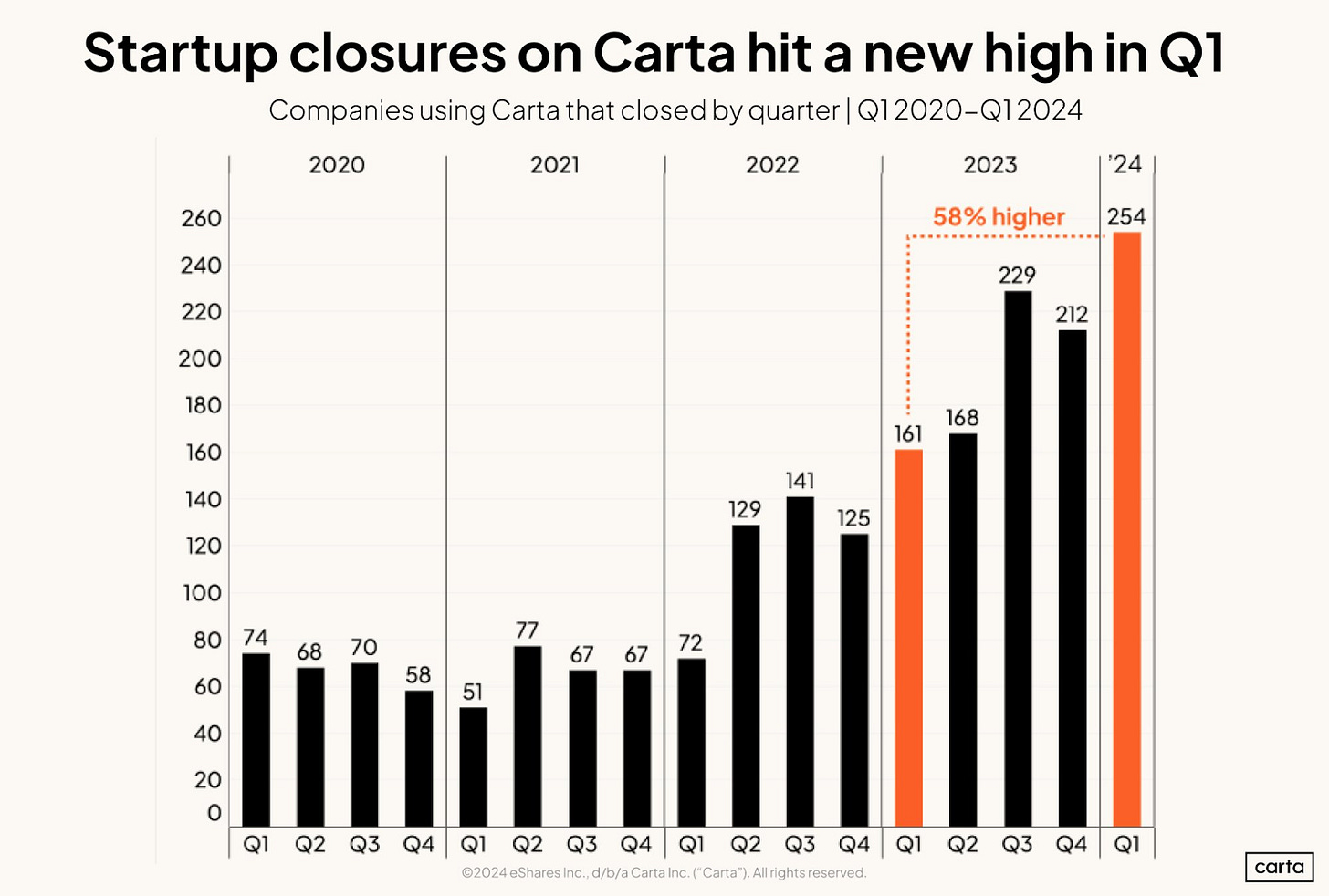

Startups are closing left and right:

I reckon this is just the beginning of a completely different world for investing and working in the digital age. If you invest in tech or in the broader stock market, or if you work in tech or in a job that AI can eventually do, some of the insights from this article might be shaping your future: A much harder world is coming, where making money will be much tougher for most, but much easier for a few. And one way to understand this process is as a continuation of what has been happening so far.

If you’re acquainted with the tech industry, you should jump ahead to section 3: The Rise of AI Startups.

1. How Software Ate the World

Before software and the Internet, most tech investments were in the physical world: energy, semiconductors, manufacturing, telecom, consumer tech, aerospace…

But most of these require heavy upfront investments, which are risky. Also, many of these industries became more and more regulated over time, making it harder and more expensive to innovate—and thus make money.

So when the software industry exploded in the 1990s, off the back of the Internet, tech investors poured in. A testament to this is the fact that “tech” is now a synonym for “Internet software”, which is crazy if you think about it.

Internet companies didn’t require billions in upfront investment. With a few million, a startup could test its ideas, and if it was successful, more capital poured in to make it grow. This was great for VCs (“venture capitalists”, the standard investors in tech) since their risk was so much lower than before!

The downside was that with lower barriers to entry, there were many more companies competing for the same markets. If you didn’t execute seamlessly, others would come to eat your lunch. As a result of these low barriers to entry and cut-throat competition, four broad types of tech companies emerged.

The 4 Types of Internet Companies

The first was the hyper-competitive type, like videogame companies. There are thousands of them and the battle for customers is so ferocious that players get access to amazing freemium games1.

The second type was B2B SaaS companies: Companies that serve software as a service (SaaS) to other companies. Because these companies offer obscure and boring business services like payroll or IT management, they have been naturally blessed with less competition. Also, these companies were replacing the terrible options that customers were stuck with previously. Suddenly, they could opt for slick software that was updated in real time. And once a company selects a provider, they stick with it for a long time—another factor that limited competition. So many B2B SaaS companies made a lot of money.

The third type of company was aggregators. As the Internet and mobile phones brought the cost of content creation and distribution to nearly zero, we were inundated with content. We needed companies that would make sense of all this information and rank it for us. That’s what companies like Google, Facebook, Pinterest, Twitter, or TikTok did. The more people used them, the more creators loaded them with content, the more content consumers could access, and the more people came. Those are network effects in action, and they didn’t just apply to content: Any item that benefitted from broad supply and demand was better online. Marketplaces appeared everywhere, from Amazon to Uber, Airbnb, Upwork, Etsy, eBay, Tinder, the App Store…

I wrote more about them here:

https://unchartedterritories.tomaspueyo.com/p/platforms-and-aggregators

This is the impact of network effects: More supply means more demand, more demand means more supply, they all gather in one place, and it’s nearly impossible to coordinate all these people to move somewhere else. Since these companies were more valuable the more they grew, it was hard for any competitor to overshadow them. So they grew to become behemoths, and investors loved them.

The final type of tech company was everything else: online investing and banking services, consumer storage, calendars, Education Technology, HealthTech… Since the dynamics of each of these industries differed substantially, VCs tended to specialize in some of them.

How This Shaped VCs

Since it was so cheap to start companies, many tried but ended up building things nobody wanted.

Others built good products, but were outcompeted.

The result was that hundreds of startups gave it a try, most of them failed, a few of them survived without making big returns, and then a handful made billions and totally dominated the market.

For investors, that meant two broad strategies:

1. Early-Stage Spray and Pray

They could invest in early-stage companies without knowing which one was going to win. In these cases, it didn’t matter if they invested in companies that lost everything. What really mattered was to not miss the big winners. So they developed a “spray and pray” approach: Invest in hundreds of companies, and surely a few will be winners.

The most successful company here is Y Combinator. Here are its companies per year:2

Y Combinator has now invested in thousands of companies. Most of them failed, but a few did amazingly well, like Airbnb, Doordash, Dropbox, Reddit, or Instacart. They returned such humongous amounts of money that Y Combinator is one of the most successful VCs.

2. Later Stage Growth Capital

What’s really difficult in startups is to find product-market fit (PMF): Building a product that the market really wants. But once you do that, the ability of the Internet is unparalleled, so companies that perfected PMF tended to keep growing and growing and became behemoths. Few of them failed.

As a result, it made sense for VCs to pour billions into these companies: Sure, a handful would fail, but most of them would not, and their huge growth meant juicy rewards. That’s how famous VC funds like Tiger Global or Softbank’s Vision Fund ended up investing billions in big growing tech companies.3

Some VCs specialized in early stage, others in late stage, and they both bled into the middle: Early-stage funds continued funding their darlings, and at some stage growth VCs would pick up for the big bucks.4

2. The COVID Peak and Trough

COVID years were crazy for tech companies, because suddenly everybody started staying home and using tech services. The business of many tech companies exploded, and they started hiring like crazy.

Then, immediately, as supply chains broke and stimulus packages flooded people’s bank accounts, inflation rose. To quell it, interest rates went up.

Suddenly, capital became very expensive. When that happens, you want companies that will make money tomorrow, not in a few years or decades.

The result is that companies that were growing fast but not making money yet could no longer be funded. This was especially true of the bigger ones, since they needed to burn billions to fuel their growth. But it was also true for smaller companies that didn’t find a very strong product-market fit.

This is why we’re seeing this huge increase in startups that are dying: They raised money in the good times, they have been living off of it all this time, but they were not able to turn a profit, so investors couldn’t pour more capital into them, and they’re sinking.

As you can see on the Y Combinator graph above, this affected early-stage companies, too, but not as much, because these companies don’t need much capital. VCs have remained open to spraying and praying, even if they do so more conservatively.

More funding for early-stage startups without funding for later ones created a chasm between them. It was easy to start a company but hard to continue one. That’s the other reason why so many startups are failing now.

But there is yet another reason why VCs have been investing in early-stage companies: AI.

3. The Rise of AI Startups

AI does two things:

It enables new services that used to be impossible

It helps people build services faster and cheaper than ever

In 2024, two thirds of Y Combinator’s startups are focused on AI—which usually means the first type, new services made possible thanks to AI:

Many still focus on B2B SaaS (tools, coding, sales, data science, customer support, security, and I guess most “vertical applications” are also B2B SaaS):

This is fantastic for VCs: Suddenly, there’s a new crop of tech companies that are emerging and can eat the lunch of more established ones! Yes please, give me some! So VC investments are still very strong in early-stage companies.

On the surface, the second force is also good for VCs: If it’s much cheaper than before to create startups, then small investments can have massive returns, right?

Remember how we said that in the past, software startups’ low need for capital attracted VCs? The same is happening now with AI.

New B2B SaaS tools have been reducing the cost of building new startups for two decades now: Most of the needs that startups have are shared by other startups. So it makes sense that they don’t all develop tools to solve their needs internally. Better that an external company (a B2B SaaS) solves their problems once and sells the solution to them. That way you only build it once, and can make it much better and maintain it properly, at an ever lowering cost.

AI has supercharged this process, especially because it has made coding so much faster. Depending on who you ask, you can save 30-50% of developer time thanks to AI.

AI support for development means that it’s much faster to ramp up, bad and inexperienced developers can easily become average, AI takes care of all tedious tasks, increases security… In other words, there’s a huge leverage for all types of developers, especially inexperienced ones. Few developers can do the work of many more.5

This is one of the reasons why we’re seeing this:

A part of the peak was due to the massive growth of online services during COVID, and part of the drop is because high interest rates mean startups are less compelling investments. But notice how the number of software engineers in demand is 30% lower than before COVID, and shrinking! AI is part of this. It’s now easier than ever to code assisted by AI.

But it also means that people who could have never coded before suddenly can. This is huge! A democratization of software development.

All of this has dramatic consequences.

The Rise of the Solopreneur

I’ve been tinkering with a friend of mine building online tools with AI this year. He went from no coding experience to shipping an app in two months. How did he do it? By asking ChatGPT what to do. Little by little, it told him the steps to follow, it wrote code for him, it corrected it, and lo and behold, within two months he had built a working app.

This is the power of AI.

In some cases now, individuals or a handful of founders are enough to build an idea and test it. With zero capital from investors, they can build and test, build and test, build and test.

The most famous one is solopreneur Pieter Levels, who codes in his underwear:

This tweet is from 2021, before the AI madness, but you can already see the mindset. With AI, his speed of iteration went through the roof, and he built successful app after successful app:

His old apps are nomads.com and RemoteOK.com, which make about $90k/month. But when he released them, PhotoAI.com and InteriorAI.com made about $130k/month.

In other words, the guy is making millions a year by coding idea after idea in his underwear in hotel rooms around the world, and the process is accelerating.6

Each of the websites below make more than $1M/year and were started by solopreneurs:

Here’s a list of 162 solopreneurs, many of whom have made over $1M with their ideas:

Here’s Greg Isenberg:

My inbox is flooded with more and more emails/DMs from bootstrapped founders with little teams doing big numbers.

They're crushing it.

No fancy offices. No huge teams. Just profitable businesses solving real problems.

Even today, I saw that ExplodingTopics was acquired by SEMrush (public company). Another bootstrapped success story.

The media won't tell you this, but it's a golden age for indie startups.

While Silicon Valley panics, the share of bootstrappers that are winning goes up and up.

It makes sense. It's cheaper than ever to build audience, build product and Silicon Valley doesn't have a monopoly on industry secrets anymore for the vast majority of businesses that do $100M or less in revenue.

This trend is accelerating. Every day that passes, it’s easier to build a startup and an online product. More tools exist, and AI helps along the way. People who didn’t know how to code months ago can now build a prototype and validate it with customers. If it doesn’t work, they can try again. If it does, they can grow it with little help.

This will create hundreds of thousands of millionaires, spread around the world. And a few billionaire solopreneurs. The first one is probably in his underwear right now talking with ChatGPT.7

The first billionaire solopreneur is probably in his underwear right now talking with ChatGPT.

Here’s a problem though: It might be very cheap to build a product, but how do you get it in front of consumers?

Build it, but they won’t come.

In the near future, AI might automate a lot of sales and marketing, creating AI avatars who can make calls and send emails on your behalf. But as this becomes possible, counter-measures will improve. Your spam folder and robo-calls detection device will get 10x better. So how can solopreneurs spread the word about their products?

The Rise of the Creator

In parallel to the solopreneur, the last decade has seen the emergence of the content creator: People like me, who also act alone or with a small team and can reach audiences of billions.

They used aggregators like Twitter, YouTube, TikTok, LinkedIn, or Instagram to generate audiences, and some of them try to capture these audiences through their emails or phone numbers (hello!).

Now that making and distributing content costs nearly nothing, and aggregators have emerged to regulate oversupply, the best creators can rise above the others and monopolize attention. Attention is now the scarce resource, and creators are capturing it.

Creators will become the distribution channel for solopreneurs.

According to this thread, Blake Anderson made $7M this year through three apps (help in dating app conversations, looks optimizer, calorie tracker) that he advertised through influencers.

Justin Welsh makes about $4M a year through the social media audience he gathers and the courses he upsells them.

Packy McCormick has a newsletter with hundreds of thousands of emails and makes several millions a year, through ads, sponsorships of his content, an investment arm that puts money in the companies he analyzes and likes, a job board,

How does that impact tech investing?

4. How AI Disrupt Tech Investment

So if we summarize, we have a combination of new factors appearing:

It’s easier and cheaper to build software than ever before

New products that were impossible before are now possible thanks to AI

Competition will become extremely intense, from companies that are much more capital-efficient, and that can make new amazing products

How will this affect investments?

1. Many Businesses Will Be Disrupted

Remember how the Internet boosted competition by making it easy to build a company? This is happening now, on steroids. New ideas might have a lifetime of a few years or months before ten copycat competitors emerge, dropping prices—and margins. This happened to Pieter Levels with his PhotoAI and InteriorAI ideas.

But what’s true for new ideas is even truer for existing ones. The competition of every business has now increased tenfold. Just remember how many B2B SaaS companies are using AI in this year’s Y Combinator crop! The good B2B SaaS businesses from the last two decades are about to suffer a competitive massacre.

And not just SaaS. An AI was just able to create a videogame on the fly. How many more videogames will we be able to create with AI? How fast will that happen? How will that affect the videogames industry?

The company character.ai has tens of millions of users. It creates pretty basic chatbots that you can interact with:

Many are using these chatbots as friends or emotional partners.

This guy built a small app that got him 50 interviews within 24h:

This guy built a prototype of an app that splits a bill in one minute:

This will spread. How does that not metamorphose the recruiting department in companies? How many recruiters will be replaced by AIs that can fend off this type of attack?

Even some aggregators will be replaced. Before, it was unlikely because they helped human supply meet human demand, people met in these marketplace, and it was near impossible to coordinate them to move somewhere else. But AI is getting to the point where it can.

Let’s consider some of the biggest examples. Google, worth $2T, is threatened by ChatGPT. Think about it, how many of your queries have you switched from Google to ChatGPT? For me, it’s about half. Now ChatGPT is releasing a search engine. Another, perplexity.ai, is growing like a weed. I have several friends who have said they use it more than Google, and even for some queries that were impossible before with Google. Google’s valuation has not yet suffered much, but when you realize the vast majority of its revenue comes from search ads, and its core business is being disrupted, you can connect the dots. As competitors become better and these new search habits spread to broader society, Google’s usage will not keep growing the way it used to.

What about companies like Instagram or TikTok? Well, they’re in the business of entertaining people. Facebook and Instagram thought this required one’s own social network, but TikTok proved them wrong by using AI to identify the best content for each person at any given time. But we’re just one step away from AI creating the content altogether. That’s definitely going to challenge these companies.

Since many existing businesses will be disrupted, many of today’s public companies will lose a lot of value.

In the past, that was not a problem because other companies appeared to replace them. But that is not going to be the case as much in the future because:

2. Successful Startups Will Need Less Capital

If you can build your startup yourself or with a friend, why raise money? Why go through the hassle of talking with investors and signing agreements with them and keeping tabs on them, exposing yourself to the risk of being ousted by them…?

If you don’t raise money, why go through an IPO8 to take your company public? Stock markets are burdensome, and that’s why private companies increasingly avoid them. Stripe is worth about $90B, OpenAI about $100B, SpaceX about $200B. But these behemoths don’t want to go public because it’s so burdensome. Sometimes, they’ve been forced to because of regulation or to allow employees to cash out. But if just a handful of employees run a company that prints money, no laws force you to go public, and employees can easily get cash from the company, there’s no reason to go public!

That, in turn, will lock the average investor out of these great companies. The stock market—the greatest engine of wealth distribution—might be disrupted.

As startups raise less money, they might also not need to go public. Not only that, but the more successful the AI company, the less incentive it will have to go public, as it might be able to fund itself from revenue from its customers! Not great for public investors.

To be clear, that doesn’t mean that no AI company will raise money. Many AI companies still need employees, get the word out, or train their own AI models. All of that requires money, and they will raise capital from VCs or the stock market. What I’m saying is all three of these costs are shrinking:

More efficiency of employees because of AI

Partnerships with creators to get the word out

AI is becoming cheaper fast, and open-source foundational models like Meta’s Llama pressure costs further down

Which means they will need less capital in the future, and it will be harder for VCs to pour money in them.9

3. VC-Funded Startups Might Have a Lower Success Rate

So not only might VCs (and stock market investors) be locked out of good AI investments and have their existing investments disrupted by AI startups, but their investments in startups are becoming much more precarious.

Since building products is becoming cheaper and cheaper, there will be much more competition. That means a higher failure rate for startups.

Before, VCs could invest in nearly all the tech startups that grew. One VC’s failure was another VC’s win. But now that so many startups will not be funded—formed by solopreneurs and small teams—one VC’s failure will not always be another VC’s win.

Takeaways

AI represents a unique opportunity for tech investors, and could turn out great for them:

Many more companies can be created because it’s cheaper to build them.

It’s especially cheaper to start, so reaching PMF will be faster, and they might be able to help lots of good businesses grow.

Many existing businesses will be disrupted, and the new AI companies might replace them.

Some defensibility might emerge, like for example access to unique data sets.

But with these opportunities loom huge risks:

Many solopreneurs will not need to raise money. VCs will be locked out of these investments, as will be stock markets.

The startups that do raise money will need less of it. It will be harder to get into deals, and when VCs do, they might not be able to invest a lot of capital.

The competition for funded companies will be more intense than ever, which might cause many more startup deaths—some at the hands of companies that are not VC-backed and never IPO.

This competition will also destroy existing investments, both in private and public companies.

How can VCs, retail investors, tech workers, and workers outside of tech adapt to this massive change? That’s what I’ll look at in this week’s premium article.

Games where you can start playing for free and you get upsold to pay if you want to progress faster or have a nicer game.

Today, Y Combinator’s biannual batches consist of a three-month accelerator program to push the companies to start, provide exposure to investors, and invest a few hundred thousand dollars in exchange for some equity in the company.

Some VCs specialized in the middle: Companies that had already reached early PMF but still had some sources of risk, like, is the team able to grow this company? Can they figure out scalable ways to develop? Etc.

There are also many other types of investors, such as angels, syndicates, VCs that specialize in Series A and beyond… Here I’m simplifying, but the idea is valid that there are broadly two extreme approaches of lots of small and risky investments vs a few, big, safer ones.

The converse is also true: Elite, specialized developers might not see as much of a productivity improvement, because the problems they face can’t be solved by AI yet, and they don’t have the same need to learn new code bases or languages as newer developers.

Here’s a long conversation between Lex Fridman and Pieter Levels from a few weeks ago if you want to know more about his philosophy.

My editor rightfully called the “his” out in this sentence. I think I’ve mentioned in the past that I use “his” or “her” rather than “theirs” because it’s still more common and helps with the flow, and then I try to mix them up, but I also try to reflect the reality of what is more common. I quickly browsed through the list of solopreneurs and 80-90% are men, with the ones making the most money being mostly men. So I think odds are the first billionaire solopreneur will be a man, even if I am neutral on whether that will be the case. I’d love to see more women solopreneurs!

Initial public offering: Starting to be traded in the stock market

Foundational models like those of OpenAI, Anthropic, or Mistral definitely need a lot of money. But also their value is being obliterated by Meta (previously Facebook), who is releasing similar models for free. Then, other companies like Perplexity or Scale AI also have needed lots of money.

Years ago, me and a couple of buddies, we had this crazy idea. We wanted to start an ISP, a clean one, no ads, just pure internet. But our so-called leader, he got greedy. He wanted to raise five million pounds just to print some damn CDs. Guess what? The whole thing went up in smoke. Not long after, some punks came up with the same idea and called it Facebook.

Then, I put my money in this startup, thought it was gold. They were supposed to sell customers to taxis, easy money, right? But those clowns running the show were all talk, no action. I pulled out before it went south. And guess what? Uber and Grab showed up and made a killing.

Another idea, another failure. The problem with these fools was they thought they needed big investors before making a move. But all the real successes? They started in garages, in bedrooms, with nothing but a dream and grit.

Yesterday, I hit up a SaaS company. Told them straight up, they needed to fix their software. Last paragraph? I threw it in their face, “I know it can be done because I built an app to do it myself last week.” Yeah, I’m technical, but before ChatGPT, I couldn’t code a damn thing.

Now, I use AI for everything. Google Ads? I get AI to write those for me. Sure, I gotta sift through some garbage, but with CoPilot, Gemini, ChatGPT, I get what I need in seconds. And then, I use AI to make it happen. I haven’t fired anyone, but the way we do things now? It’s faster, it’s better, and it’s ruthless.

Spot on, compadre.

Ahem… The text above was written by AI, converting my story but told to write like a Mexican drug lord..

Always enjoy your articles, Tomas. And I think this will be the week I upgrade to paid.

This said, I think the evolution of venture capital is more nuanced than you describe. I think smart venture money is going to shift from pure software businesses to complex vertical integrators that need lots of capital to solve problems in industries where incremental solutions are no longer possible.

See this week's article from Packy: https://www.notboring.co/p/vertical-integrators-part-ii