Peak Oil Is Coming

And petrostates are not ready for it

Renewable electricity is so cheap that it’s taking over the world. It will replace most fossil fuels: in power generation, car propulsion, heating… When it does, the budgets of dozens of countries will be destroyed because they mostly rely on oil and gas production today. What will happen to these countries? To global geopolitics? This is what we’ll explore in this series, starting by asking ourselves: When will oil sales start shrinking?

When the Oil Runs Out

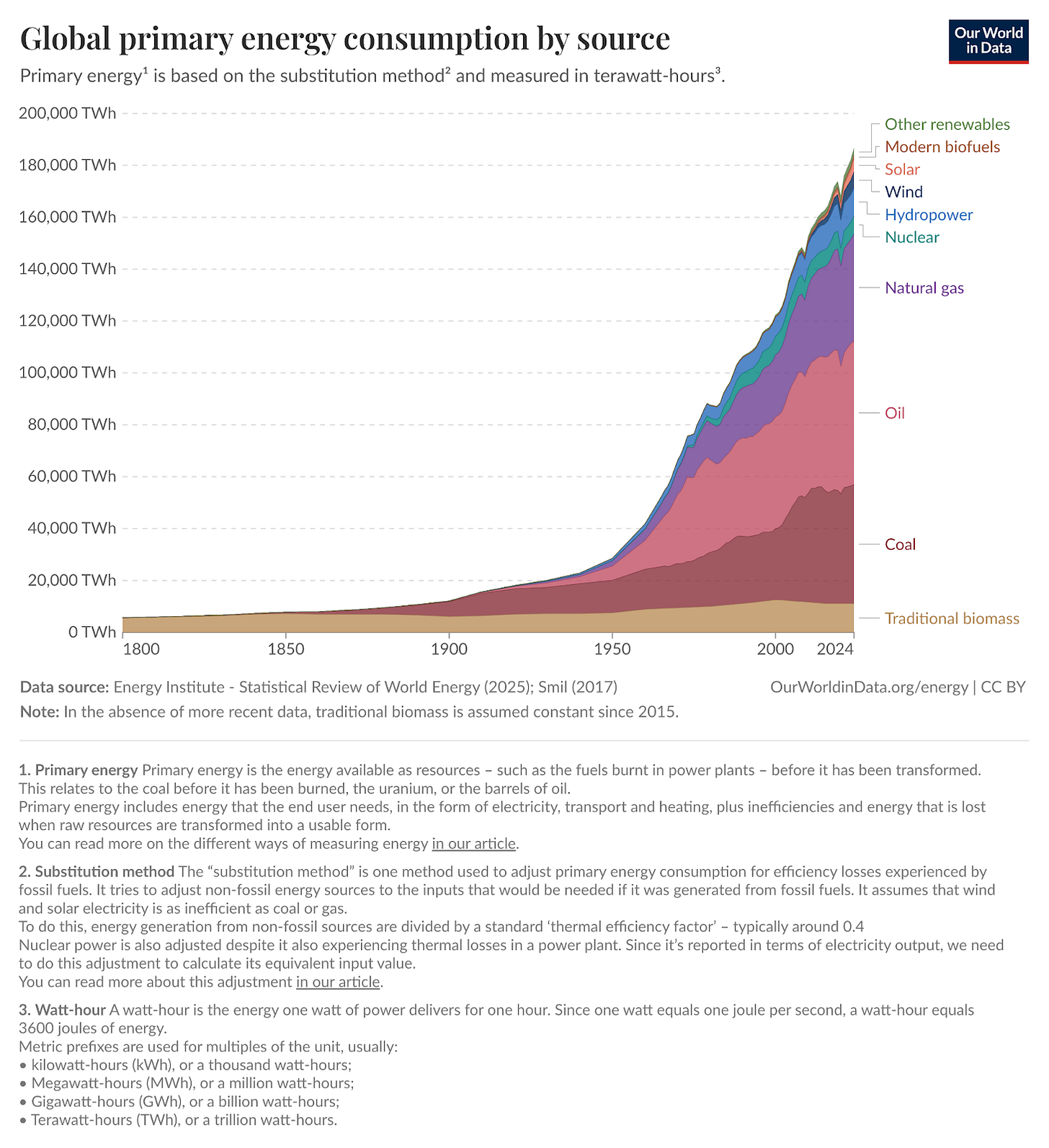

Energy has driven the geopolitics of the last two centuries:

First, the expansion of coal in the 19th Century drove the Industrial Revolution. Then, the expansion of oil and gas in the 20th fueled the world’s wealth explosion.

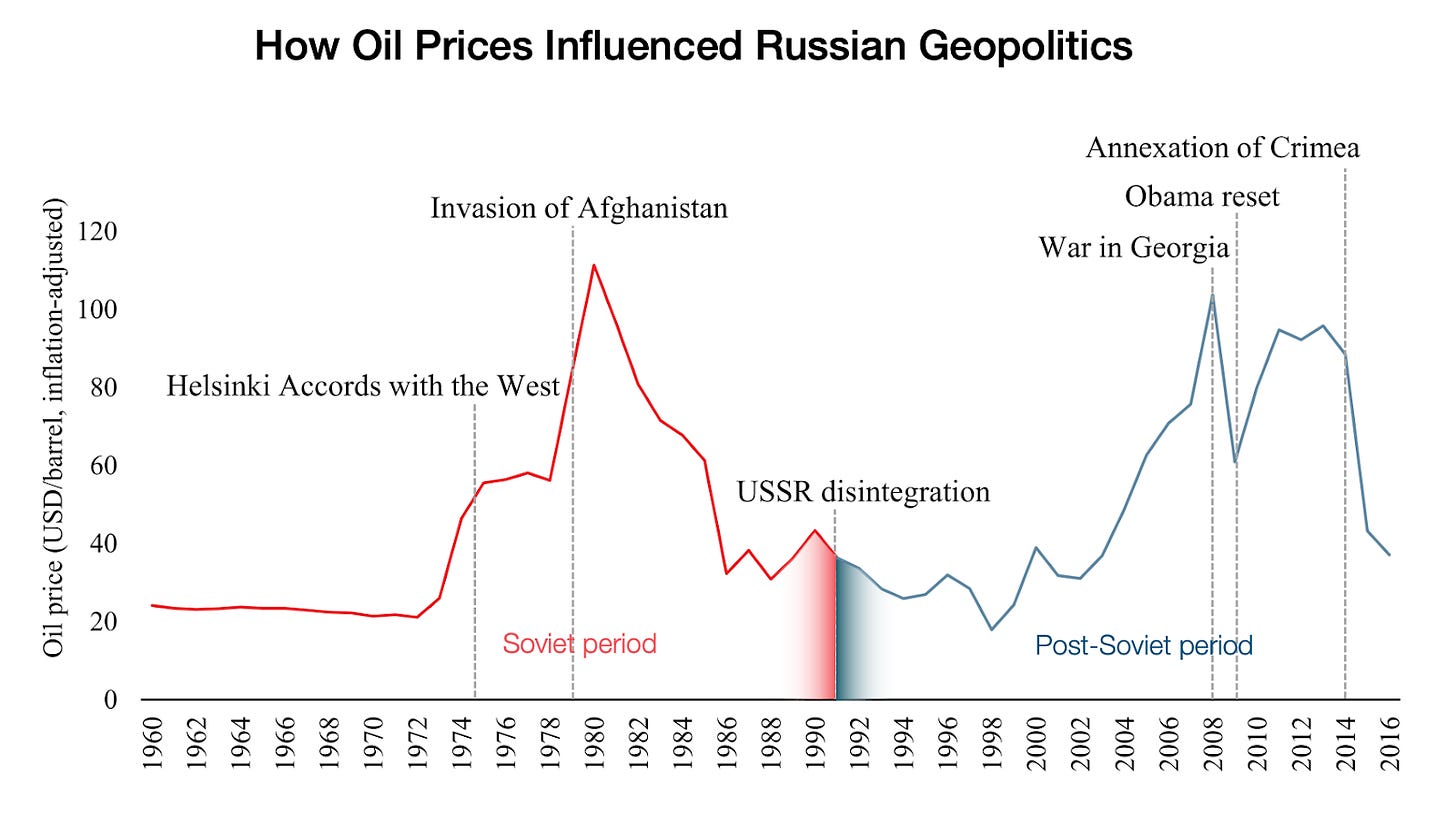

Everybody won, but the suppliers of oil and gas won an outsized return. The USSR was only viable as long as oil prices were high. Today, Russia’s war in Ukraine is financed by Russian gas.

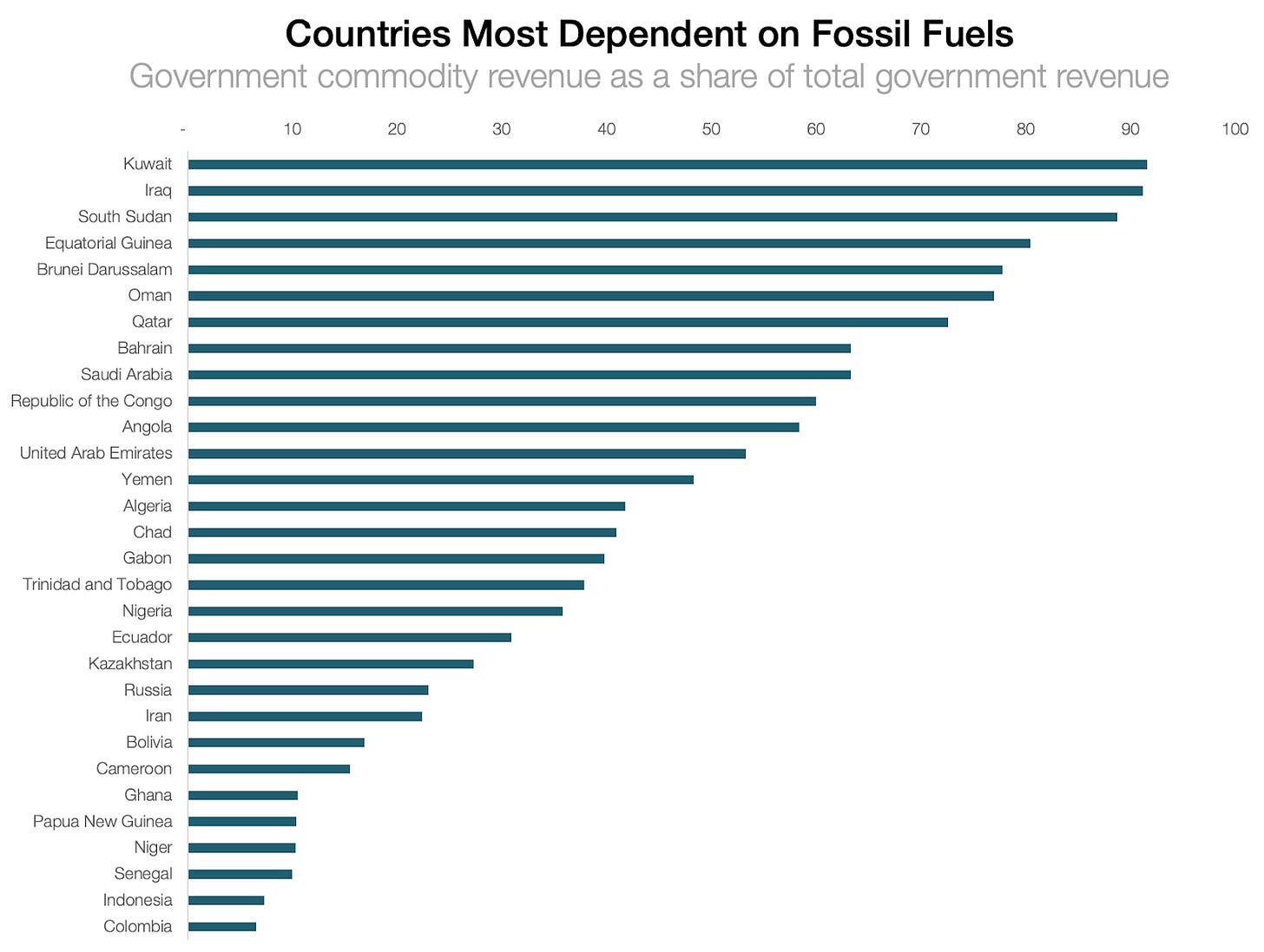

Many countries are dead without oil and gas income, as their entire governments’ budgets depend on these resources:

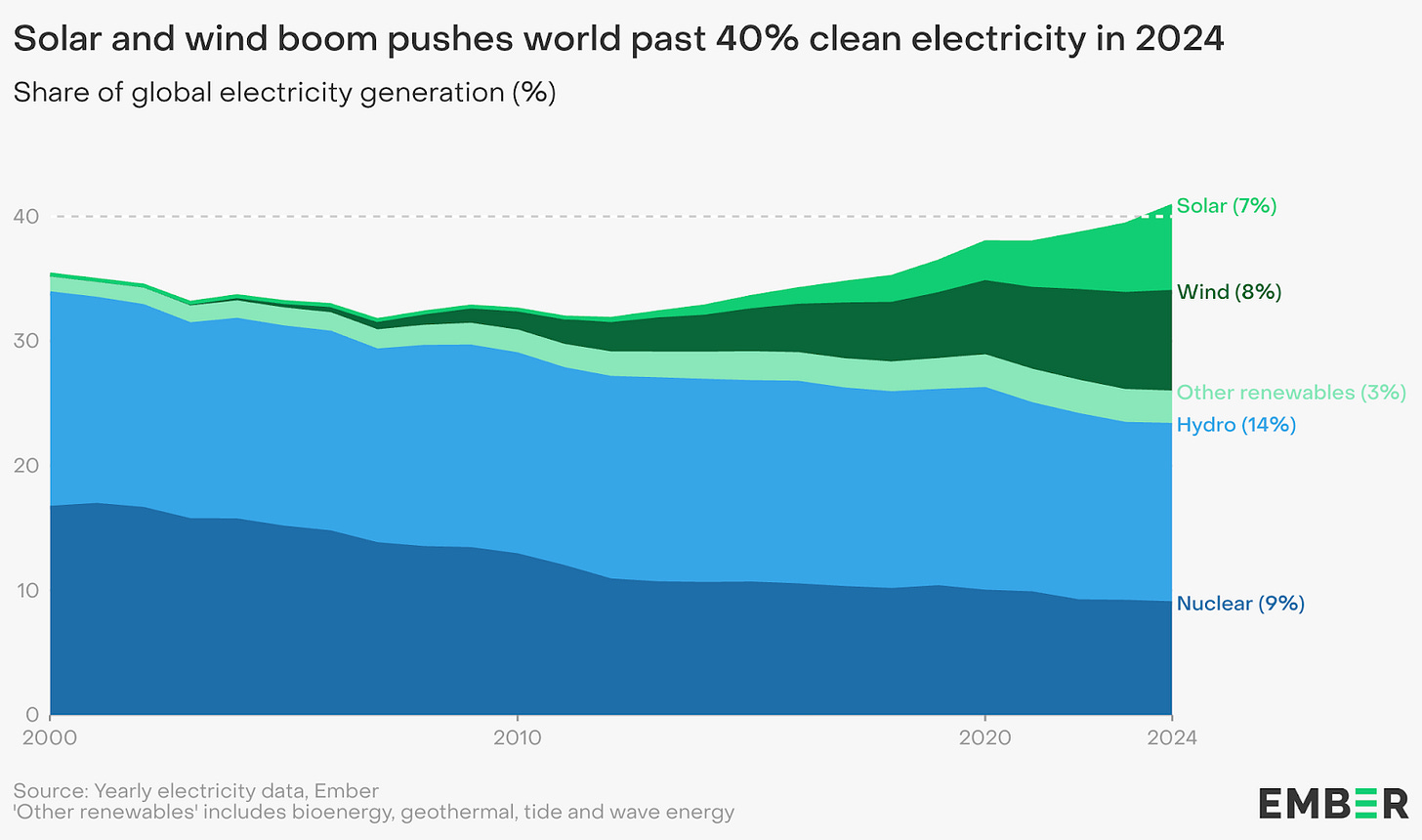

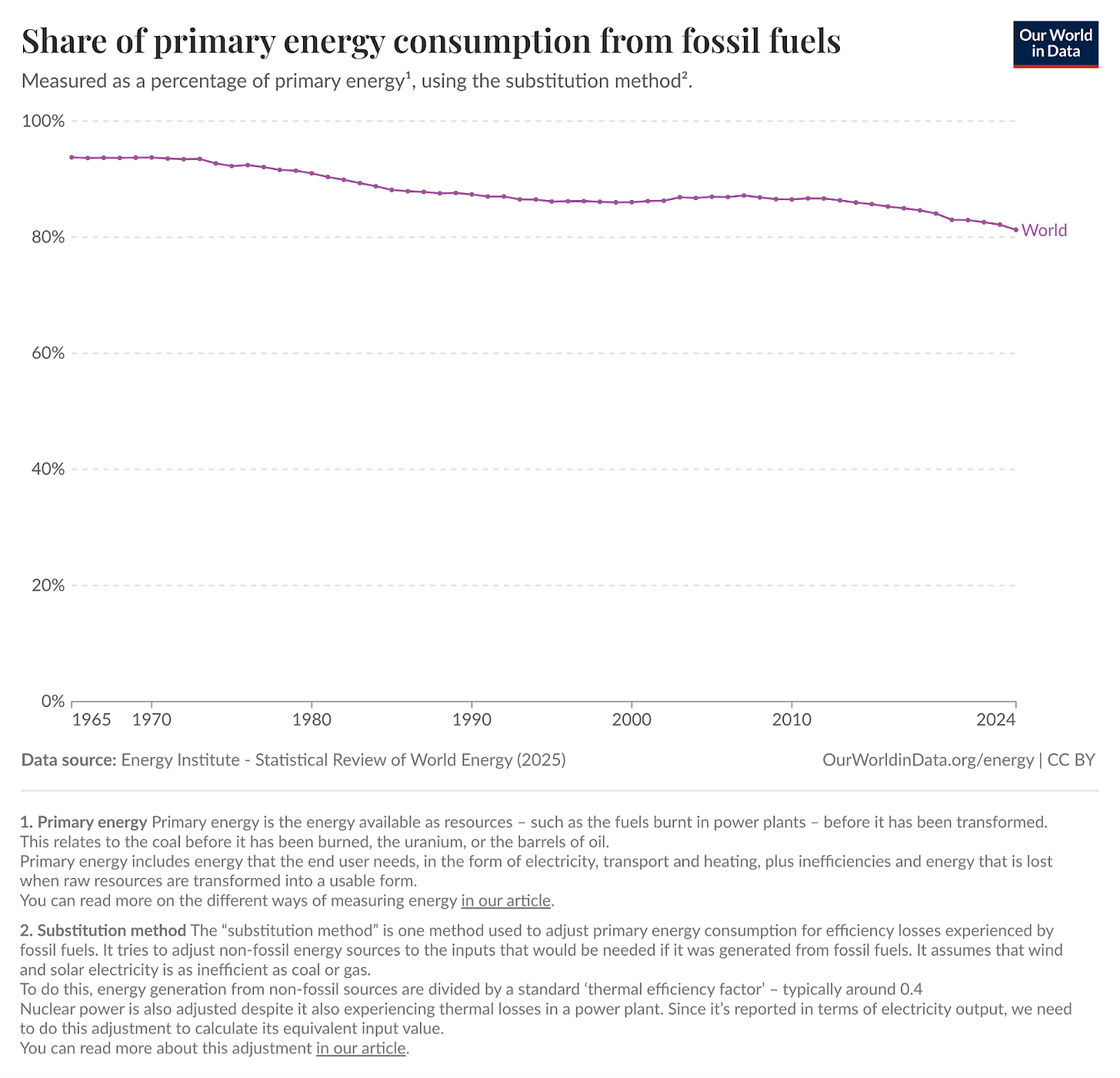

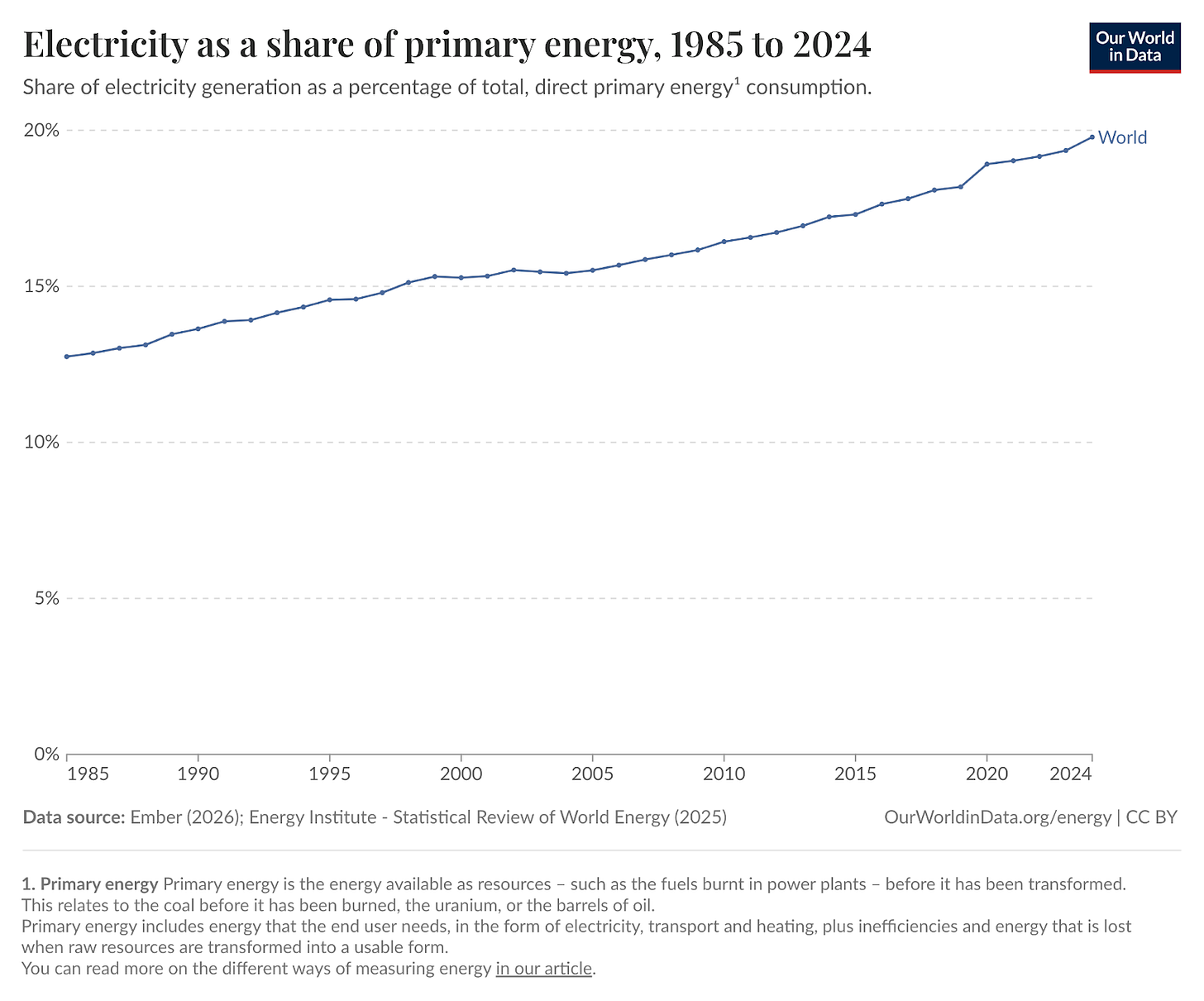

So what happens if fossil fuel incomes crater? That’s entirely possible. The share of all world energy coming from fossil fuels is shrinking:

And this shrinking is accelerating because of electricity.

The world is electrifying, and that will accelerate: Unfortunately for fossil fuel countries—and fortunately for the world’s climate—renewable energy will completely take over electricity generation.

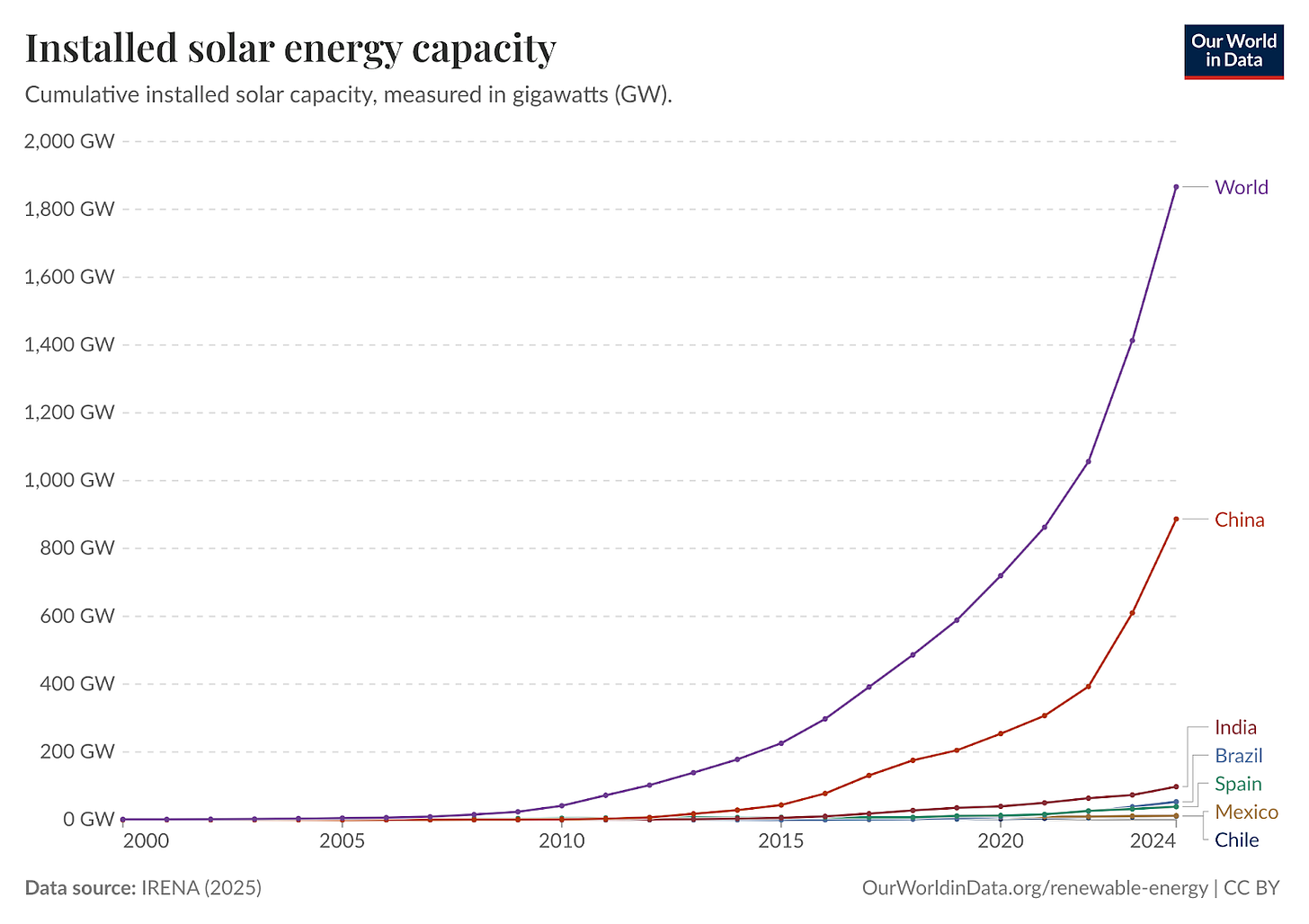

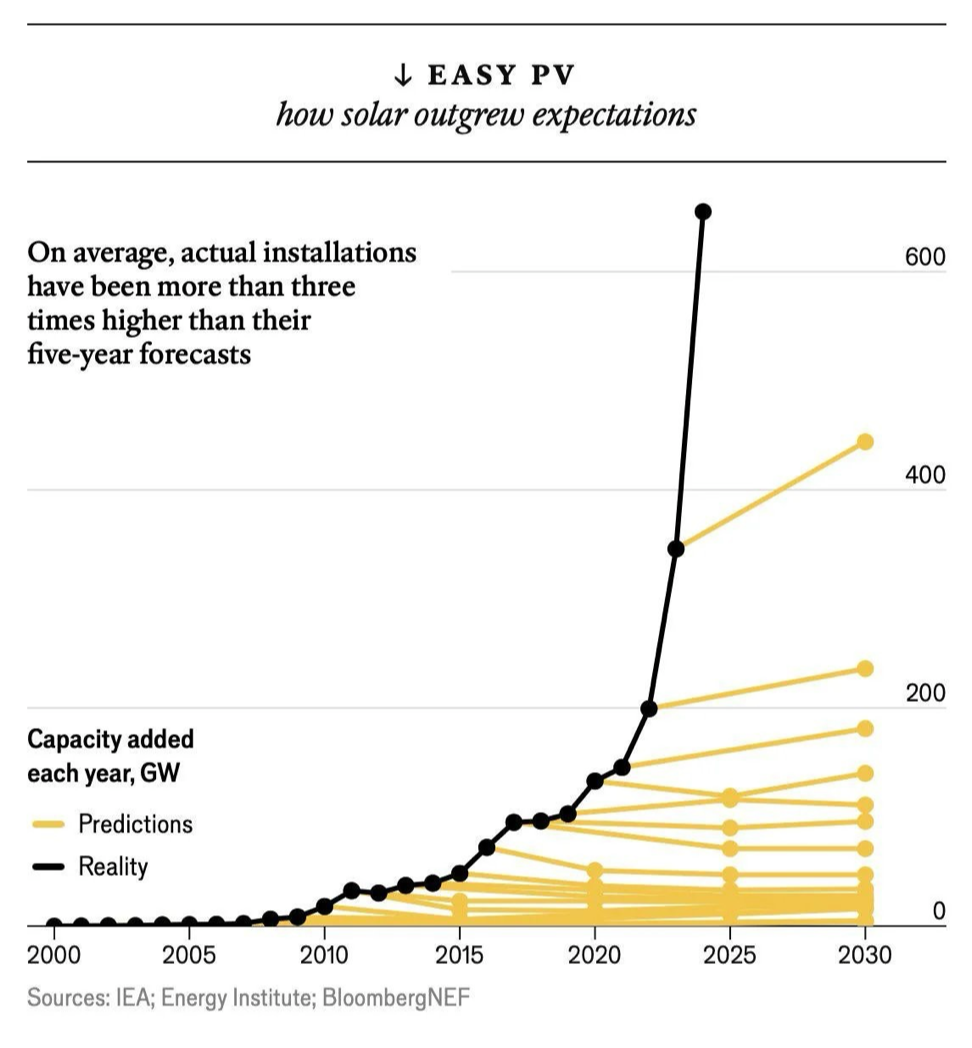

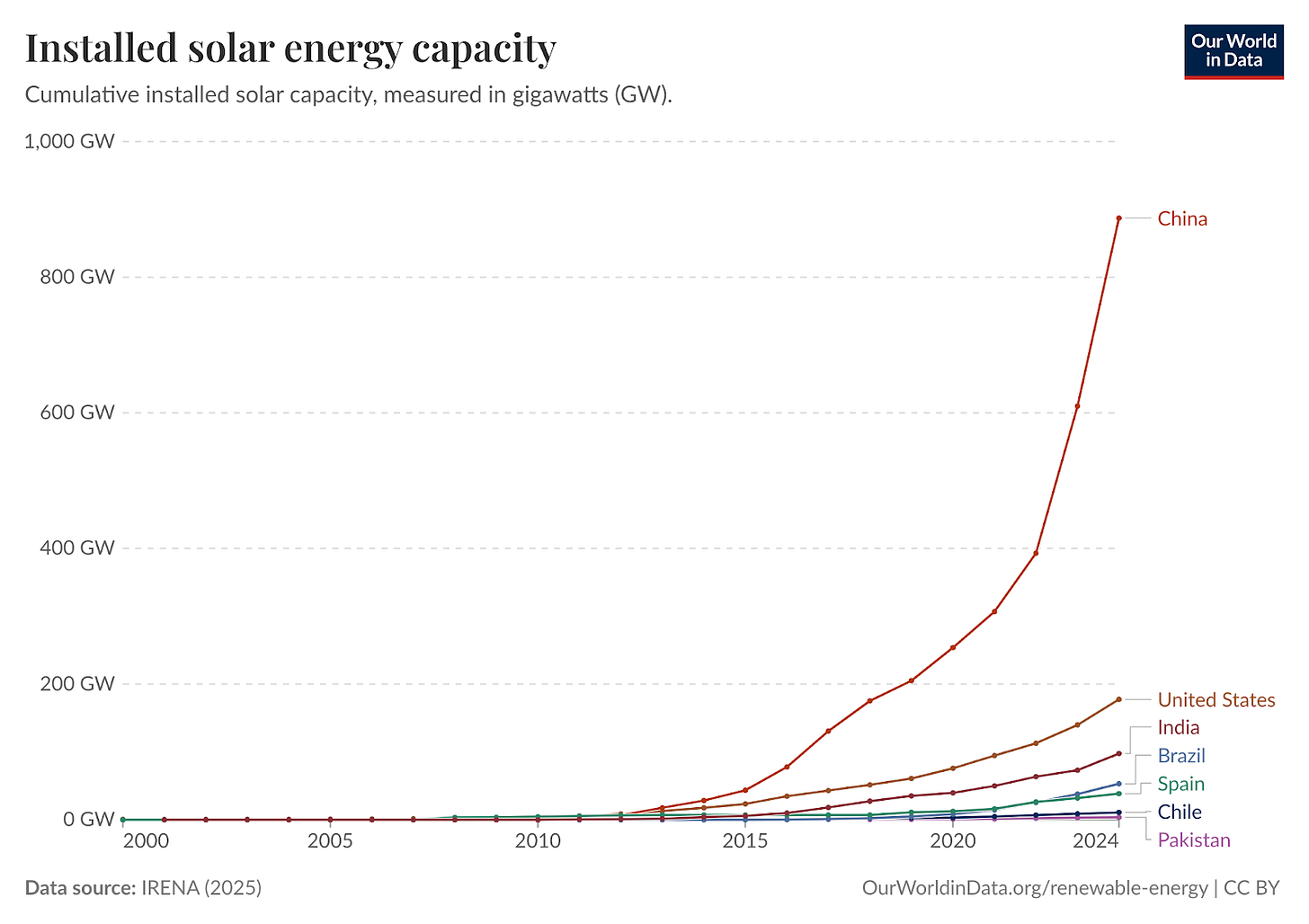

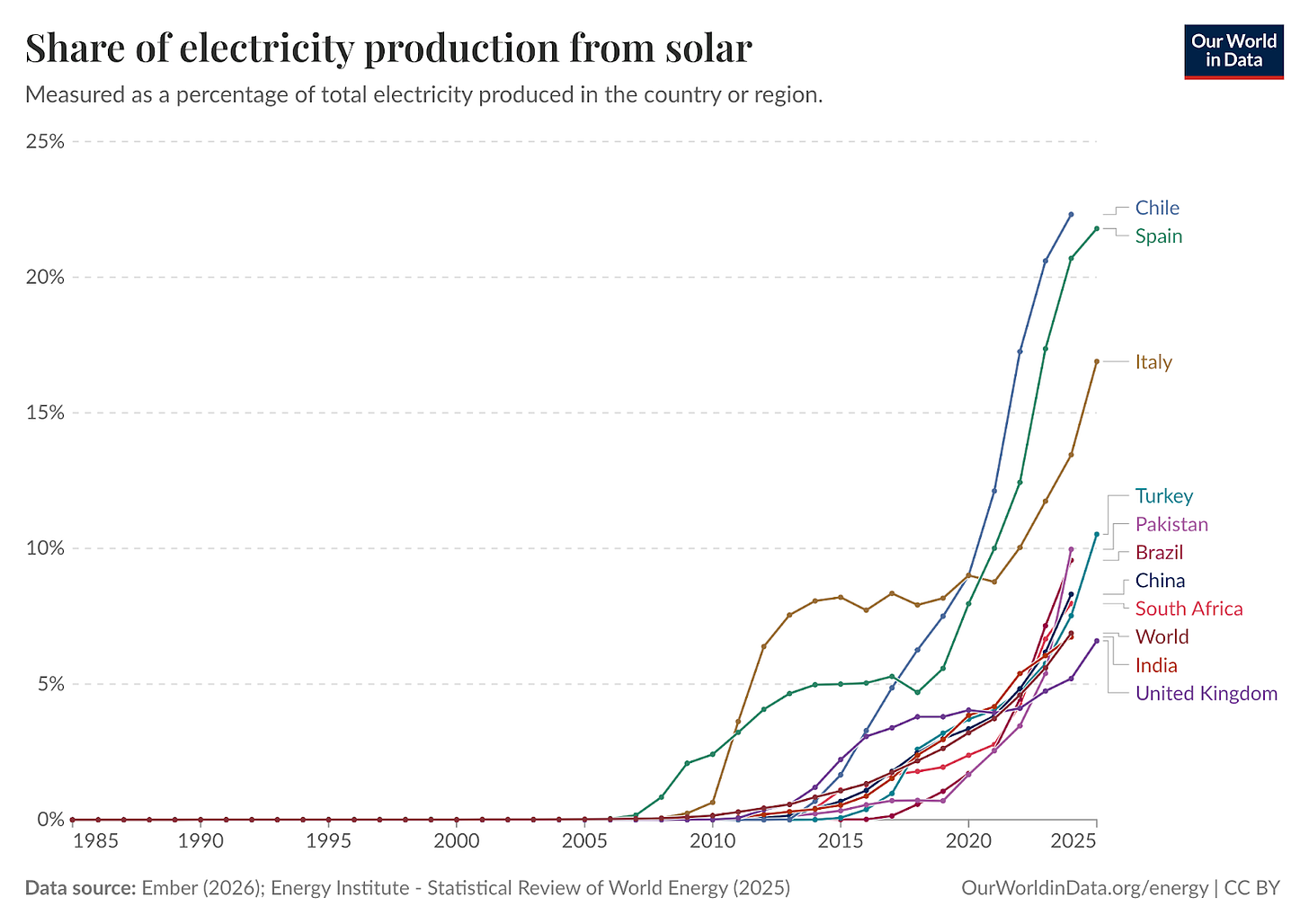

The fact that solar generation in particular is accelerating can be seen through the installed base of solar capacity:

This exponential is fueled by the virtuous cycle of production and costs:

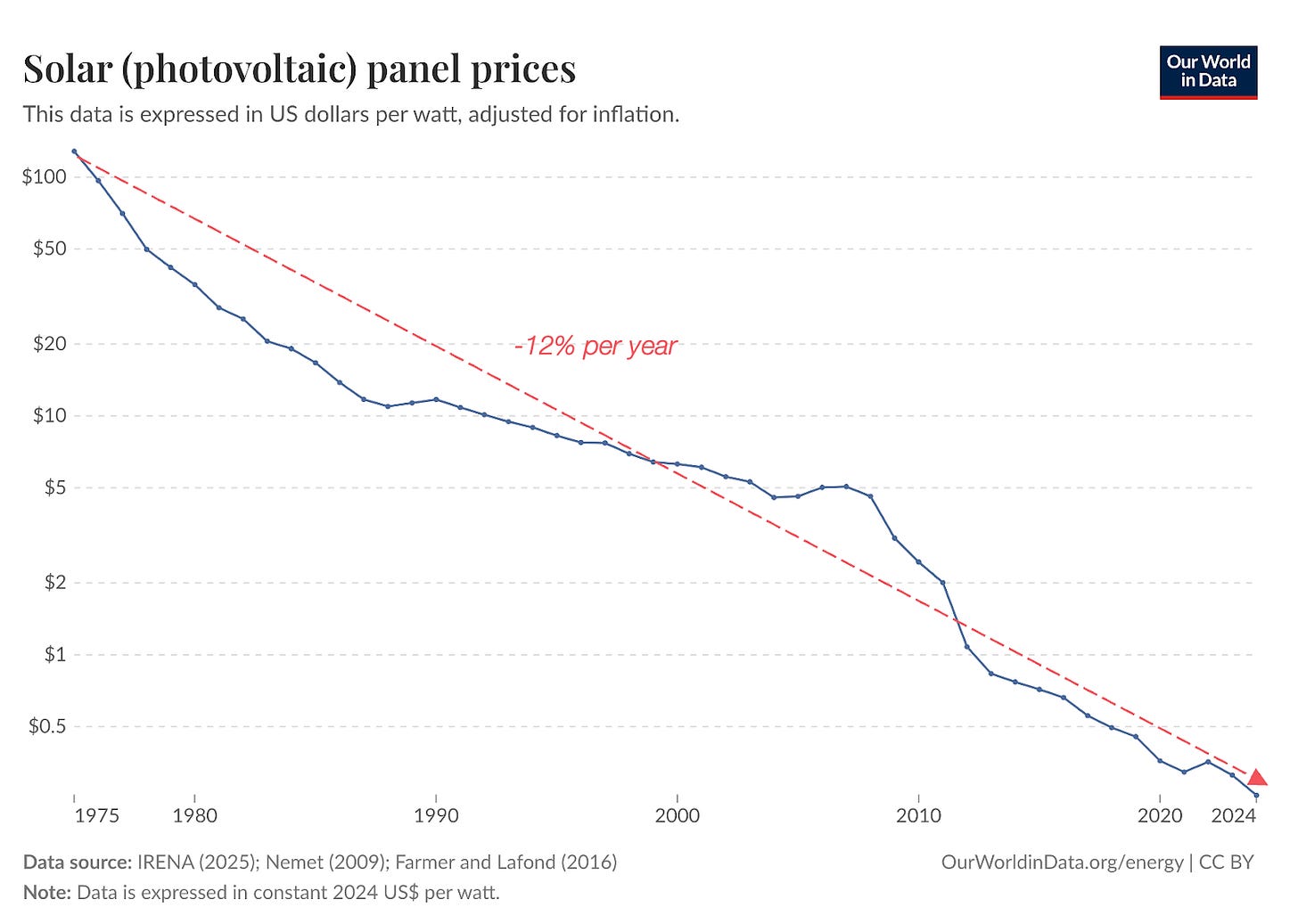

Indeed, solar costs keep shrinking:

That’s just for solar panels, but overall solar electricity generation costs are also shrinking and will continue to do so.

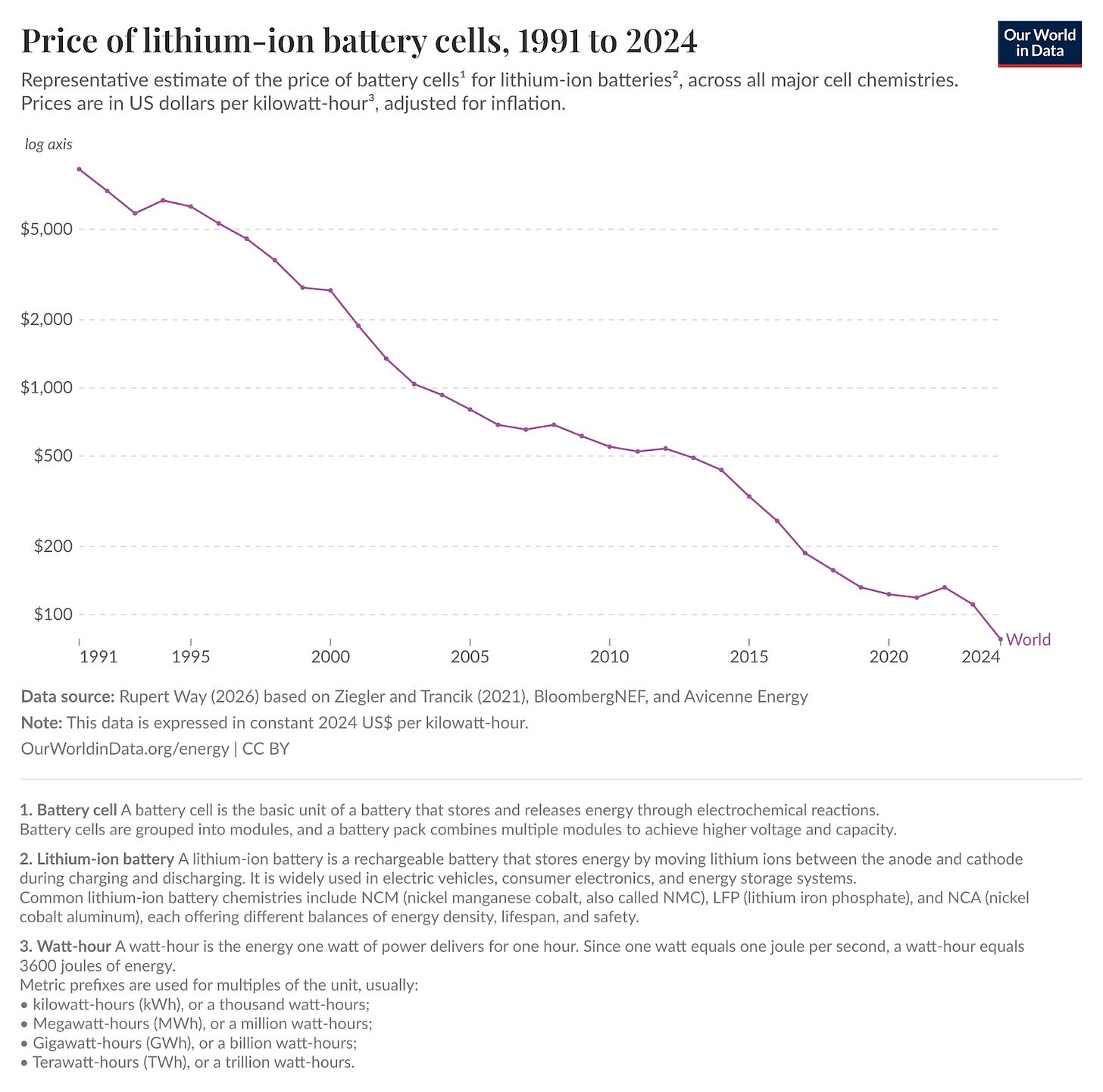

The Sun only shines during the day, but batteries bring sunshine to the night, and their cost is shrinking too.

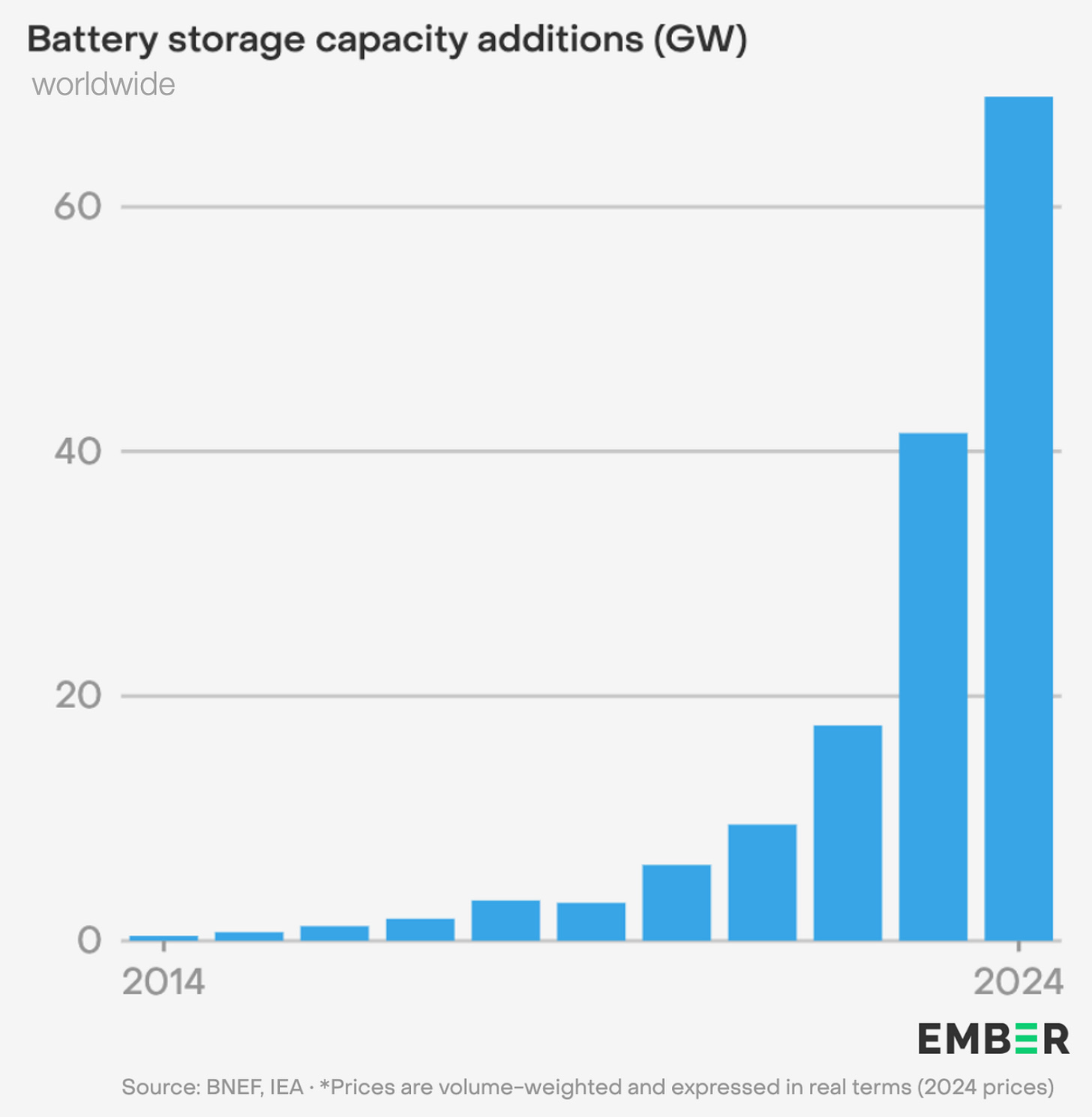

Which is why battery installations are exploding too.

It doesn’t take a genius to connect the dots:

Solar is already the cheapest source of electricity, and its costs keep shrinking. Together with batteries, their combined cost will keep getting cheaper vs alternatives.

Installed capacity will continue soaring globally to cover demand. What we’re seeing in China will happen everywhere.

This will further accelerate electrification: Everybody wants cheap energy! Electric vehicles will replace internal combustion engines (ICE) faster, electric heat pumps will replace gas-fueled heaters, electric arc furnaces will replace combustion ones…

As electricity eats up global energy consumption, via solar and batteries, the demand for oil & gas will plummet.

The countries whose economies and government budgets depend on oil & gas…

What happens to them? Well, it depends on when all of this happens.

When Peak Oil?

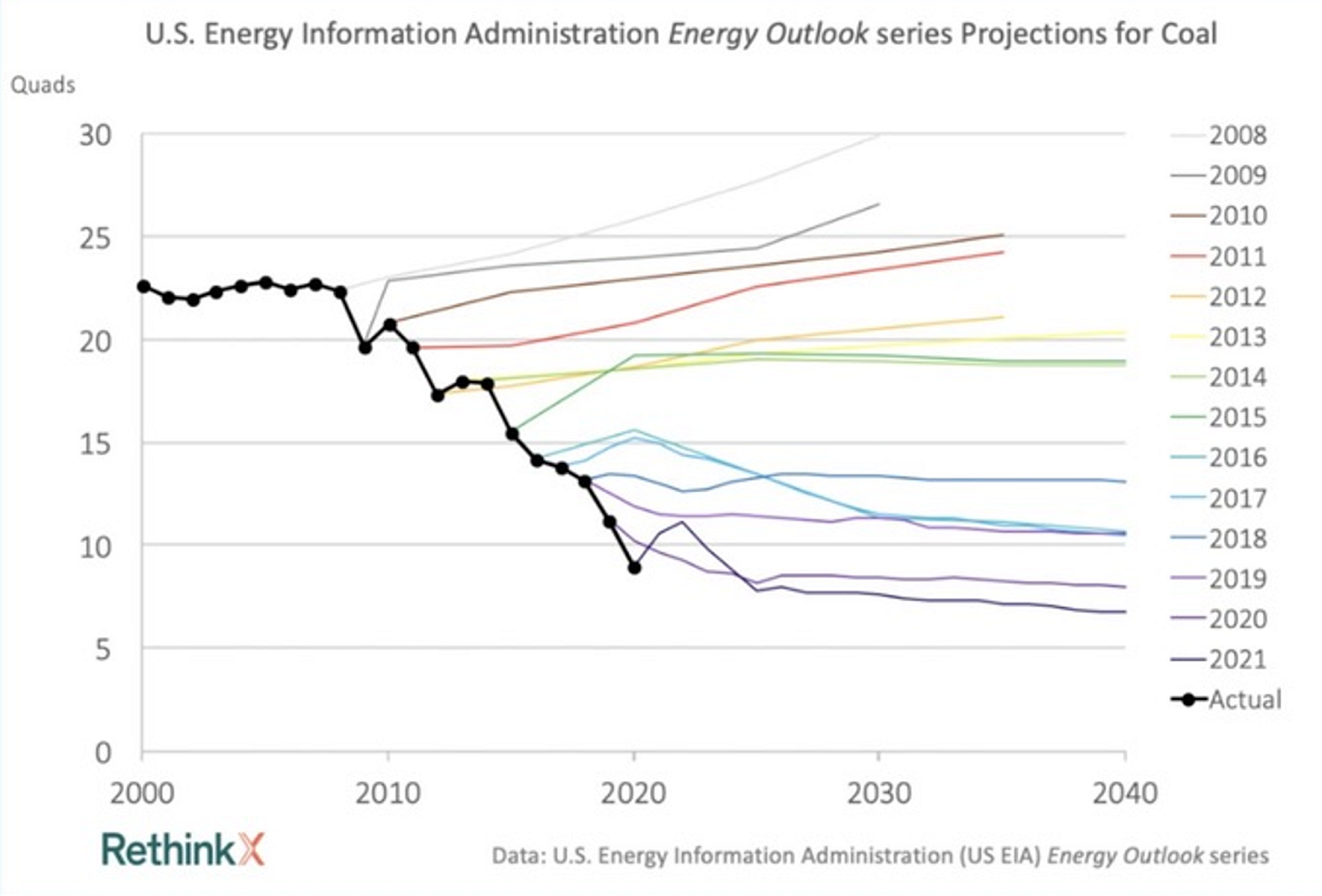

This is no easy calculation. Dozens of organizations project demand for oil and gas in the coming decades, but this is the type of stupid mistake they make:

And conversely, for coal:

Why are these forecasts so flawed? I think one reason is vested interests: For example, of course OPEC forecasts see an increase in oil demand by 2045!1 Its existence depends on it.

The other reason is that people assume the world will continue with business as usual. They don’t realize that, in energy, transitions can be extremely fast.

Fast Transitions

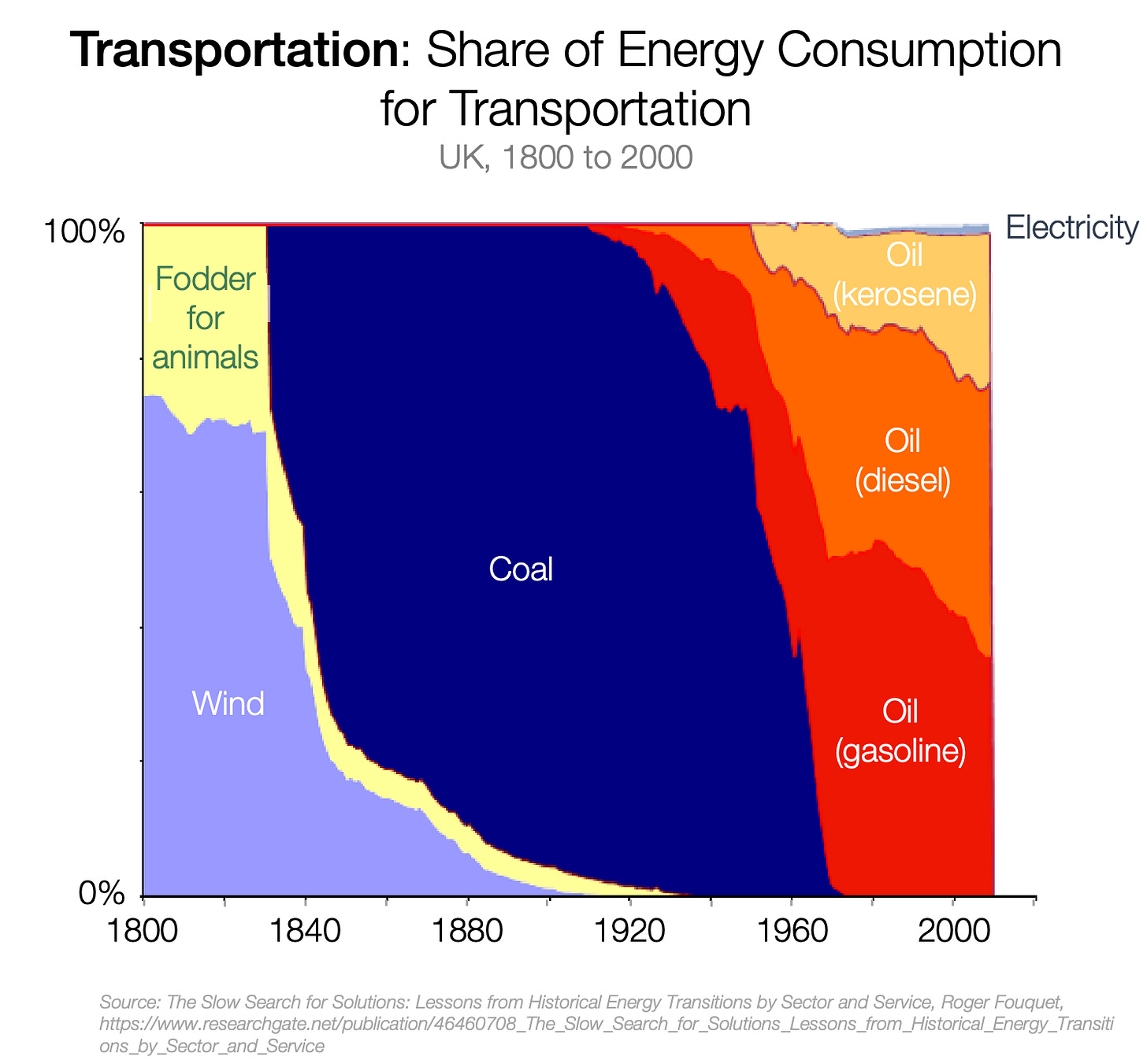

Look at transportation:

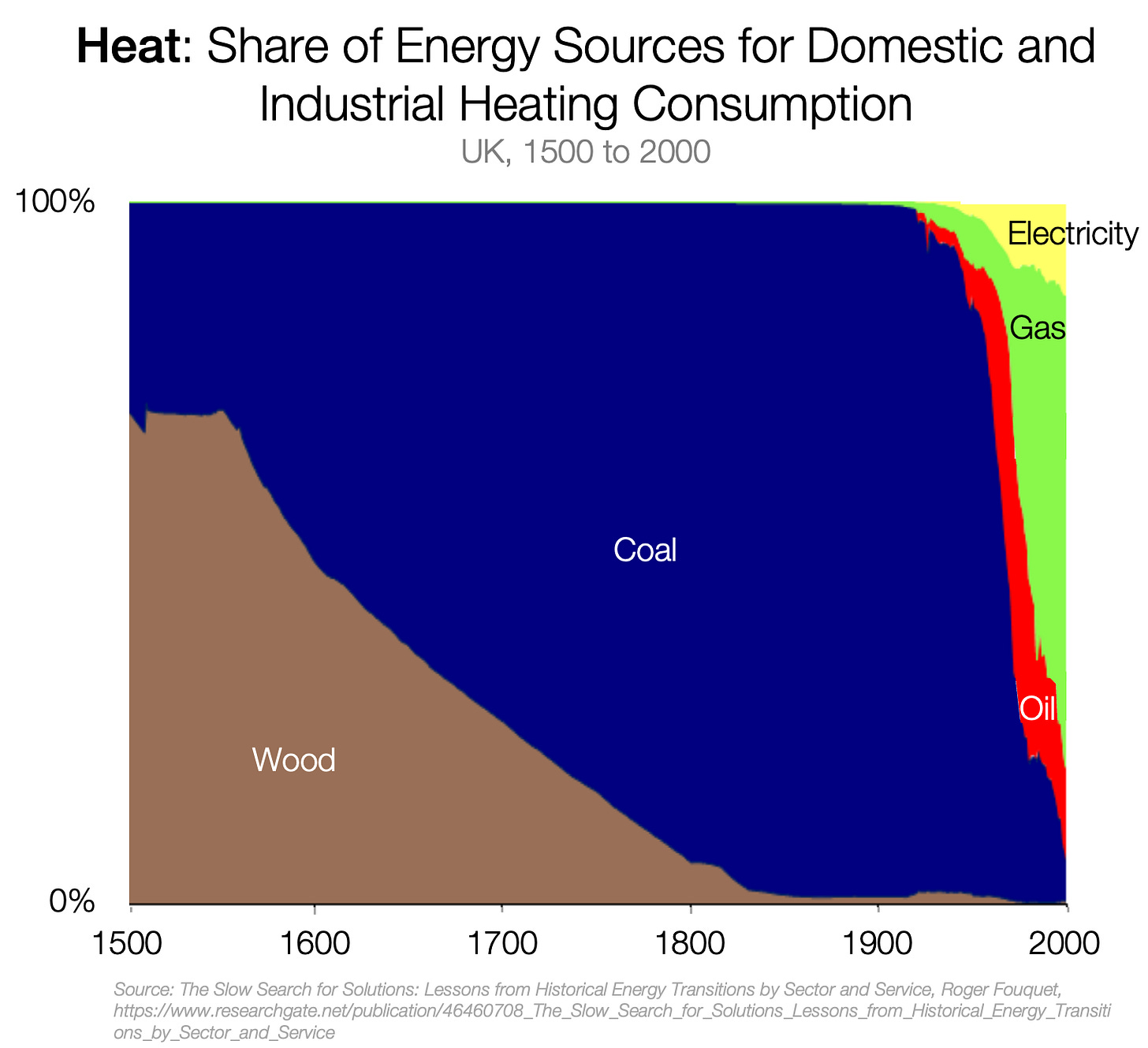

Here’s industrial heating:

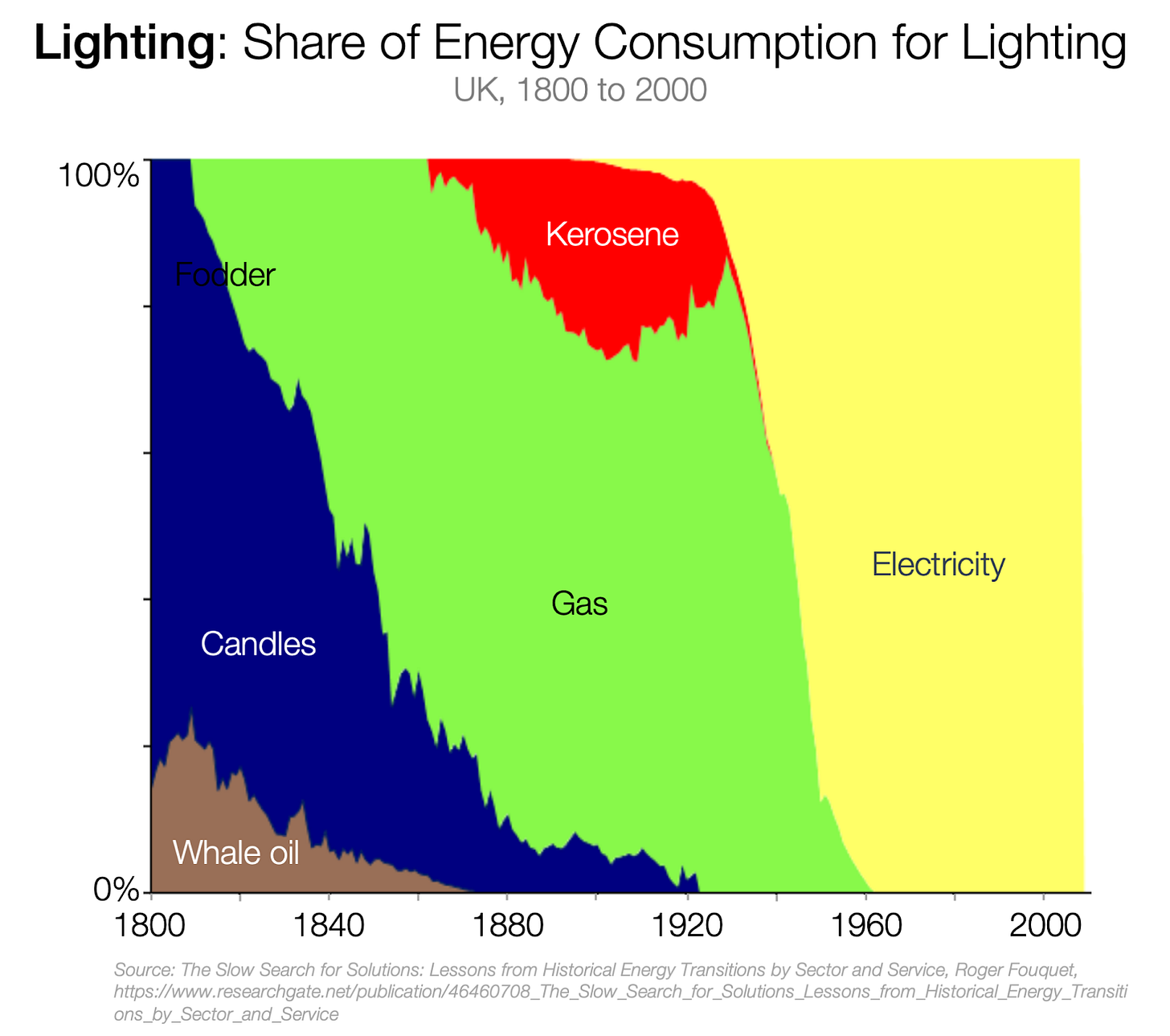

Here’s lighting:

Electricity went from less than 5% electric to over 90% in less than 20 years!

At the beginning, new technologies take some time to figure out, but once they’re ready, uptake can be vertiginous.

Solar, wind, and batteries seem to be on that path.

If we assume that’s indeed the case, how will oil demand change in the coming decades?

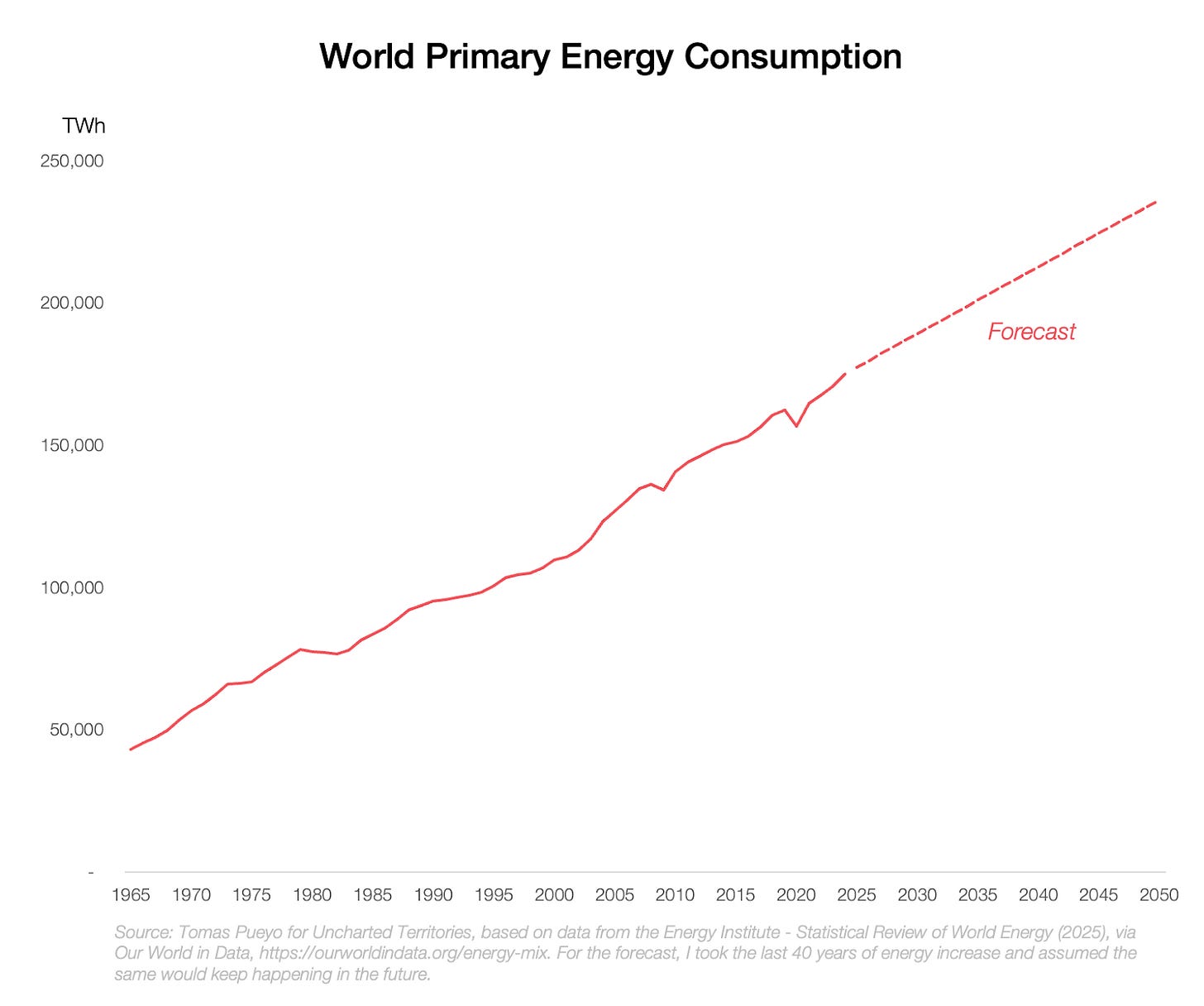

1. Total Energy Demand

Energy demand has been quite stable for decades. Let’s assume it continues.

2. Electrification

Here’s where we face a much harder problem.

It’s clear to me that electrification will start accelerating due to cheaper electricity prices from renewables, which will prop up electric vehicles (EVs), heat pumps, electric arc furnaces, and other electrification technologies. How do you model this?

The future is already here, it’s just not evenly distributed.—William Gibson

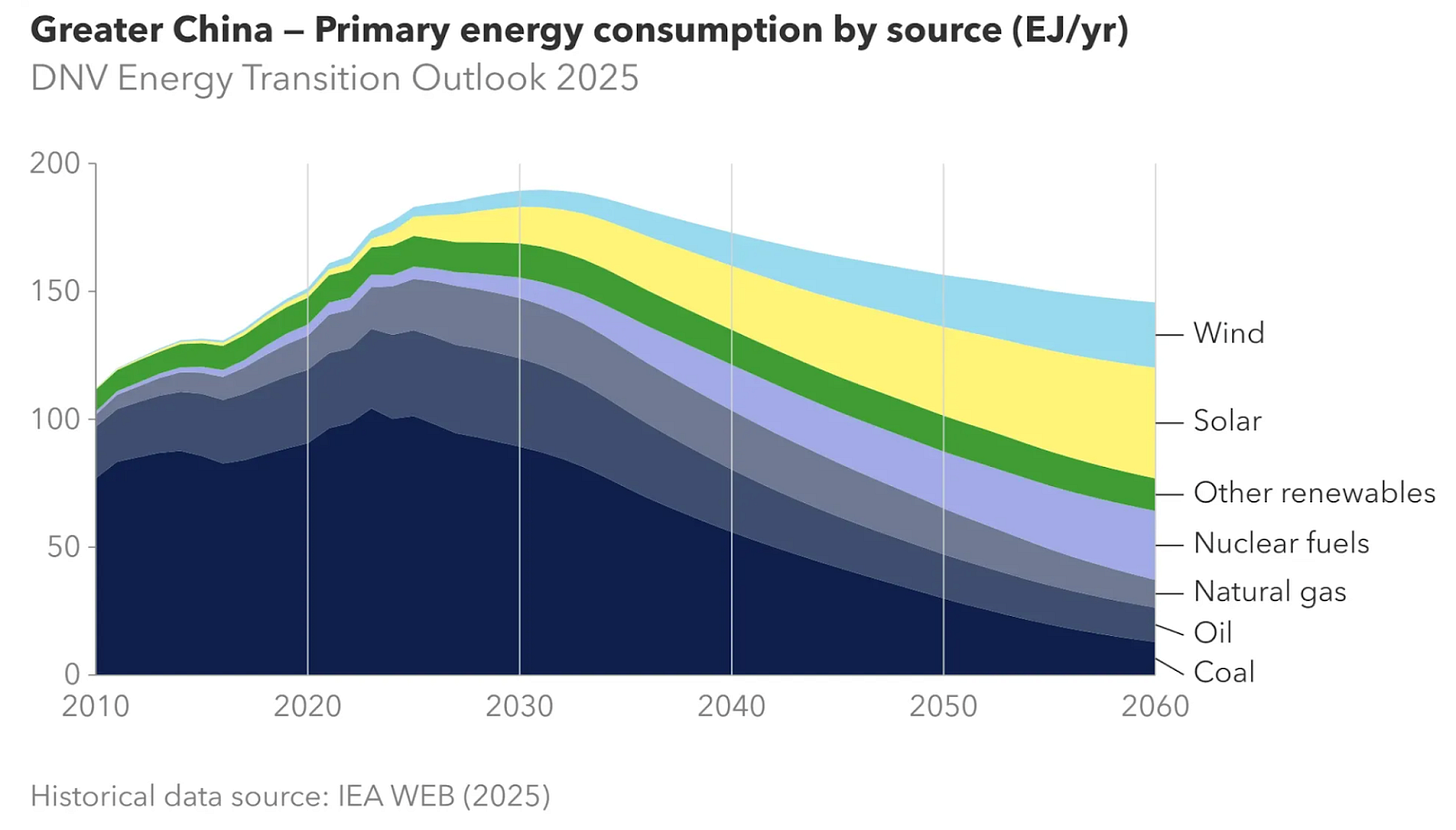

According to this, China’s consumption of O&G will shrink by 40% by 2050 and 60% by 2060. I personally think that the transition will be much faster, because of solar.

3. The Solar Revolution

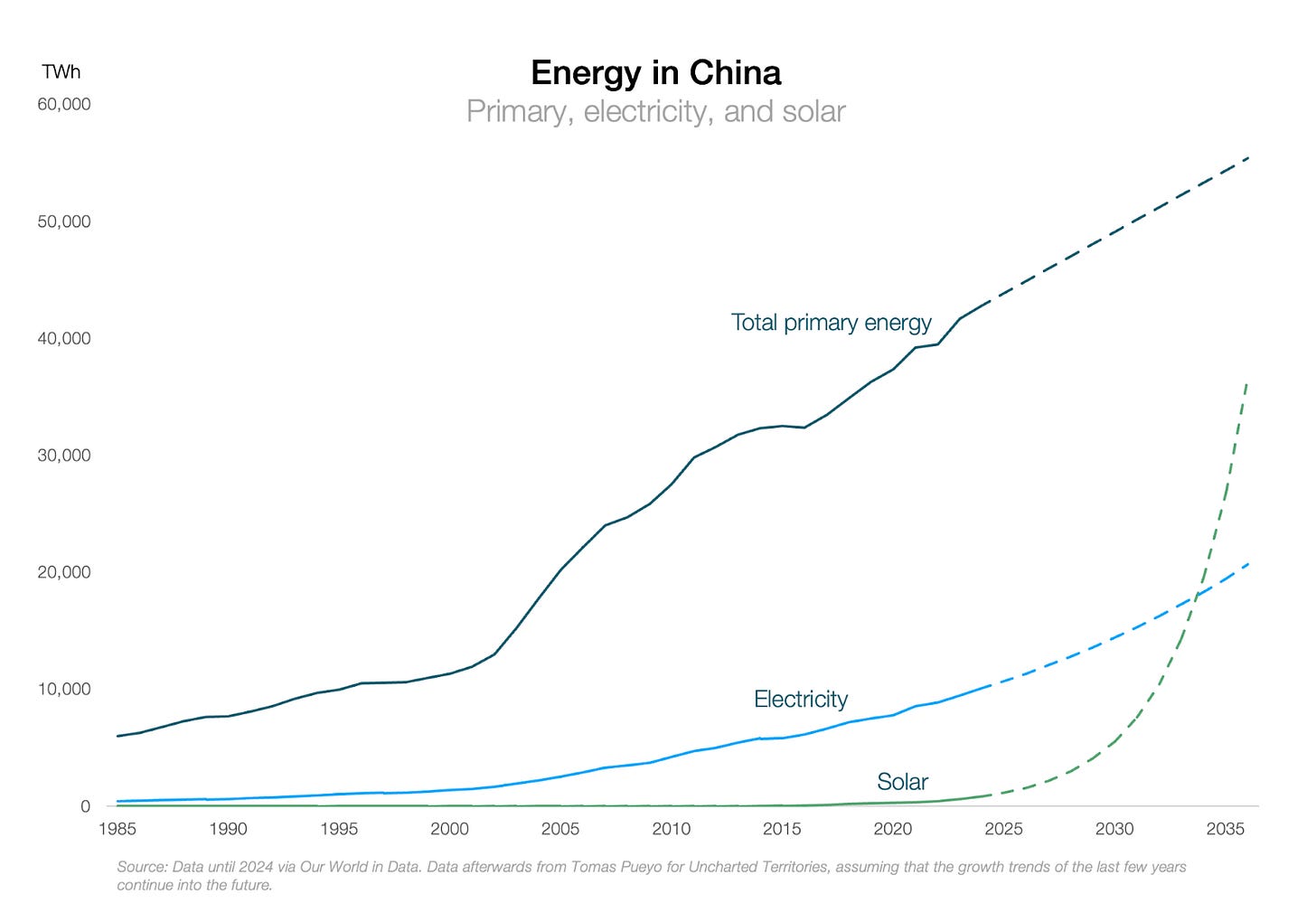

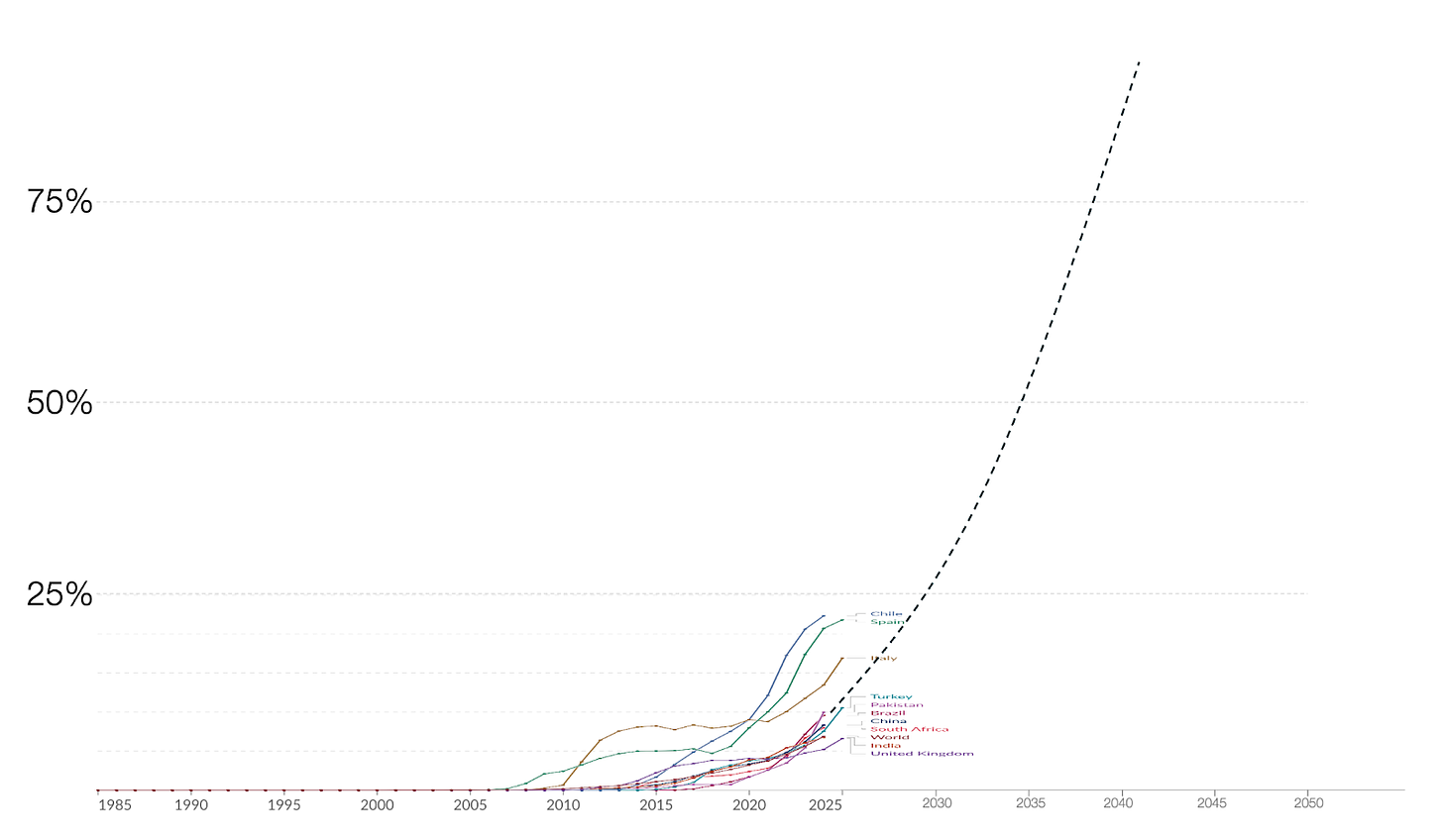

If you just project the growth of the last few years into the future, you get this:

The amount of solar capacity that China is installing is so massive that, if the annual growth continues, solar electricity would surpass the current trend of all electricity generation within 10 years! Of course that’s impossible, so what would happen instead is that:

This would accelerate electrification. That’s why China is a leader in solar panels, batteries, and EVs: The three technologies go hand in hand.

Primary energy would also grow faster, given such cheap electricity prices.

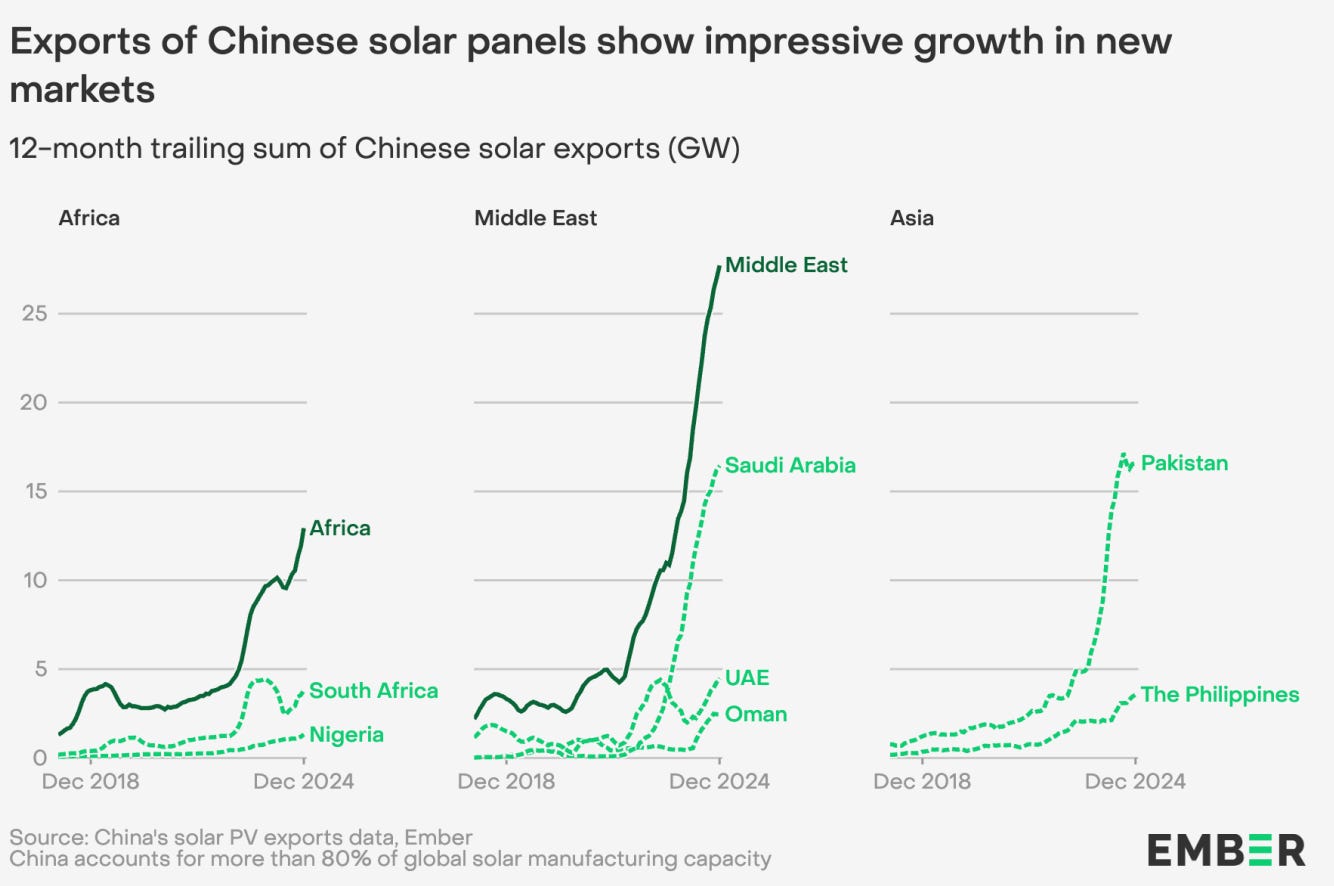

China will flood the world market with these electric devices.

Solar capacity growth will have to slow down in the coming years.

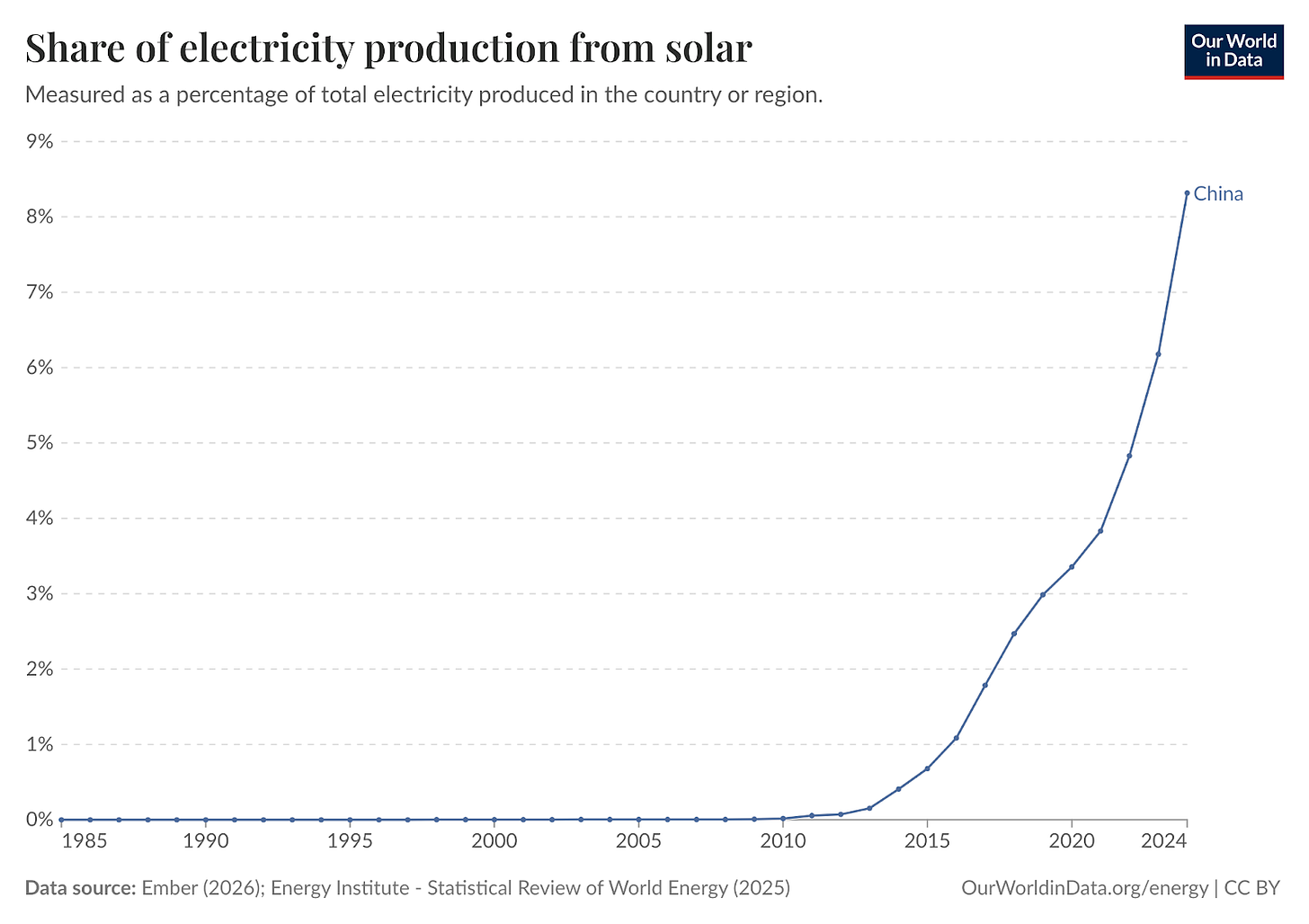

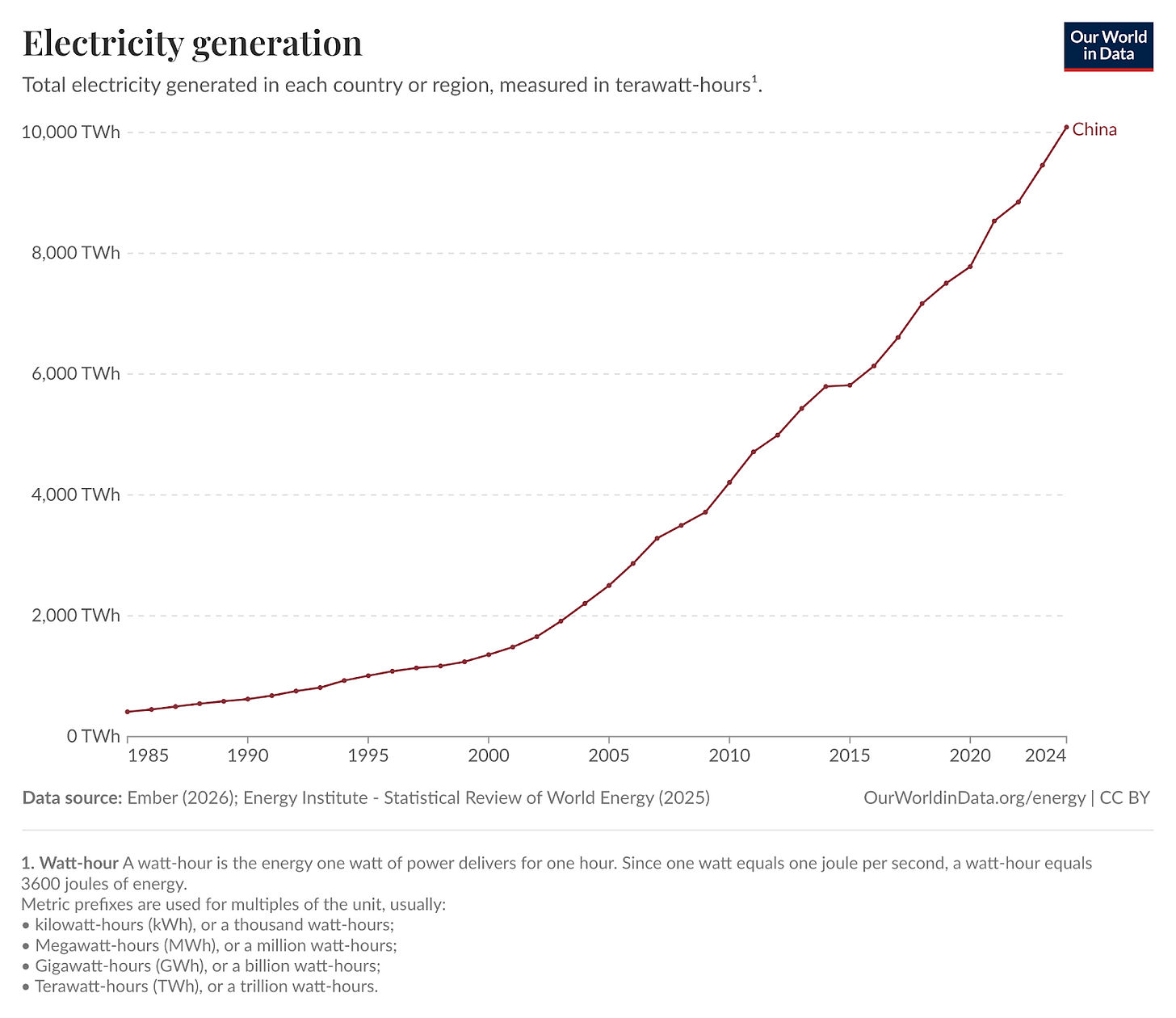

For that, we should be seeing exponential growth for China’s solar generation, electricity generation, EVs, heat pumps… Is that what we see?

Yes for solar.

Yes for electricity (although of course its growth must look less aggressive because solar is still just a tiny part). To put this in context:

In 2024, the total installed electricity capacity of the planet—every coal, gas, hydro, and nuclear plant and all of the renewables—was about 10 TW. The Chinese solar supply chain can now pump out 1 TW of panels every year.—Source

Let me repeat that: China can produce every year solar capacity equivalent to 10% of all electricity in the world today!

This is why China (and India) have cut emissions from electricity generation for the first time in decades.

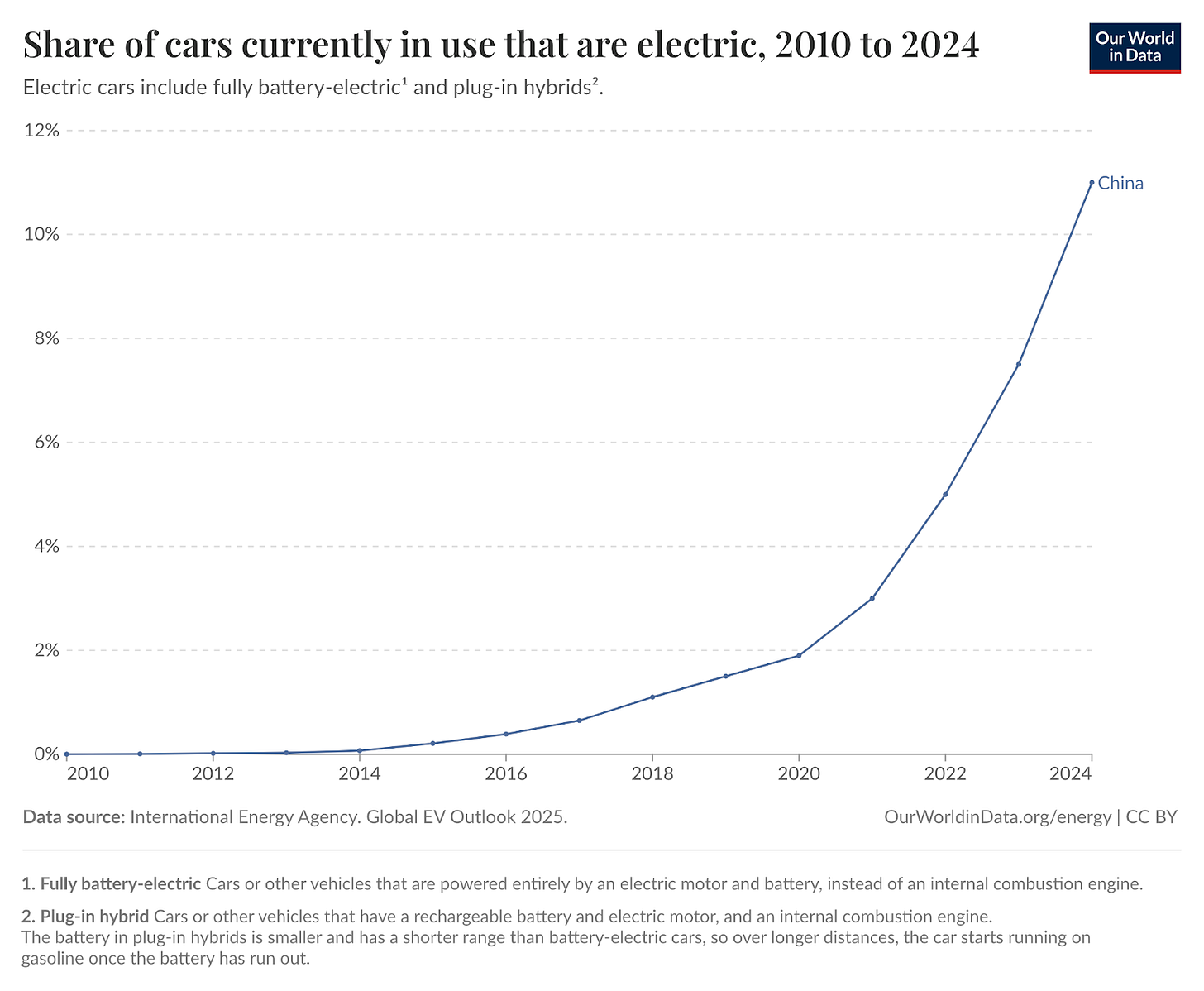

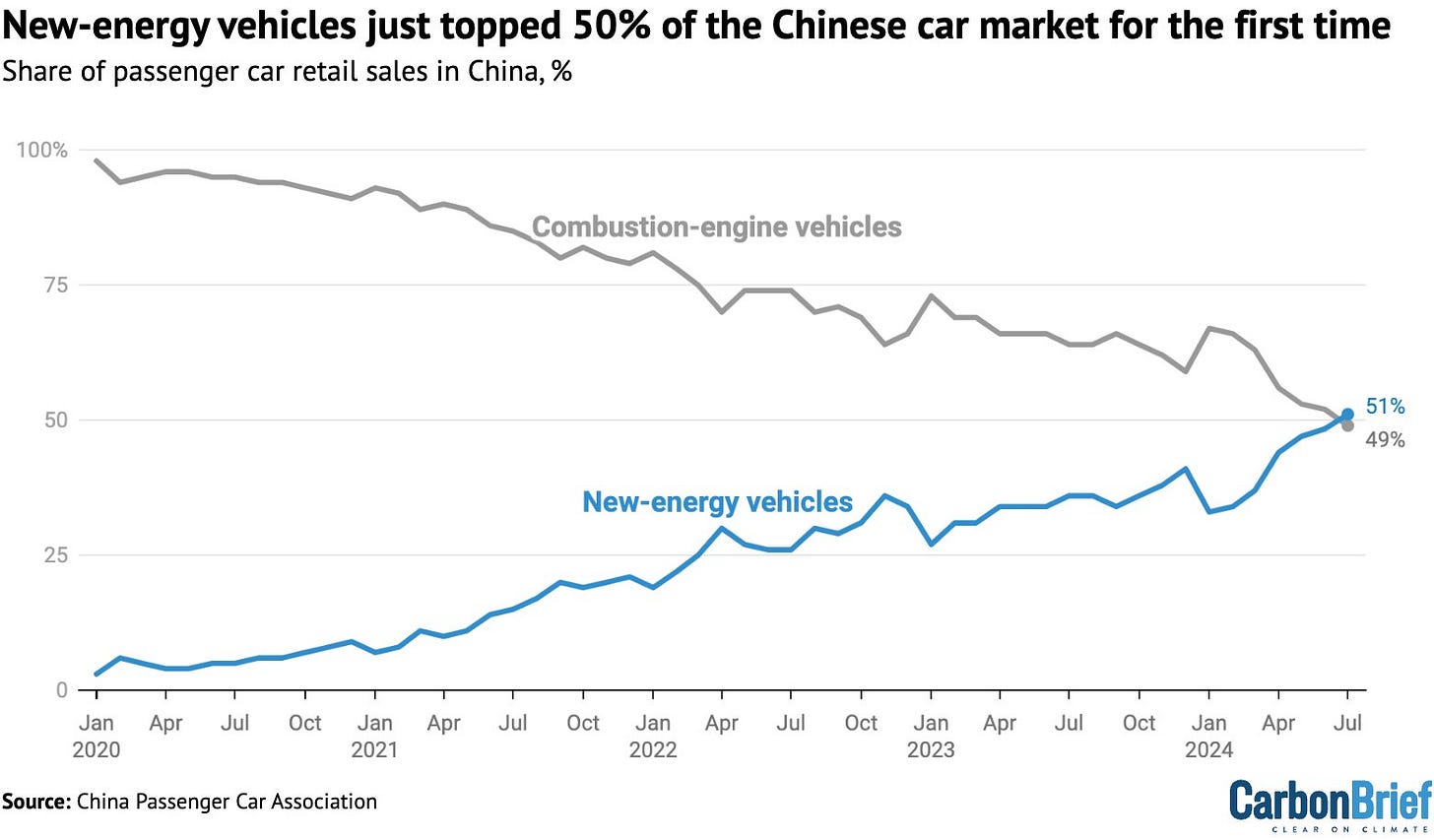

What about cars?

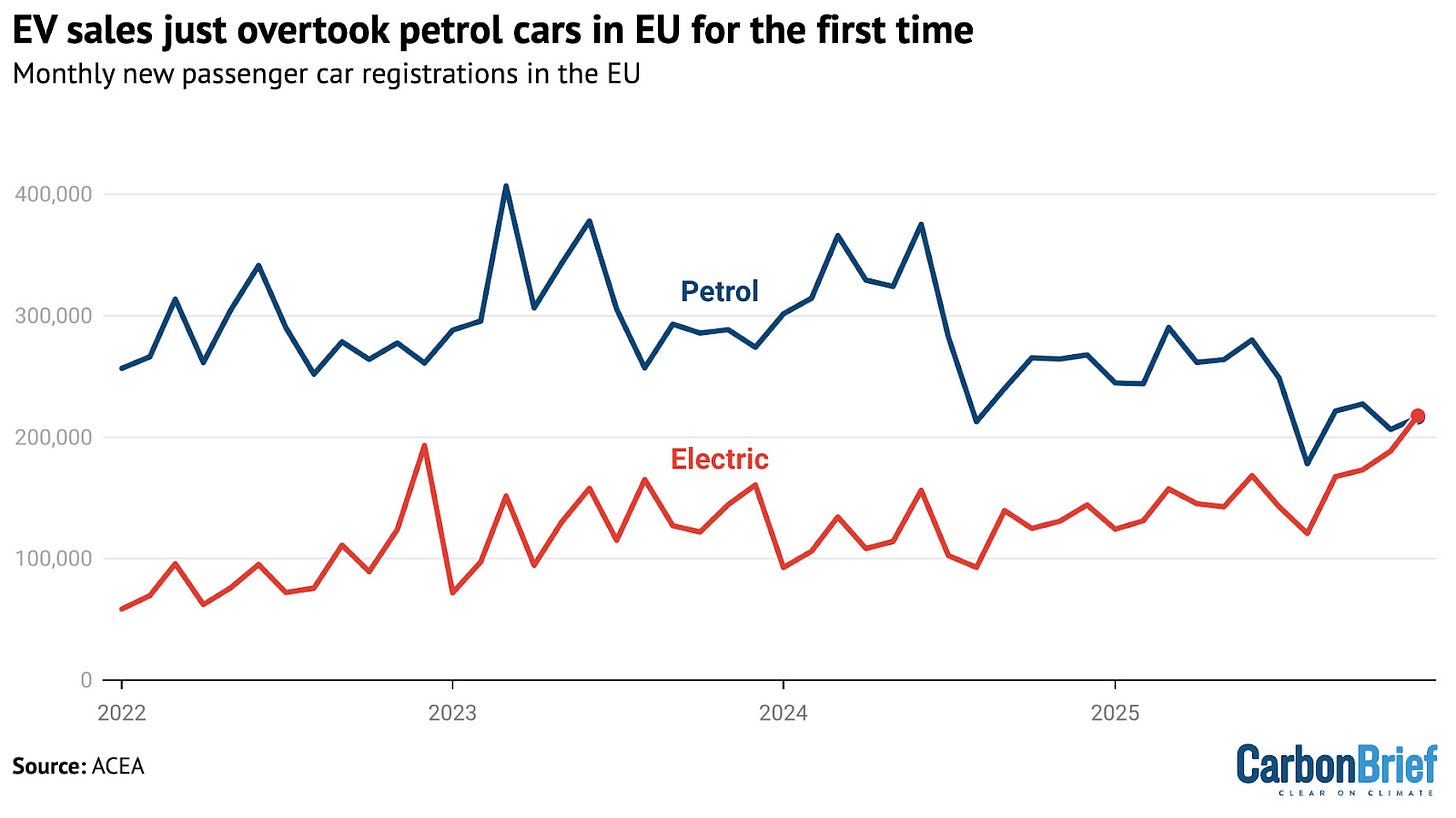

Yes for electric vehicles. For the first time, sales of EVs have surpassed those of ICE.

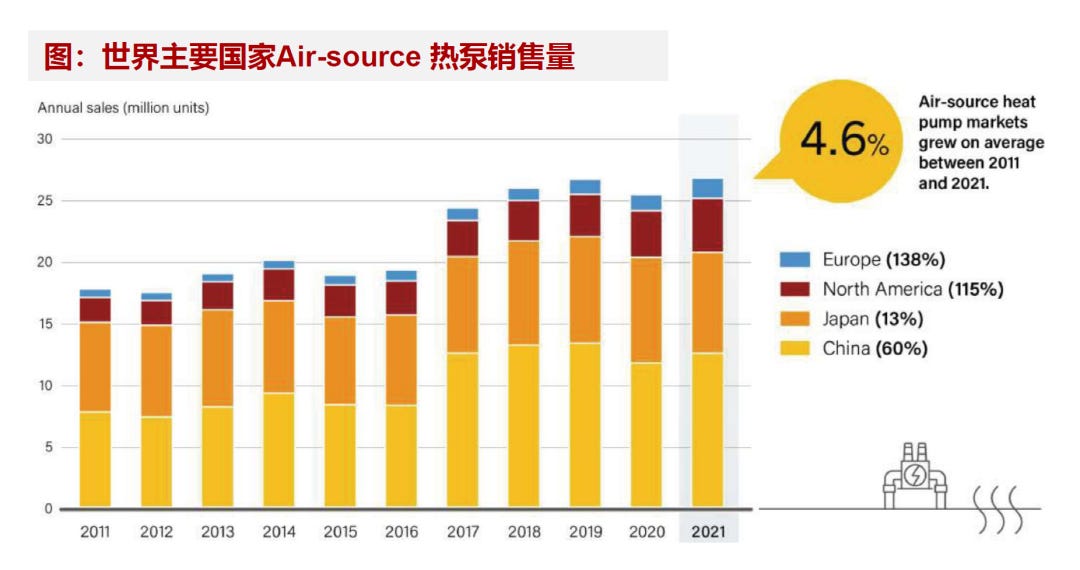

What about heat pumps?

It’s less true for heat pumps, although I’d assume these would take longer to penetrate the market, because:

Electricity wasn’t so cheap in the past

The real estate market crashed in 2020-21

Once a heating system is installed, it requires huge savings in energy to be retrofitted, and electricity prices are not quite there yet (but will be).

I think what’s clear is this: By 2050, the share of China’s primary energy coming from O&G will be tiny.

And if you think this is just China…

Exponentials everywhere! Look at these lines and try to project them into the future. No, actually, let me do that for you:

For the last few years, after a great start, EV sales didn’t look so good in Europe, but now it’s finally true: There are more EV sales than ICE.

I think the slowdown in EV sales is because of a series of one-off issues:

Richer customers bought Teslas fast, but Elon Musk’s politicization slowed that down

EV fiscal support has shrunk, making them more expensive to buy for citizens

The charging infrastructure isn’t quite there yet

Europeans can’t yet feel the reduction in electricity prices from solar

Car makers focused on premium models (which competed against Tesla), when the true market was in cheap EVs like those of China’s BYD

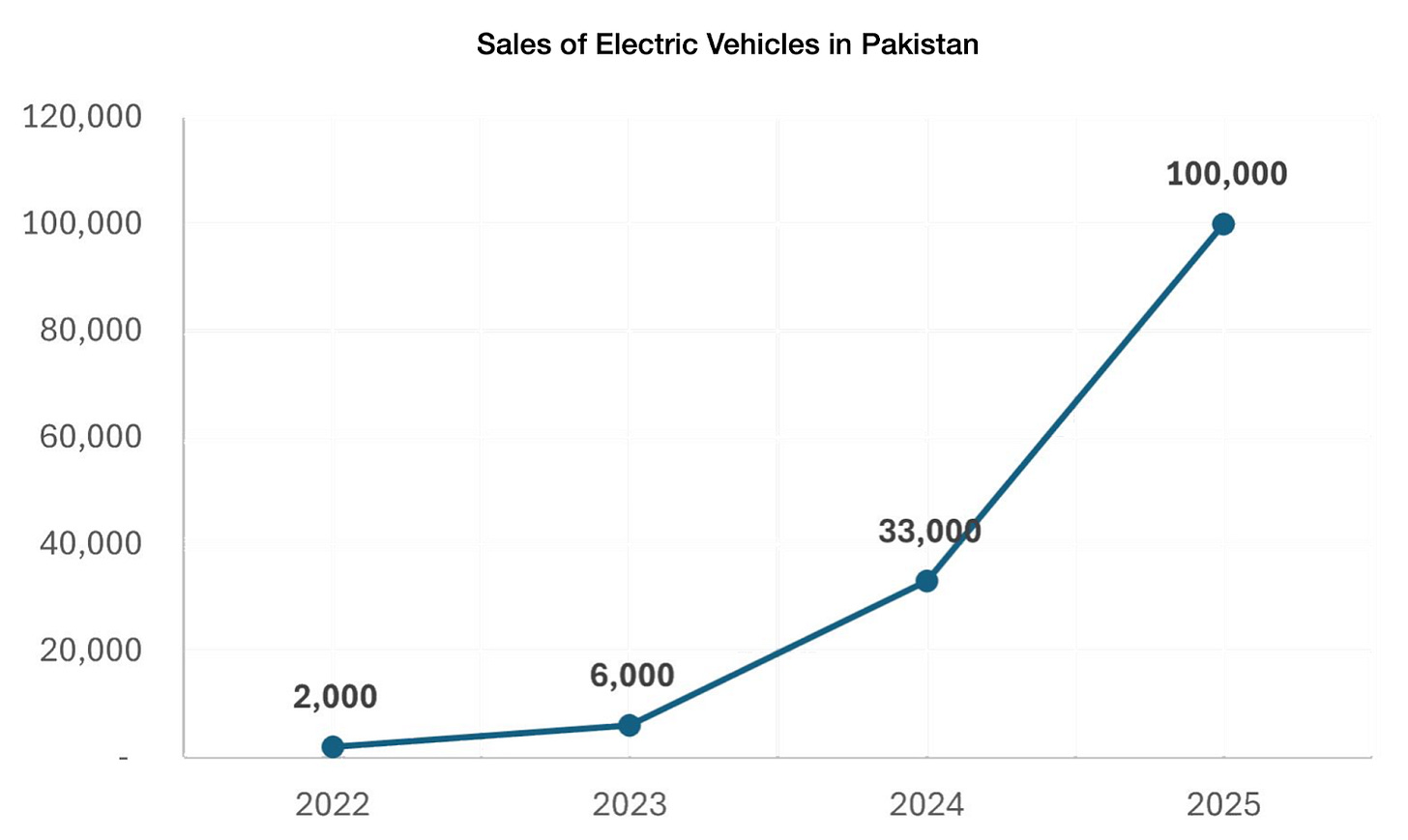

But it’s not just China and the rich world. Medium income and poor countries are seeing similar trends. The Pakistani story is especially interesting: In a country where electricity is expensive and unreliable, people have flocked to solar so quickly that it has gone from less than 1% of electricity generation to more than 10% in 5 years! The more cheap electricity there is, the more EVs people buy.

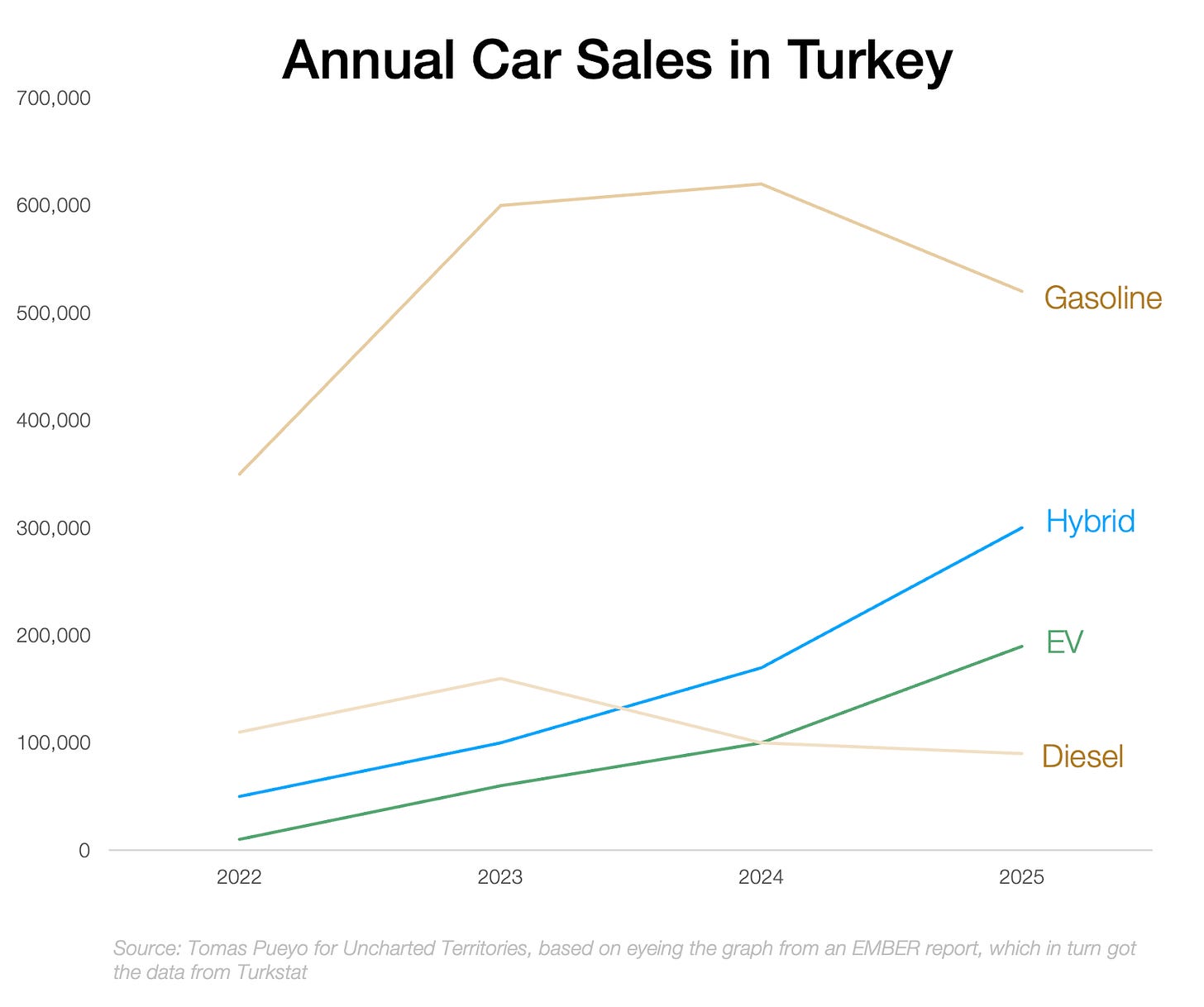

In Turkey, sales of EVs and hybrids2 are soaring so much that, even in a growing overall car market, gasoline and diesel cars are shrinking.

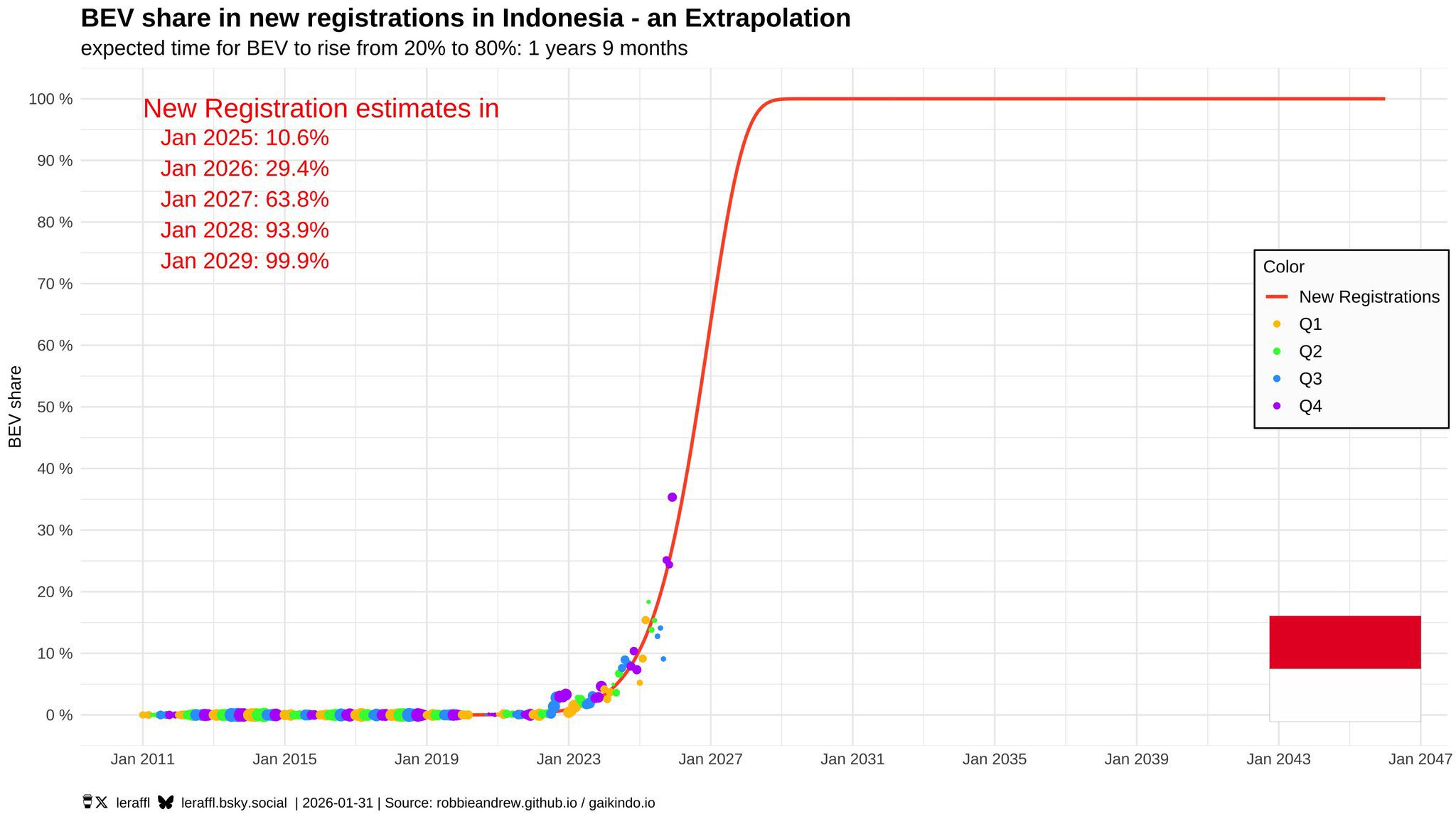

Look at Indonesia!

This will happen across the world, especially in places where electricity from the grid is expensive and unreliable but the Sun shines a lot, like Africa.3

It might take a bit longer there, because poor countries don’t buy new cars (only second-hand ones), and the EV car market is not old enough yet,4 but it will happen within a decade.

All these trends are the reason why so many models predicting O&G demand are off:

They try to figure out primary energy and electricity from past trends

Except you can’t do that because renewables are coming in like a bullet train in a china shop. They will upend everything, drive prices to the bottom, and with that electricity consumption will grow faster than in the past.

This will drive a massive electrification of the world, which will increase overall energy consumption, but it will shrink the share of that coming from O&G.

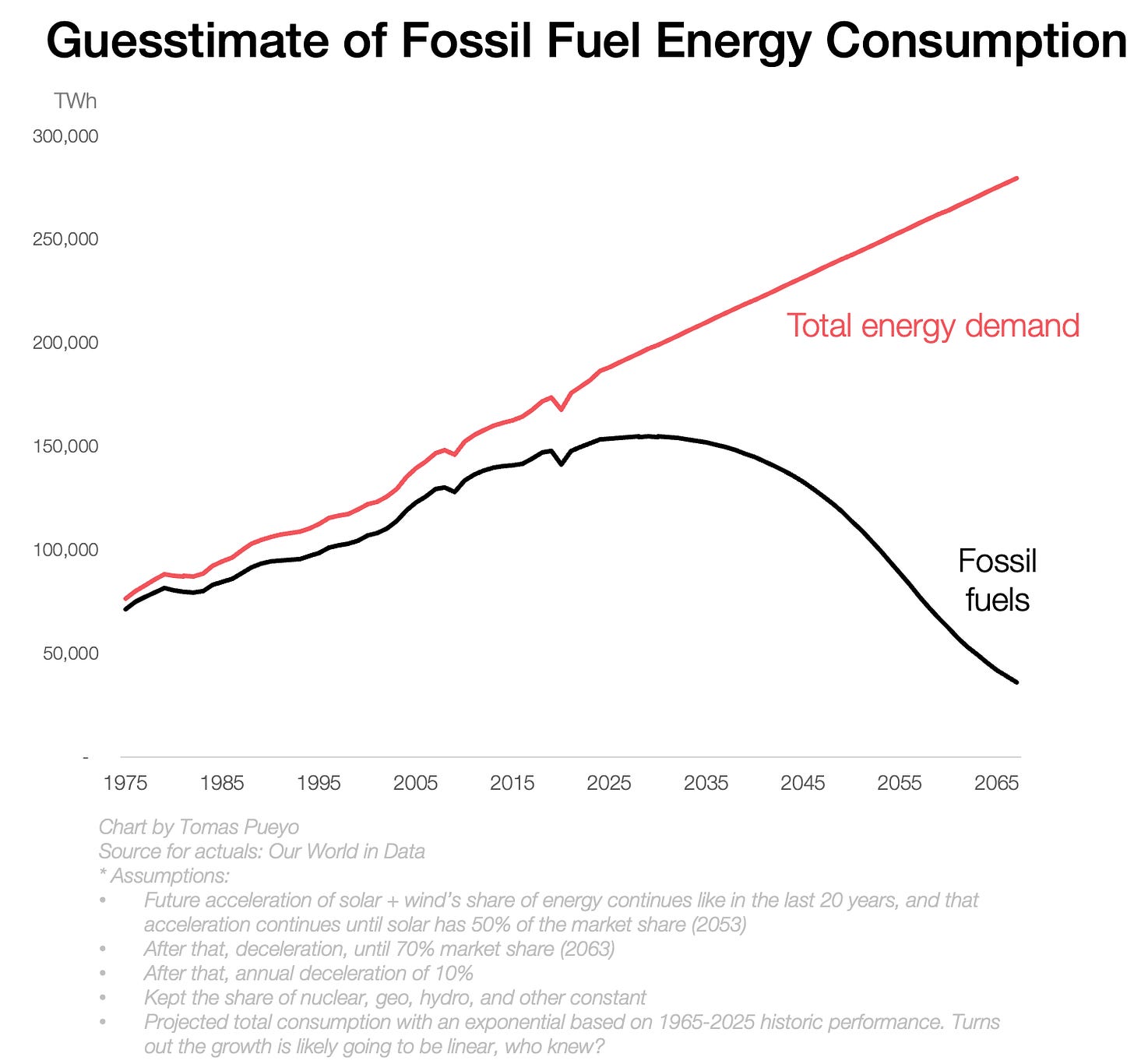

What if you just take the share of all energy coming from renewables, and assume it continues accelerating at the same pace as in the last 20 years, what would fossil fuel energy look like in that case?

According to this, fossil fuels would peak by the early 2030s:

The first to crash would be coal, and later it’d be followed by oil & gas.

Gas remains stable for the longest

Peak oil seems to happen in the early 2030s.

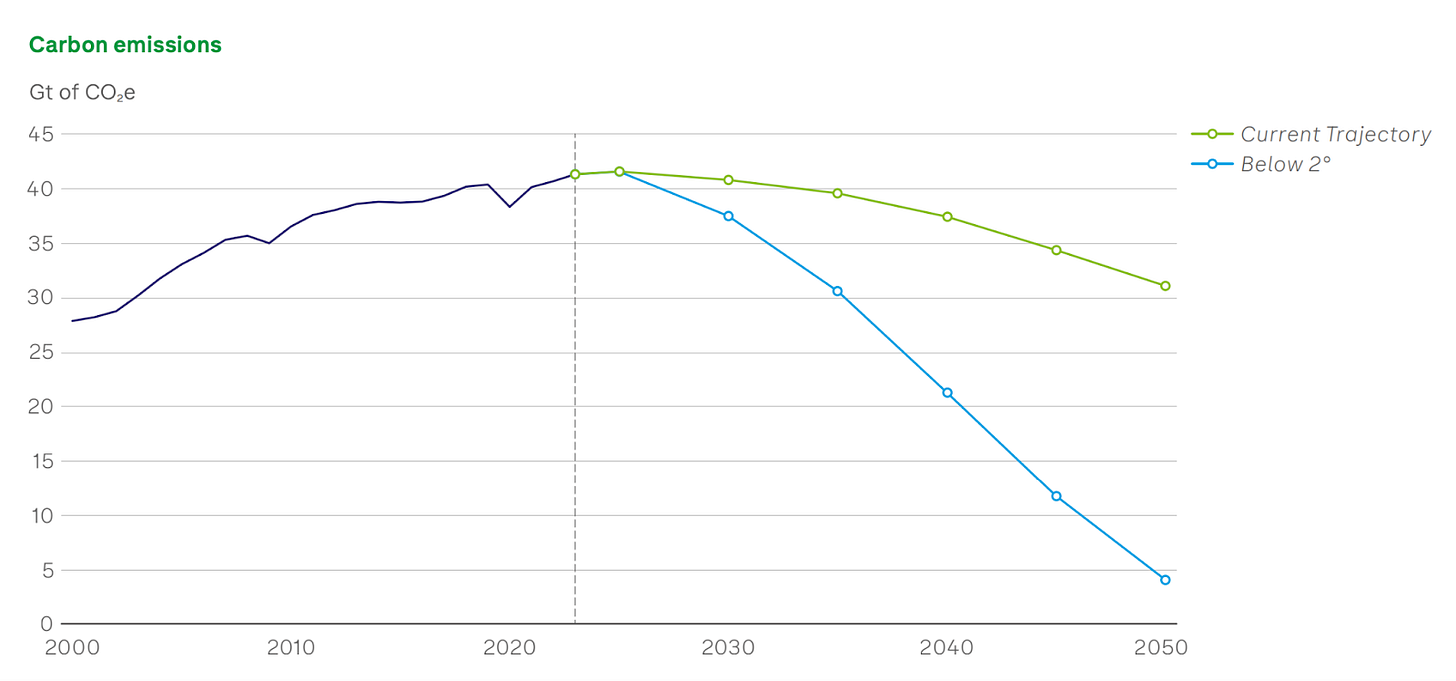

The Net Zero Proxy

For years, society has been dreaming of Net Zero: A world where all governments get together to limit their own emissions. It turns out the naiveté of rich countries was exposed by poor countries when they said: “No way we’re remaining poor.”

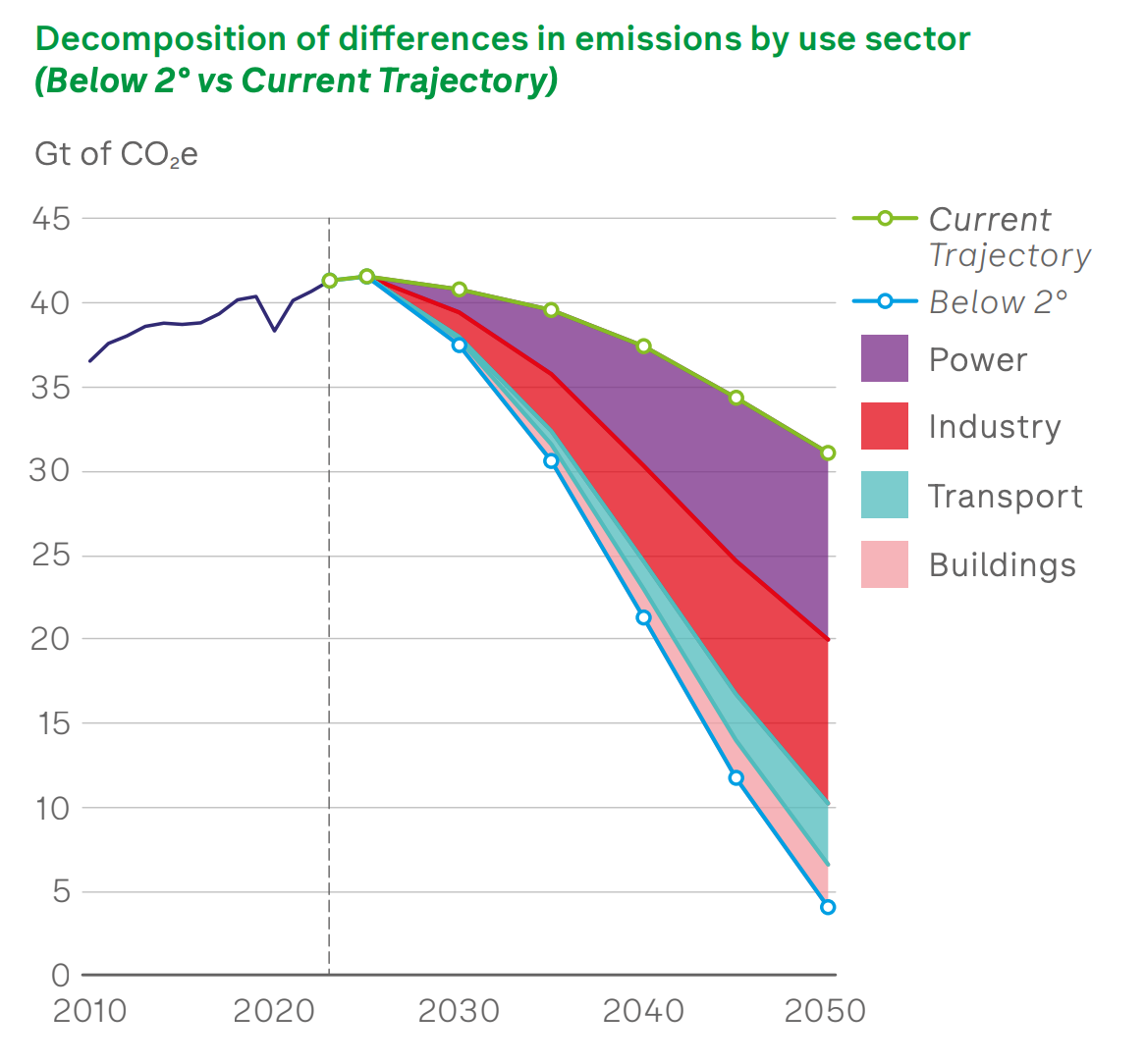

But what we’re saying here is that something akin to that is going to happen. Not because governments can agree—they can’t agree on anything—but because the economics of new tech overwhelmed politics. What it means is we can take the Net Zero modeling exercises and use them as a proxy for what might happen. BP has a good one:

The shrinking would be due to renewables and batteries (“power” below), industry (both electricity and heat, which can be achieved through heat pumps and electric arcs), and transportation (EVs):

So it doesn’t look like we’re far off.

Takeaways

If solar, wind, batteries, and EVs keep going as they have been, peak oil will come soon, and by 2050, demand for oil and gas will have shrunk considerably. It’s the dusk of the age of fossil fuels.

This will be great for the environment!

But the consequences for geopolitics are up in the air.

What will happen then to countries like Russia, Venezuela, or Saudi Arabia?

Will their economies crater?

Will this reorganize global geopolitics?

That’s what we’re going to explore in the next articles.

Just to give you an example: This OPEC study projects the demand for oil & gas (O&G) to increase from now to 2045. Why? It assumes:

An optimistic increase in global population

That electrification won’t go as fast as China suggests—notably OPEC assumes that in poor countries, people will buy lots of cars with internal combustion engines (ICE)!

That oil & gas electricity generation will barely budge!

That electric heat pumps won’t take over the heating market!

Of course, OPEC has a vested interest in O&G demand increasing, so we can’t blame them. But everybody has vested interests, making it really hard to estimate when it will peak and shrink.

In early markets, hybrids always prevail because there’s not enough electric infrastructure. As it develops and people can charge their cars more easily, the share of EVs increases.

And as we know, warmer countries are poorer.

Plus, battery aging will be a problem there. What’s most likely to happen is that 10 year old EVs will find themselves in places like Africa, coupled with new batteries, which will be much cheaper then.

Excellent synthesis of the solar/EV exponentials. The projection gap between OPEC and reality feels like watching 19th century coal barons forecast the futrue of steam engines. I work in energy infrastructure and the speed at which utilites are scrambling to adapt their grids tells the real story, the centralized model everyone built for is getting disrupted way faster than the 2050 timelines suggest.

I read that new data centers are constrained by how much power (electricity) can be delivered. Are new data centers being powered with solar/battery systems? I read about gas turbines and anticipation of nuclear (fission, but also some hype about fusion). But I don't recall reading about big solar installations to power data center installations. (Except maybe in China.) Have I missed it?